Market Rotation Alert: Key Areas To Shift Your Attention For Potential Profits

Image Source: Pexels

The price action last Friday was very meaningful. It has been a long time since all 4 major indices rallied together with Russell 2000 up the most (3.5%) and S&P 500 breaking out of the pivot at 4220. This could suggest a rotation in play to support the rally led by Nasdaq 100 previously.

Watch and stay till the end of the video to find out how the current rally could unfold in S&P 500 based on an analog from the Nasdaq 100 and at what point could it be violated.

Video Length: 00:11:50

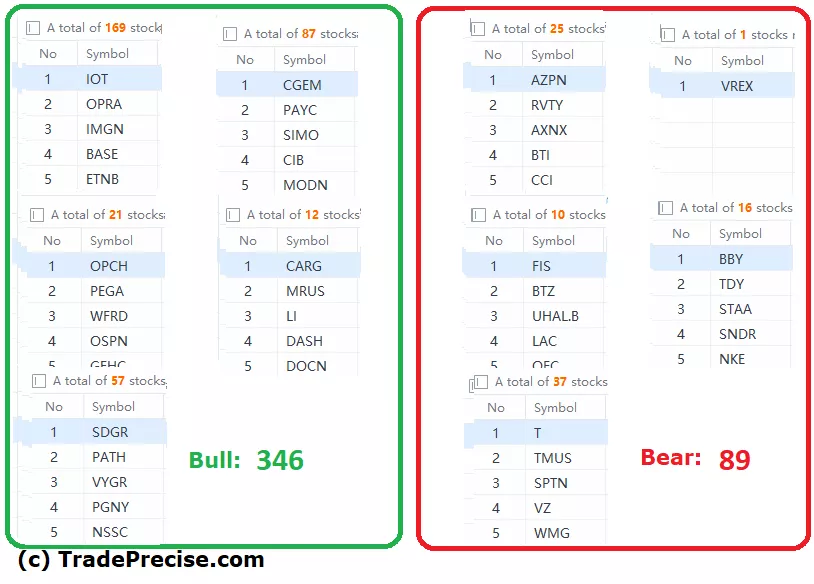

The bullish setup vs. the bearish setup is 346 to 89 from the screenshot of my stock screener below pointing to a positive market environment.

The short-term market breadth points to strong momentum and bullishness while the long-term market breadth will take time to work its way to a positive level as long as the market rotation is ongoing to sustain the rally.

More By This Author:

Bifurcated Market, Lousy Market Breadth: Is A Crash Looming Or A Bull Run Brewing?

Aggressive Demand Falters In S&P 500: Will A Shakeout Follow?

Using Wyckoff’s Effort Vs. Result To Unlock The S&P 500 Direction Bias For Swing & Day Trading

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.