TalkMarkets Tuesday Talk: Ever Higher And Retail Redux

Good Morning. If you haven't done your market check, it was a mixed day on Monday, with the Dow and the S&P remaining more or less flat, closing at 27,845 and 3,382 respectively, but the Nasdaq was up a full 1 percent, closing at 11,130. Currently the New York markets are flat, but the day has just begun.

Source: NYT

Today's TalkMarkets contributor roundup looks at what new market heights we might expect and how this jives with the state of the overall economy's recovery amidst the long shadow of Covid-19.

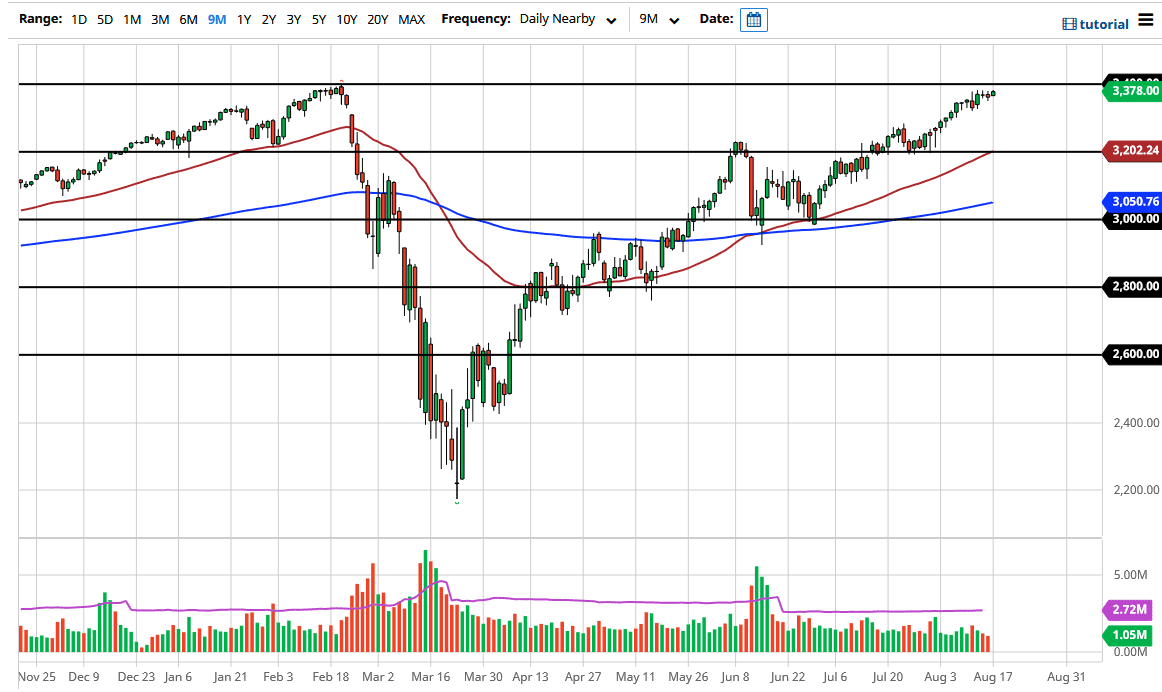

Christopher Lewis, this morning in S&P 500 Forecast: Looking Bullish, predicts the S&P is on track to hit an all time high. He writes "it is only a matter of time before we get the breakout that will send this market much higher".

"I think it is only a matter of time before we break above the 3400 level and when we do it will send this market looking towards the 3500 level above. That is a large, round, psychologically significant figure, and it is an area where we would find a lot of potential profit-takings. For what it is worth, several of the large banks on Wall Street have increased their estimates, and therefore a lot of the typical Wall Street traders will be looking to buy this market."

Lewis contends that, only if the S&P does drop back below the 3000 level, would one need to be concerned with a change in the overall trend. In the meantime he suggests that "buying dips continues to be the best play". See the S&P trend chart below:

The staff at Upfina, writing in What Will The New Economy Look Like? is upbeat about the month of August and charts that the first governmental stimulus has done the job of getting the retail sector back online.

"Even though there was a 2nd spike in COVID-19 cases in July, retail sales growth was strong. The one major weak point was autos and auto parts. Without that, it was great. Real retail sales are now 0.6% above the pre-recession peak. Retail sales bounced back in 5 months which is a record quick recovery. It took over 6 years for real retail sales to recover from the financial crisis decline and it took almost 4 years to recover after the 1990 recession. The enormous fiscal stimulus did it’s job.

Retail sales are just 1/3rd of personal consumption as this report just measures goods. Essentially, it’s measuring the best part of the economy (outside of housing which is also doing really well). Even though retail sales are 1.7% above the pre-recession peak, the makeup of the sales is dramatically different. The biggest shift has been towards online sales.

As you can see from the chart above, non-store sales were 21.9% above where they were in February. Monthly growth was only 0.7% following -1.4% growth. That’s likely because stores reopened causing some people to go back to shopping how they used to. Even still, yearly growth was 24.7%. As of June, Morgan Stanley projected e-commerce to be 24.5% of retail sales in 2020 and 25.6% in 2021."

Upfina concludes as follows:

"Retail sales had a V-shaped recovery because of the fiscal stimulus. Let’s see how retail sales react to the decline in unemployment benefits ($600 per week to $300 per week). The good news is the labor market is rebounding solidly in August. Some of the trends in retail sales have reversed as the economy has reopened. What will the new economy look like? There is clear euphoria in the stock market because it vanquished the March decline so easily."

Well that is pretty heady stuff and they did not answer their question about what the economy will look like. We've still got a ways to go till Q3 is over.

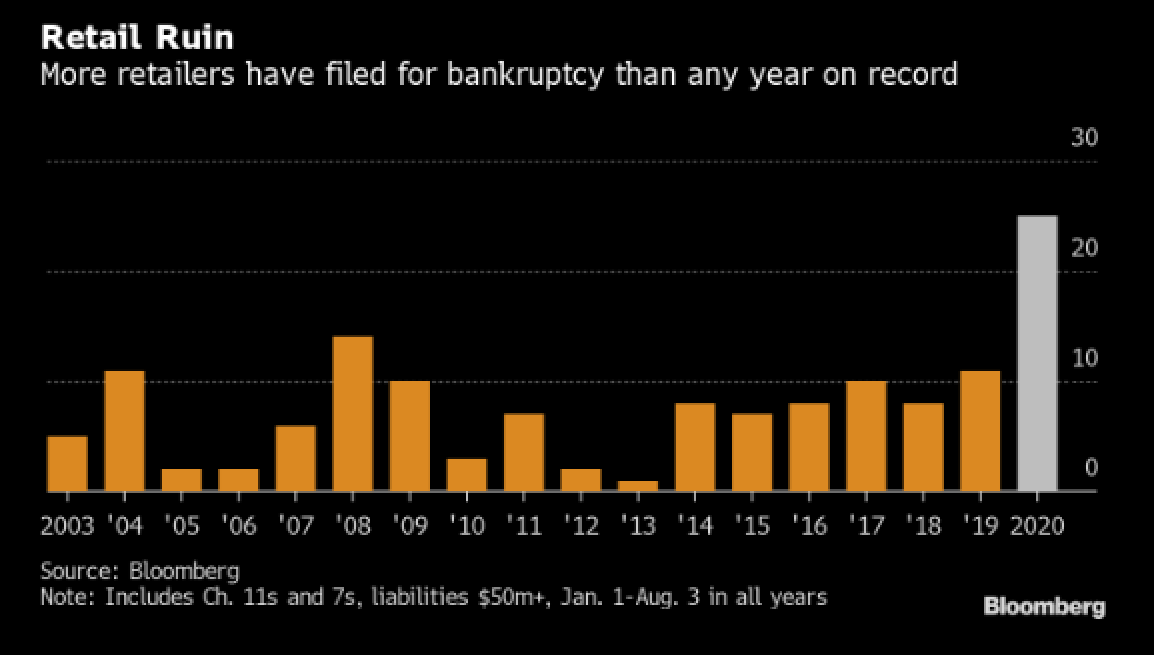

In a TalkMarkets exclusive, Retail Apocalypse, contributor Pennywiser takes note of the continuing bloodletting in the apparel sector, though it does make note of the V-shaped retail sector recovery recorded in July.

"Retail sales did witness a swifter V-shaped recovery with the total value of retail sales in July climbing higher than the pre-pandemic levels with the reopening across the country. The figure highlights the rebound in consumer spending which would pull up the economy from the decadal lows, although the growth remained modest in July at just 1.2% as stimulus benefit fades. However, apparel sales continue to struggle, down 20.9% compared to the previous year, although it jumped over 5% month over month which remains a silver lining."

Pennywiser notes that this has been a disaster for many retailers and their mall landlords as well with up to 25,000 stores expected to close in 2020.

"At least 26 major retailers have filed for bankruptcy so far, with 10 coming in last month, the latest being the 194-year-old Lord & Taylor. Apparel stores have been particularly hit hard with its bankruptcy list featuring household names like J.C. Penney (JCP) which halted trading in May of this year, Brooks Brothers (the mall operator Simon Properties and Authentic brands are trying to buy the assets of BrooksBrothers), Neiman Marcus, and GNC (GNC). Although the country has been largely opened up, for now, the conditions are far from ideal with lackluster demand and discouraging footfalls."

Tracey Ryniec a TalkMarkets contributor from Zacks.com looks for value in retail in 5 Must-See Big Cap Retail Earnings Charts despite the rough waters. Tracy writes that there are haves and have nots in the retail sector but looks at the following five companies as ones to watch:

"1. Walmart (WMT) has been a big winner during the coronavirus pandemic as online sales have soared. Shares are up 14.3% year-to-date. It has a good track record of beating with just 3 misses in the last 5 years. Will it blow it out this quarter?

2. Home Depot (HD) has only missed once in the last 5 years and it was last quarter, just as the pandemic hit. Investors didn’t care, though, as they’ve been piling into the shares again, pushing them up to 5-year highs. Shares are up 32% year-to-date. Is there more left in the tank?

3. The TJX Companies (TJX) is coming off a big miss last quarter. Remember, TJX is three companies: TJ Maxx, Marshalls and Home Goods. Home Goods likely had a good quarter, once its stores had reopened. But what will be the result of the apparel sales at the other brands? Shares are still down 2% year-to-date but they’re not cheap with a forward P/E of 100.

4. Lowes (LOW) has beat 4 quarters in a row and shares have soared 32% in 2020 to new 5-year highs. With a forward P/E of “just” 21, it’s the cheapest of these 5 retailers. Is it a hidden gem?

5. Ross Stores, Inc. (ROST) is coming off its first miss since 2017. Shares hit new 5-year highs in early 2020 but haven’t recovered it as Wall Street is concerned about apparel sales. Shares are still down 17% year-to-date. Is this a buying opportunity in a quality name?"

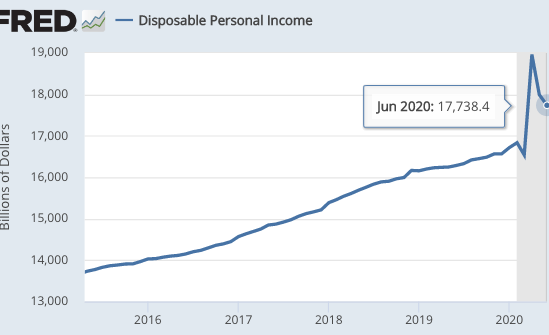

Scott Sumner brings us back to reality in a fine piece titled, Disposable Income Is Not Holding Back The Economy, he writes quite convincingly that "the economy is not being held back by a lack of disposable income. So what is holding it back? My theory is that the Covid-19 epidemic is making people reluctant to spend money on services where there is human interaction."

He includes a stunning chart to show that the first round of Fed stimulus did indeed provide a strong rebound in disposable income.

While not saying that more Federal stimulus is not needed, personal spending (and therefore much of the economy) is not stuck for lack of disposable income, it is simply that people are afraid to go out to stores and are afraid to spend. This is contrary to or despite the July retail data mentioned earlier. Sumner writes that the thorny issue of getting Covid-19 under control is the major impetus to to economic recovery.

"I’m genuinely mystified by claims that lack of fiscal stimulus is a big problem right now. I actually do think monetary policy should be a bit more expansionary—enough to prevent disinflation—but I’m under no illusion that this would miraculously cure the recession. We need to address Covid-19 before we can return to a healthy economy."

Maybe Congress should stay on vacation after all, and let the scientists keep working.

WE see that "the economy is recovering", at least as far as SOME stocks indicate. What actual reality shows is that there are a few big winners and a whole lot of losers. Restaurants, gas stations, and apparel are the mail losers, with furniture and appliances being losers as well. With gas stations suffering it seems like the oil companies will be suffering a bit as well.

So that hard times ARE NOT OVER just yet, and in reality the damage has not stopped, but just become a slower process.

Certainly that blast of cash pumped in helped in some areas but not in others, but it did not leave the public with the feeling that the emergency is past.

Possibly, if some method of actually stopping the disease is created and made available, "a real recovery" can happen. But that is presuming that the federal banking folks do not make some really dumb moves. That is my wishful presumption, not my sincere belief.

Good read. And thanks for linking to @[PennyWiser](user:84653)'s article. I enjoyed what he had to say.