Disposable Income Is Not Holding Back The Economy

In the Keynesian model, fiscal stimulus boosts demand during a recession by making up for the decline in disposable income during a period of falling GDP. For example, disposable income fell between March 2008 and March 2009, even in nominal terms. That was one motivation for the Obama stimulus package.

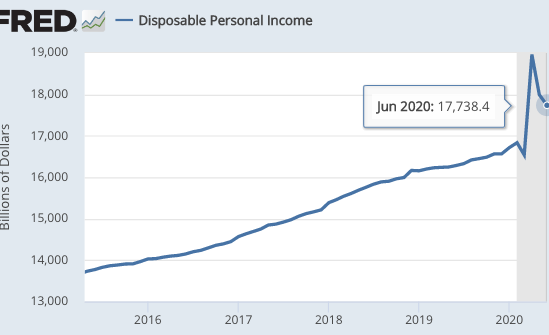

This time things are very different. Not only is disposable income not falling, but it’s also rising at perhaps the fastest pace in history, mostly due to fiscal stimulus.

And yet the recent fall in GDP is even worse than in 2008-09. Clearly the economy is not being held back by a lack of disposable income. So what is holding it back? My theory is that the Covid-19 epidemic is making people reluctant to spend money on services where there is human interaction.

(Click on image to enlarge)

The conventional wisdom is exactly the opposite. I see article after article claiming that the problem is a lack of sufficient fiscal stimulus. Here’s Bloomberg:

Chances for a deal in Congress on a new, comprehensive stimulus package before September diminish with each passing day, leaving the U.S. economy limping and many businesses and millions of consumers coming up short.

So what’s the argument against my claim? I see several, none persuasive:

1. Other things equal, fiscal stimulus would help, even though Covid-19 is also a problem. That may be true to a small extent, but it’s hard to see how it could have a decisive effect. Again, we’ve seen the biggest increase in disposable income in history, coinciding with plunging consumer spending. Doesn’t that suggest that lack of disposable income is not the relevant constraint right now? How is even more disposable income going to make a decisive difference if people are afraid to spend?

2. Disposable income fell between April and June. Yes, but it’s levels that matter, and even in June disposable income was far higher than 6 months earlier. And yet spending is far lower.

3. Inequality. Maybe all the extra disposable income is going to the rich. That seems unlikely. The rich don’t qualify for the $1200 payment or the enhanced unemployment compensation. Yes, the rich have seen their stocks go back to February levels, but that’s not counted as “disposable income”. Both the $1200 checks and the extra $600 unemployment compensation tend to be a higher percentage of the income of the poor. I suspect that if you had a graph of the disposable income of the bottom 50%, or the bottom 25%, it would show the same sort of spike after March that this Fred graph shows, maybe even bigger. If I’m wrong, please present data showing that fact.

I’m genuinely mystified by claims that lack of fiscal stimulus is a big problem right now. I actually do think monetary policy should be a bit more expansionary—enough to prevent disinflation—but I’m under no illusion that this would miraculously cure the recession. We need to address Covid-19 before we can return to a healthy economy.