Has The Market Bottomed In Oct 2022? Check This Hint From Bloomberg

Image Source: Unsplash

According to Bloomberg Intelligence, the worst of earning contraction could be in Q1 2023, which is the current earning season's reporting. If the stock market is usually 6–9 months ahead of the economy, this should suggest the worst could be over and the market has already priced in the earning contraction.

Watch the video below to find out how this macro view could be consistent with the current market structure of the S&P 500 using the Wyckoff method to assess the long-term view.

Video Length: 00:15:30

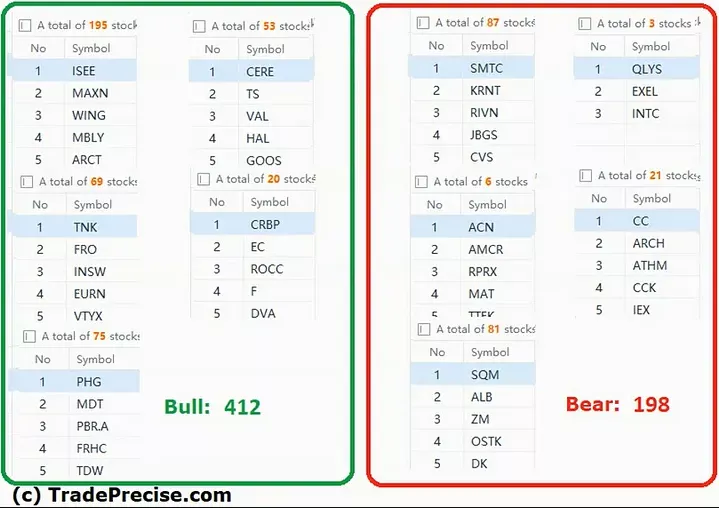

The bullish setup vs. the bearish setup is 412 to 198 from the screenshot of my stock screener below pointed still a positive market environment with no shortage of the trade entry setup.

The video above is part of the latest Weekly Live Group Coaching Session (1.5 hours) on 25 Apr 2023. The market breadth, especially the percentage of stocks above the 20 days MA, took a big hit after the pullback on 25 April 2023, which become negative. There are a lot of stocks that violated the support and structure, which should trigger more testing and consolidation.

More By This Author:

Get Ready To Ride The Bull: Price-Volume Behavior Points To A Market Breakout

Ready For S&P 500 Rally? These 2 Price Action Characteristics Could Be A Game-Changer

Eldorado Gold: The New Gold Rush After Soaring 100% In Less Than 4 Months?

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.