Market Rotation Into One Juicy Group Could Put A Cap On Nasdaq

Image Source: Unsplash

Watch the video extracted from the live session on 11 Jul 2023 below to find out the following:

- The dilemma the market is facing between the seasonality and the end-of-quarter effect

- The ongoing market rotation that will benefit this juicy group

- How to derive the likely scenario for S&P 500 using Wyckoff's efforts vs results

- The key levels to watch out for

- And a lot more

Video Length: 00:07:43

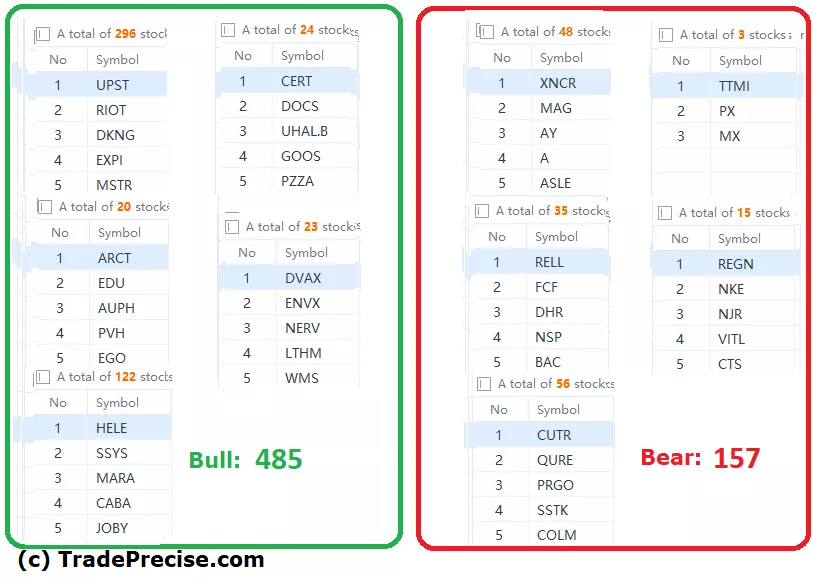

The bullish vs. bearish setup is 485 to 157 from the screenshot of my stock screener below pointing to a positive market environment.

The long-term market breadth is still above 50 while the short-term market breadth pullback slightly. Overall, this still points to a healthy market environment where more than 50% of the stocks are above the 150/200 day Moving Average (MA).

14 “low hanging fruits” (XRT, TTD, etc…) trade entries setup + 38 others (ABNB, BILL, etc…) have been discussed during the live session.

(Click on image to enlarge)

Trade Setup from 2 weeks ago: GLBE

GLBE was first discussed on 6 Jun 2023 and the subsequent live sessions while the cup and handle pattern is forming the right handle. GLBE is building a bull flag pending a breakout now, which could be a potential opportunity for scaling in.

(Click on image to enlarge)

More By This Author:

Market Correction Or New High? Is History Repeating Itself Or Taking A Different Path

Stopping Action Detected: Get Ready For A Bounce At This Support Zone

Market Breadth Signals Decoded: Crash Or Healthy Pullback?

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.