Retail Apocalypse

The retail sector has been one of the worst-hit sectors as COVID-19 ravaged through across the globe. The store lockdowns, as the government looked to control the spread, took many casualties with several retailers filing bankruptcies. S&P Apparel Retail has largely been an underperformer compared to the meteoric rise of S&P from its March lows to almost eclipsing its February high recently.

Data by YCharts

Retail sales did witness a swifter V-shaped recovery with the total value of retail sales in July climbing higher than the pre-pandemic levels with the reopening across the country. The figure highlights the rebound in consumer spending which would pull up the economy from the decadal lows, although the growth remained modest in July at just 1.2% as stimulus benefit fades. However, apparel sales continue to struggle, down 20.9% compared to the previous year, although it jumped over 5% month over month which remains a silver lining. However, the month over month sales improved only as a result of a lower base with sales plunging 90% down month over month in April (down from $23bn in March to under $3bn in April).

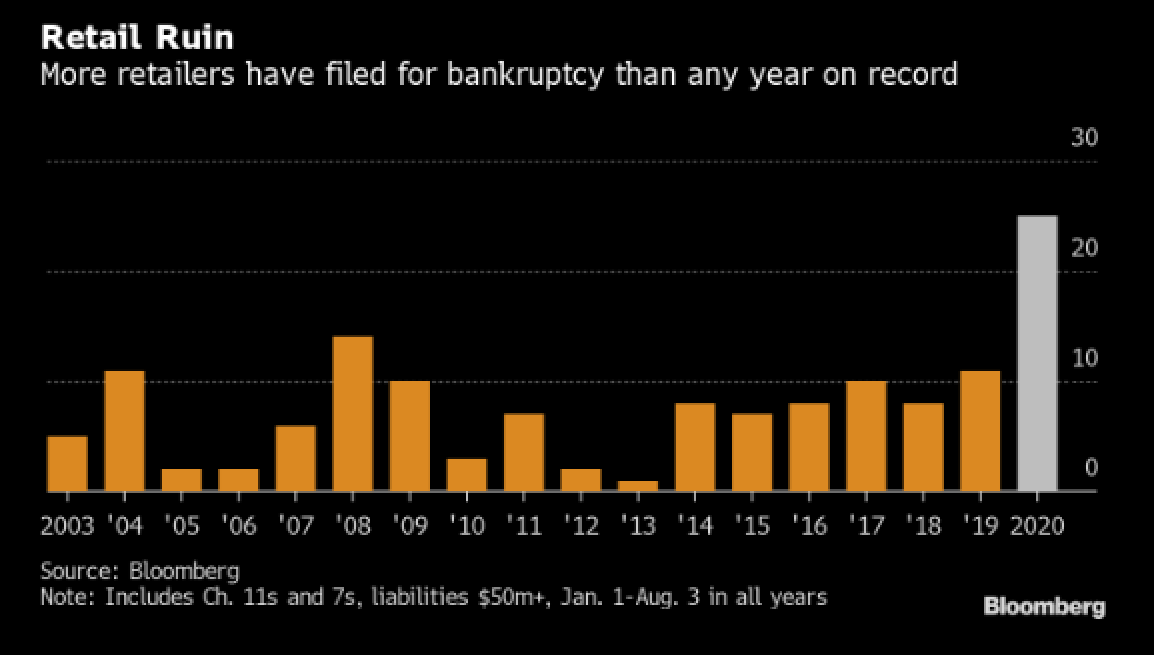

But despite the improving consumer spending, retail bankruptcies continue to soar with no end in sight, in particular for the mall-based tenants. According to the report from Coresight, about 20-25,000 stores are expected to close down in 2020, up from its previous estimate of 15,000, with 55 to 60% of them based in malls. To give a context, about 9,000 retail stores shuttered down in 2019. The store closures are seen particularly tilted towards the apparel retail sector while the consumer electronics, sporting goods, and household and leisure remains fairly insulated among the discretionary sectors.

At least 26 major retailers have filed for bankruptcy so far, with 10 coming in last month, the latest being the 194-year-old Lord & Taylor. Apparel stores have been particularly hit hard with its bankruptcy list featuring household names like J.C. Penney, Brooks Brothers, Neiman Marcus, and GNC. Although the country has been largely opened up, for now, the conditions are far from ideal with lackluster demand and discouraging footfalls. With the virus growing, retailers are caught in bind gearing up for the holiday season, in particular. Along with that, companies have taken additional financing leaving them more leveraged in their battle to survive. The only hope remains is that the holiday season will somehow provide decent traction to the battered sector, but otherwise, the retail apocalypse could paint even a worse picture.

Beware or REITs, especially commercial and apartment REITs. There is a reason why they are trying to get people into these. That way banks etc can unload their losses on uninformed investors with high rates that won't last much like the last downturn.

Thanks Pennywiser, which retail stores do you think will fare the best?

Thanks, Adam. To answer your question, I'd redirect to one of my previous article where I had highlighted on the survival within the departmental stores space. As predicted, JC Penney has now already declared bankruptcy.

talkmarkets.com/.../deeper-diagnosis-of-department-stores-survival