Lithium Americas: Divide And Conquer

Image Source: Pixabay

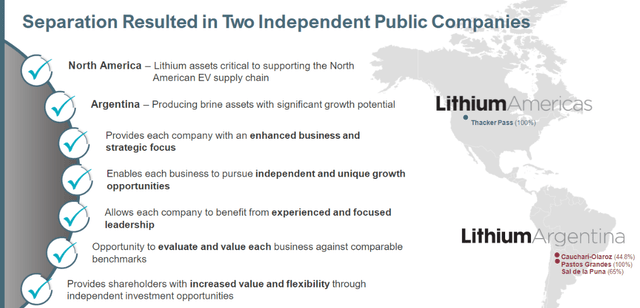

Just this week, Canada-based Lithium Americas (NYSE: LAC) completed the long-awaited division of its company into two independent firms, Lithium Americas and Lithium Americas (Argentina) Corp (LAAC).

(Caveat: Many market information providers have not yet correctly updated the ticker symbols for these two companies! Some list “LAC,” for instance, as Lithium Americas Argentina Corp. For clarity, LAC closed yesterday at $11.73, LAAC at $6.01.)

For every share of Lithium Americas owned as of Oct. 2, 2023, a holder has now received a share of Lithium Americas Argentina. If you owned 500 shares of LAC, you still do. But you also now own 500 shares of LAAC as well.

The new LAC trades on both the Toronto Stock Exchange and the NYSE. LAAC trades on the NYSE and probably the TSX as well. No source, including AI, could confirm this.

There are just more than 160 million shares of the old Lithium Americas outstanding, so we may safely presume there are now the same number of Lithium “Argentina” (NYSE: LAAC) shares outstanding.

Why Did The Company Separate Into 2 Different Firms?

The two previous “divisions” of LAC operate in two different geographic regions of the world. Each also uses different techniques to extract lithium – and from a different type of lithium-bearing source. While old (and new!) LAC owns 100% of its property in the US, the Argentina properties are a mix of owned- and partially owned holdings. Different operating management, engineering, legal, and negotiation skills are needed for each area.

Each operates under very different regulatory regimes in two nations with vastly different political systems. And finally – and most importantly in my analysis – separating the Argentinian properties, two of three of which have a Chinese partner, means that LAC can now qualify for US government loans to develop this and other possible sites in the US. (The company has already secured a $650 million loan – in tranches – as well as an offtake agreement with General Motors.)

Lithium Americas (LAC)

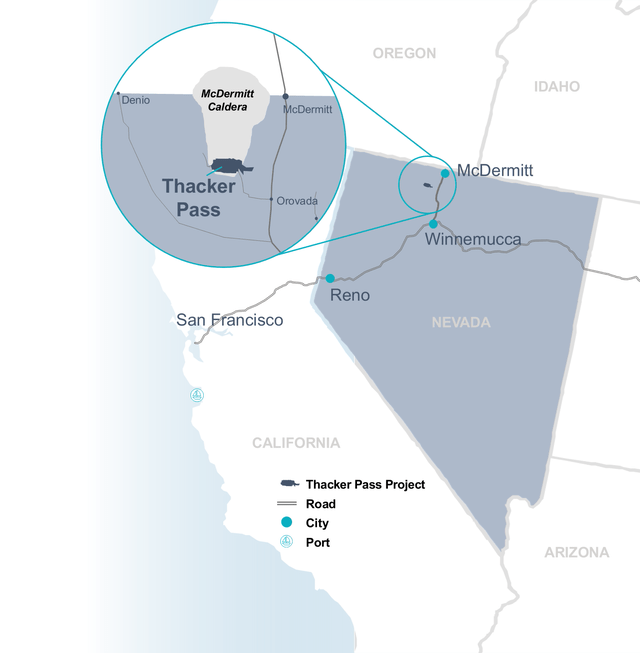

The new Lithium Americas has one 100%-owned property in development, with the first deliveries expected in 2026. This is the Thacker Pass project in northern Nevada, just a couple of hours away from my home. Construction commenced earlier this year after all manner of legal challenges, some serious, some frivolous. All challenges were settled in favor of LAC up to the level of the 9th Circuit Court.

LAC website

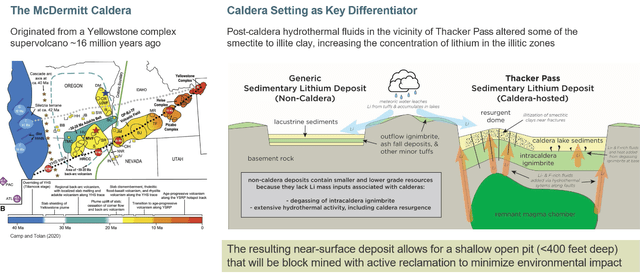

Thacker Pass is the largest known M&I (Measured and Indicated) lithium resource in the United States – and there may be much more to come. While LAC owns the rights to mine Thacker Pass, the company also owns the rights to mine an area, also within the McDermitt Caldera area, of three times as much land as they have at Thacker Pass – a good amount of which may hold even greater amounts of sedimentary-(sometimes called “clay-”) bound lithium! There's already known lithium mineralization in these other places, all nearby.

For an overview of how this works for the more geologically-minded…

LAC website/Lithium Americas website

Why I Own Lithium Americas

LAC’s Thacker Pass holdings look to be the largest known find in the US. LAC’s separation into two companies opens the possibility of government funding to bring production of lithium back to the United States. LAC may very well make more discoveries in the immediate area, an area where the legality and right to mine already is established – an important consideration in the SAA’s litigious society If these other discoveries occur, LAC already has processing facilities, roads and rights-of-way, and agreements with local communities. In my opinion, it's essential for national security that North American nations not be dependent upon some faraway region or foreign power for their future energy needs.

Lithium Americas (Argentina) Corp.

Lithium Argentina will now own all Argentinian properties once held by “old” LAC. These include the following:

The Caucharí-Olaroz lithium brine project, a 40,000 tonnes per annum (tpa) brine project under construction in Salar de Olaroz and Salar de Cauchari in the Jujuy province in northwest Argentina. Developed by “Minera Exar,” it's jointly owned. LAAC’s share of the project is 44.8%, with the majority ownership position going to China’s Ganfeng Lithium.

The Pastos Grandes is a lithium brine project located in Salta Province, Argentina. The project is 100% owned by LAAC and is expected to commence commercial production by early next year. It's projected to produce 24,000 tons of battery-grade lithium carbonate a year and has an anticipated mine life of approximately 40 years.

The Sal de la Puna project is a lithium brine project also located in Salta Province. The project is operated by LAAC, with a 65% interest, and owned partially by Ganfent Lithium, with the other 35% of ownership.

Please note, all three of these projects use the brine extraction process, whereas LAC’s Thacker Pass uses a sedimentary (clay) extraction process.

LAC Presentation Oct 3, 2023

Which Company Should I Own?

Personally, I'm holding both for the moment.

I believe LAC has the greatest long-term appreciation potential, is located in the more stable region, has a hard-earned good relationship with the local communities, and has already been through the wringer with various groups trying and failing to stop the project from going forward. (It's amazing how the same groups that insist on no more oil and gas are also the first in line to prevent the use of an effective alternative!)

But I also imagine LAAC may well decline as a result of the above factors to a point where it merits additional investment. I'm keeping my current position and will add at lower prices. I'm not equally convinced that LAC will decline now that it is on its own.

I wrote one of my first analyses of LAC for Seeking Alpha readers back in April 2021. You can find it here.

I have since sold some shares more than once as they raced ahead, but I have always repurchased in greater quantity when the price declined. I personally have a “Strong Buy” analysis at the current price for LAC and, at lower prices, a “Buy” for LAAC.

More By This Author:

Why Lithium Stocks Are Falling

The Most Precious Resource On Earth Is In Danger

The Glencore Trifecta: Cobalt, Copper And Nickel (And More)

Disclosure: I/we have a beneficial long position in the shares of LAC, LAAC either through stock ownership, options, or other derivatives.

Disclaimer: Unless you are a client of my ...

more

Thank you for your thorough analysis. Can you explain the volatility in the companies? Its crazy. The shares are all over the place and the even the values. I'm so confused. I am frustrated with lack of press release from lac and concerned that the owners or CEO sold over 8 million in shares at 27 himself. something is fishy here. I hope it sorts itself out soon. livens and alb are great buys here too. I also liked that your clarified that lac will send product in 2026 and not begin production. that should be beginning of next year. thank you