Momentum, A Robust Hard To Overlook Factor

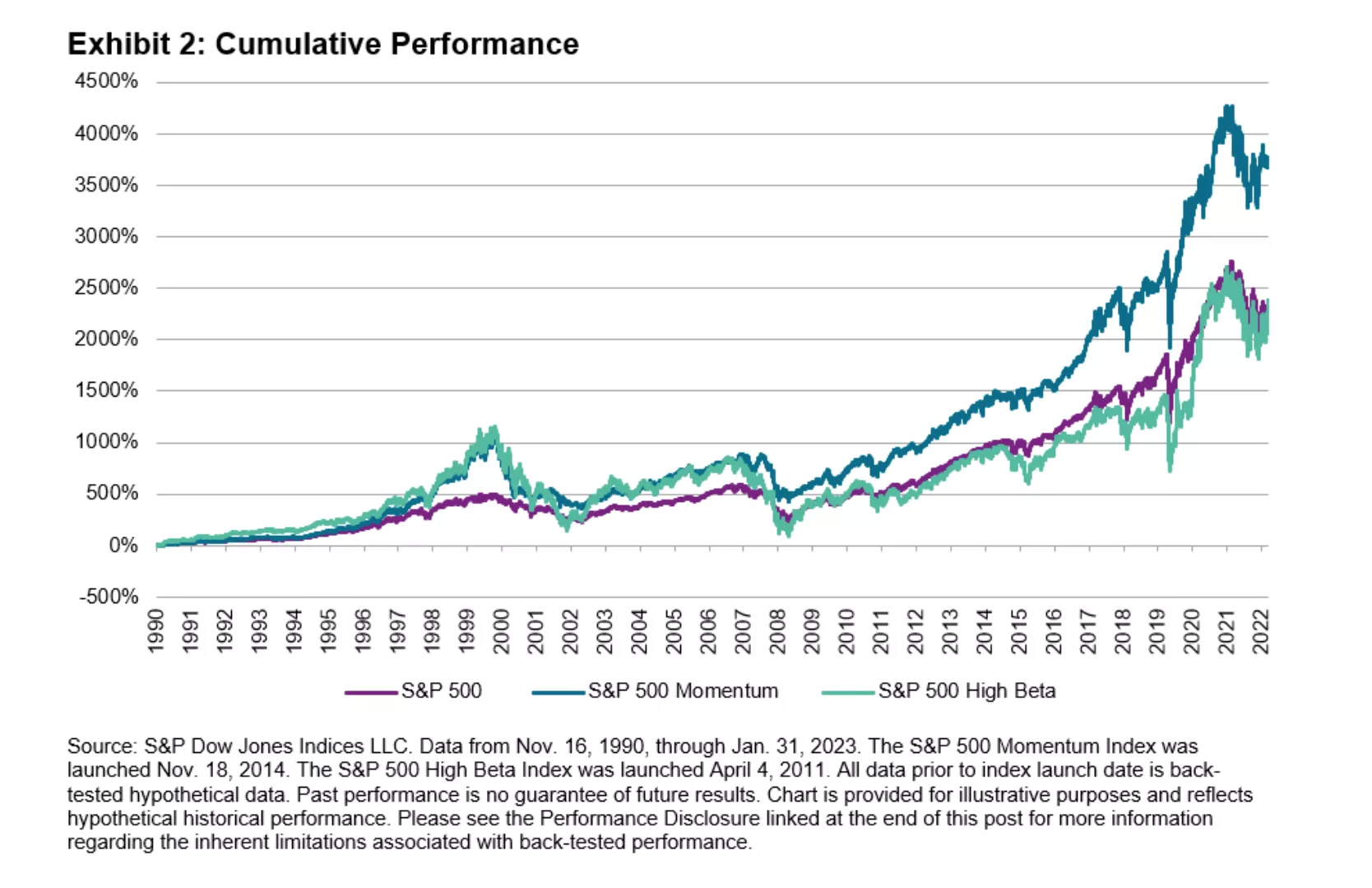

The momentum premium is attributed to human behavioral biases like loss fear or self-attribution by some, while others see it as merely compensating for risk. In other words, the individuals who make up markets don't always behave logically, and many of them don't comprehend momentum. With the help of data from the S&P 500 Momentum Index, let's dispel three prevalent misconceptions about momentum (Mystique-blue in the charts below, naturally).

One who pays close attention will notice that Momentum outperformed on a relative level for the year 2022, possibly dispelling the second half of Myth #1 that the factor is inherently riskier. The S&P 500 Momentum Index actually chooses stocks with strong risk-adjusted performance, resulting in an index with annualized risk that has traditionally been comparable to or lower than that of the S&P 500. (see Exhibit 3).

The S&P 500 Momentum Index is constantly changing by design, evolving in reaction to market conditions and keeping a high exposure to the factor

More By This Author:

The Relevance Of Copper To The Economy And Stocks

The Current State Of Global Liquidity And Bank Policy Rates… Two Deflationary Headwinds

From An Annualized Peak Of 9.1% Last Summer, Inflation Has Dropped

Disclaimer: These illustrations are not a solicitation to buy or sell any ETF. I am not an investment advisor/broker