The Relevance Of Copper To The Economy And Stocks

Image Source: Pixabay

Due to its widespread use across a variety of economic areas, copper is one of the most significant base metals. Demand for copper has consistently been a dependable early indicator of the state of the world economy.

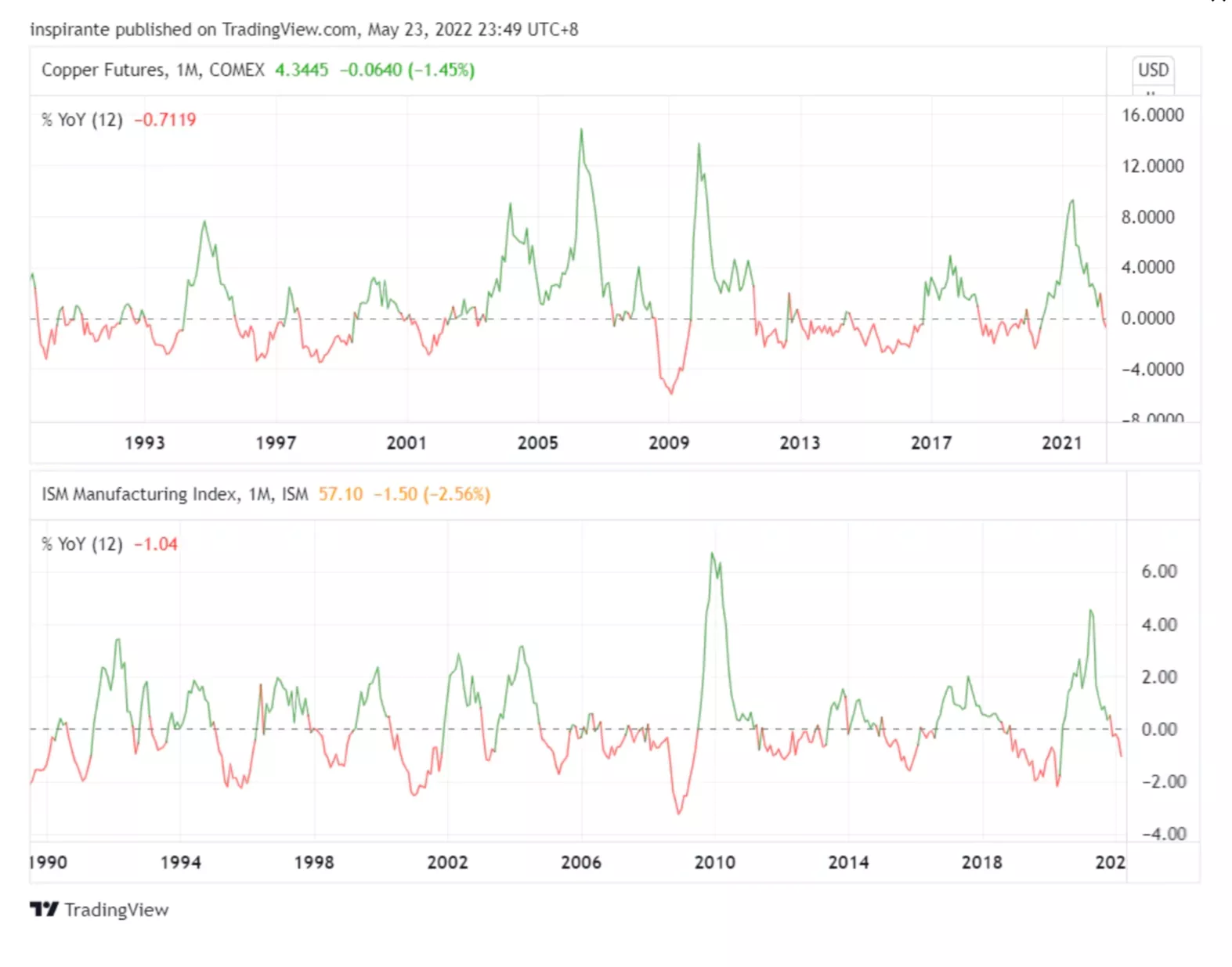

The ISM Manufacturing PMI, which is generally regarded as a key indicator of the health of the US economy, and the change in copper price over the past year (YoY) are closely correlated (Figure 1).

(Click on image to enlarge)

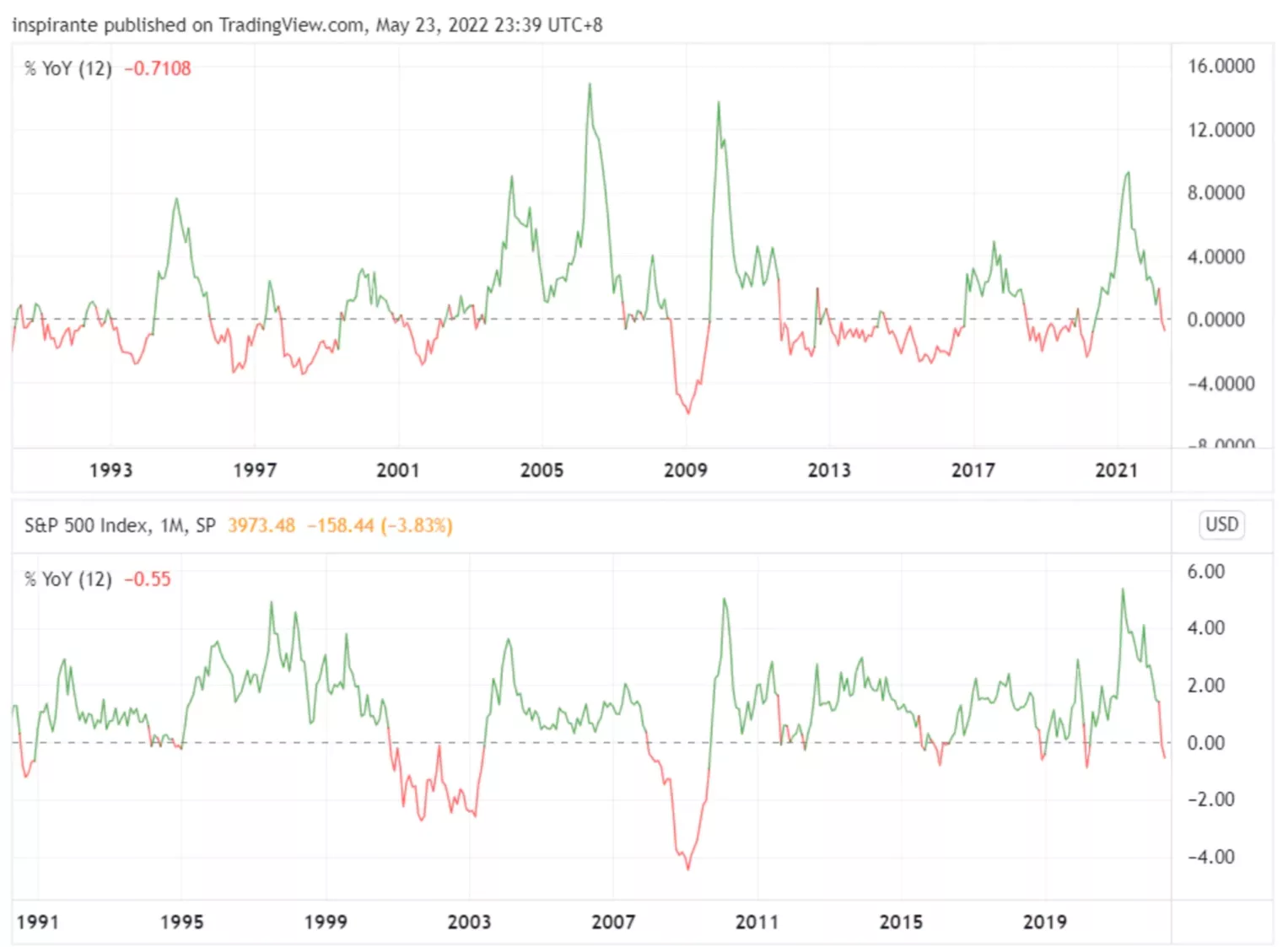

According to the correlation between the YoY shift in the price of copper and the S&P 500 index, this base metal is also a trustworthy indicator of economic cycles (Figure 2). Hence, "Dr. Copper" in market jargon.

(Click on image to enlarge)

More By This Author:

The Current State Of Global Liquidity And Bank Policy Rates… Two Deflationary Headwinds

From An Annualized Peak Of 9.1% Last Summer, Inflation Has Dropped

Deflation Has Begun

Disclaimer: These illustrations are not a solicitation to buy or sell any ETF. I am not an investment advisor/broker