The Glencore Trifecta: Cobalt, Copper And Nickel (And More)

I may have saved the best for last. One reason the shares of Switzerland-based Glencore (OTCPK: GLNCY) trades for such a low multiple is that it *is* the world leader in cobalt production. If that seems counter-intuitive, here is why:

It seems everyone is working to reduce the amount of cobalt in the typicon Li-Ion battery. For good reasons -- cobalt is expensive, it is sourced from some of the world’s most corrupt regimes, and some of it finds its way into the global flow from the bent backs of forced labor and child labor.

However, new resources in socially responsible nations are cranking up and that additional cobalt coming on line may well come at a lower price. Greater supply, with less baggage, could bring the price of cobalt down.

Another approach, taken by Tesla (TSLA), other EV and battery manufacturers, and many government labs, is to experiment with using less cobalt in each battery. The idea is to usually replace with much more (but less expensive) nickel or an amalgam of nickel and other materials. Even if this happens, very less expensive batteries and battery packs – the largest expense in EVs – will only mean greater price competition and thus more sales.

Even if we could create batteries without *any* cobalt, with Glencore we still have all that copper and nickel – plus a brilliant commodities trading firm (Glencore’s first business).

Here is a layman’s look at one of these new batteries -- Tesla’s new lower-cobalt, higher-nickel 4680 battery.

What We Know About Tesla’s New Battery

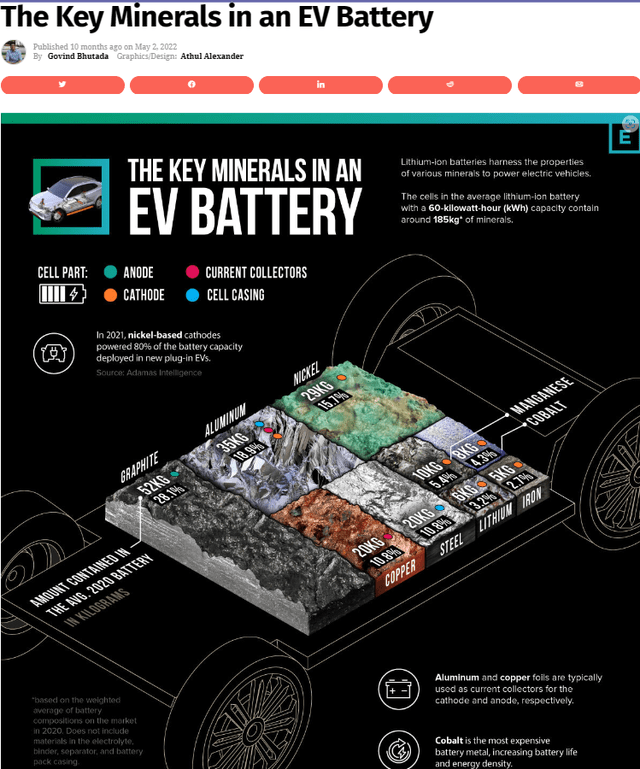

Below is a typical NCM (Nickel-Cobalt-Manganese) used in many EVs over the past few years. This graphic is from May of 2022.

Visualizing the Key Minerals in an EV Battery (visualcapitalist.com)

Tesla’s goal with the 4680 battery is to use a greater amount of cheaper nickel and less of more expensive (or rarer or more difficult to extract) materials like cobalt. Currently produced only in-house in low quantities, I believe Tesla’s long-term battery production partner, Panasonic (OTCPK: PCRFY), will likely be the first to produce this new battery in marketable size. Many readers already know about this successful TSLA-PCRFY partnership. I have friends who work at the “Tesla Gigafactory” just down the hill from me in Reno-Sparks, Nevada... except they do not work for Tesla. They work on the other side of the building, the side that makes the bulk of the batteries – the Panasonic side.

Speaking recently of the new Panasonic gigafactory being built in De Soto, KS (a suburb of Kansas City), the company noted it “continues to strengthen its lineup of automotive lithium-ion batteries and expand its production capacity, currently developing the new '4680' high-capacity lithium-ion battery in Japan.” First in Japan, next in the US?

According to Inside EVs battery teardown, “Tesla's in-house produced 4680-type battery cell... is equipped with NCM 811 cathode chemistry. The material characterization indicates 81.6% nickel content.” And “The 4680-type cell already stores over 5-times more energy than the physically smaller 2170-type cell.” Impressive.

Neither Tesla nor Panasonic have discussed the actual decrease in the amount of cobalt used in the 4680 battery, but they have suggested it is “lower,” which would make the price of each battery less, allowing for greater price competition. Giving further credence to the likelihood of a dynamic change to this battery going forward, three weeks ago Reuters reported that “Tesla plans a $3.6 bln expansion [of its] Nevada gigafactory to make Semi truck battery cells. Tesla [said] it would [build] two new factories, one to mass produce its long-delayed Semi electric truck and the other to make its new 4680 battery cell.”

What Are the Ramifications of This New Battery Technology?

First, it is not some massive breakthrough that will change the world. Almost all change in this field is iterative, building upon others’ mistakes or successes. But it does show that combining materials in different ways chemically might lead to meaningful improvements. Lighter weight and greater energy density equals greater range and lower cost to produce. If the technology works out, I see all automakers within a short time creating their own 4680 type batteries – or improving upon them.

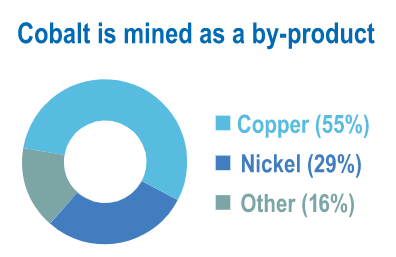

Right now, EV batteries can have up to 40 pounds or more of cobalt in each 100 kilowatt-hour (kWh) pack. Most of the cobalt mined comes as a secondary material from nickel and copper ores. I do not see any reduction in the use of these ores so I am not as concerned as many other analysts who bemoan the fact that the supply of cobalt might be reduced. As long as copper and nickel are produced, we will have cobalt as a byproduct.

I wish Tesla and others good fortune in lowering the use of cobalt for the battery cathode by using different combinations of manganese, nickel, iron, titanium, magnesium and aluminum. It may well happen, but today cobalt oxide simply provides the best combination of high voltage, good energy density, and spiritedly moving lithium ions around as they wend their way to the anode. What is great about cobalt is that it needs no chemical optimization to work. Just as it is, it stores a lot of energy in a small space and can release a huge amount of electricity at once if you really need to stomp on that accelerator.

And if the new mines coming along mean more abundant cobalt, in locations where miners could avoid the corrupt regimes that use forced and child labor, might the cheaper price resulting from greater supply be every bit as elegant a solution as a new chemical soup for EV cathodes?

After all, we are not stopping our quest to find more essential nickel and more copper. And roughly 84% of cobalt comes as a “side benefit” of copper and nickel mining.

Cobalt Institute

This was one reason why I added the Global X Copper Miners ETF (COPX) to my CCLANG (Cobalt, Copper, Lithium, Aluminum, Nickel, and Graphite) portfolio at Investor’s Edge®. Not all nations that have copper production or reserves are particularly stable. I want to cover the globe in owning copper companies so that a change in governance or internal strife does not knock my portfolio for a significant loss.

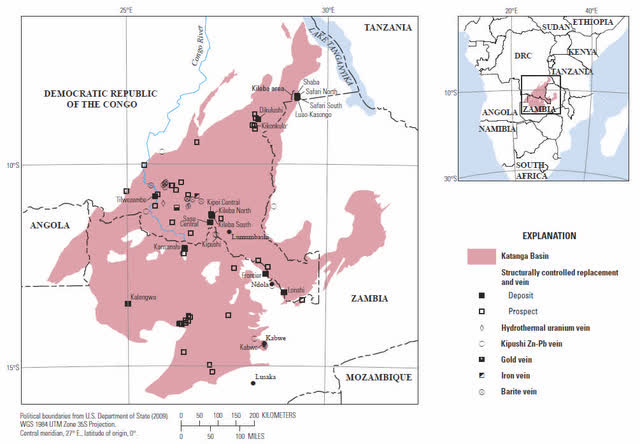

Nothing illustrates this better than the fact that 70% of all the world's cobalt, and significant copper and nickel, is currently produced in the violent, poverty stricken and conflict-ridden country known as the Democratic Republic of the Congo (DRC). This massive nation, bigger than the size of the Louisiana Purchase, has a per capita income of something like $1100 USD per year. It is a prime beneficiary of the Central African copper belt. It is within this copper belt, especially the eastern province of Katanga in the DRC, that the cobalt is primarily found. There are more than 100 insurgencies of all stripes, as well as government-sponsored militias in this country, with most of them also operating in the eastern part of the DRC.

Rather than dwell upon all this in an investing publication, to understand the troubled history and current state of affairs in the DRC I would invite you to review the CIA Factbook on the country, which provides a clear view of events there: Congo.

This is the Central African Copper Belt:

The Central African Copper Belt (Geology for Investors)

There are scores of operating mines managed by responsible international companies in this vast area. These large international companies are under the microscope at all times. They must answer to their shareholders as well as their home constituents. That is why most now adhere to the following:

- Universal Declaration of Human Rights

- United Nations Guiding Principles for Business and Human Rights

- OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas

- Equator Principles

- Extractive Industry Transparency Initiative (EITI)

- ICMM Mining Principles

- IFC Environmental and Social Performance Standards

- The Voluntary Principles on Security and Human Rights

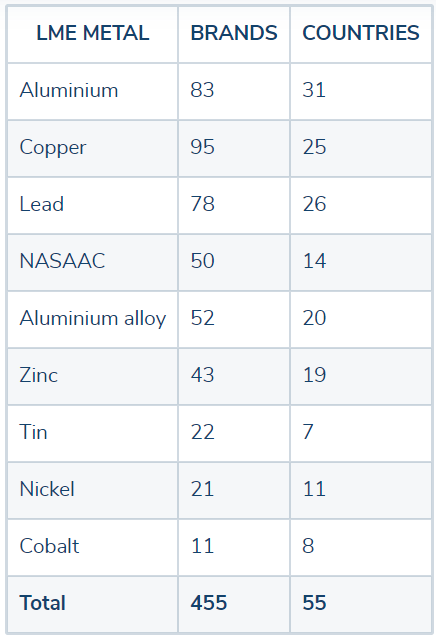

In addition to these, I believe the best way to encourage miners to source responsibly is to hit them where it counts – in their pocketbook. The DRC is but one of many nations that was instrumental in the London Metals Exchange (the world’s largest metals exchange) decision to create the “LME responsible sourcing” standards for any firm or country that wishes to trade its metals on the LME. Since the LME is by far the largest, adherence to the LME’s guidelines ensures a fair and free market. This is especially important to those who trade in any size. Begun in 2019, registrants – and there are many – have until this year to be in full compliance. Here is a quick look at the number of companies that have sworn to abide by the responsible sourcing standards.

LME Responsible Sourcing (London Metal Exchange.)

For those of you who are ESG investors, you can find a treasure trove of information at all the sites above plus the myriad links from the LME’s website: LME Responsible Sourcing | London Metal Exchange.

Even with all these efforts, we must remember that in almost every country there is also a vast “artisanal” mining sector. If that sounds like arts and crafts, or the benign individual findings of a few stones here and there, it is not. It is people who dig out gold, silver, cobalt or rare earth with pick, shovel and by hand.

What Choice Do We Have If We Want the Cobalt Now?

First, we must find redouble our efforts to find new sources because the “overall” use of cobalt is likely to increase even if less is used in each battery cell.

And we must diversify among nations and providers to blunt any monopoly. Here are “today’s” top 5 cobalt producing nations. Data from the USGS / output for the year 2021.

1. Democratic Republic of the Congo -- Mine production: 120,000 MT (Metric Tons, or “Tonnes.”)

The DRC accounts for some 70% of the world’s entire cobalt production year in and year out. After promising a couple of years back not to raise its royalties, increased them from 2.5% to 10%. Simple greed, mixed with a dollop of graft and corruption, could still price the DRC out of the market. The government has also decided to take control of all artisanal collection of cobalt, as well, so even the poorest of workers will effectively be working for the regime.

2. Russia -- Mine production: 7,600 MT.

Russia is a distant runner-up to the DRC’s current production stranglehold, producing around 4% of the global share, all from within Russia, mostly in the Altai Republic area. You might think that Russia’s production – and sales – of cobalt would diminish under global sanctions. But as a blog last week from Maxim Trudolyubov at the Wilson Center think tank recently noted, “We should not forget that the Russian budget is also supported by revenues from other export commodities, which the West keeps quiet about because these commodities, primarily industrial metals, are too important for Western markets to impose sanctions on.

“Russia's exports of aluminum and nickel to the European Union and the United States increased by as much as 70 percent between March and June of last year. Last year the… LME… *considered* banning Russian aluminum from being traded and stored in its system, but decided against it.

“Because of the boom in the electric car market and in renewable energy—and therefore in batteries—the growing demand for nickel (of which Russia is a major producer) and lithium is a logical result. Russia provides 40 percent of Germany's nickel needs and is the largest supplier of palladium to the United States, and palladium is needed for the automotive industry worldwide.”

My response: Never overlook the “real” in “realpolitik.”

3. Australia – Mine production: 5,600 MT

Third on the list of largest cobalt-producing countries is Australia, which is increasing its output every year. With the right investment, Australia will continue to build responsible production. As the DRC becomes a more difficult and more heavily-taxed place for miners, I see Australia as the most logical next nation to increase its cobalt production markedly. Even though headquartered in Switzerland, the number of Glencore’s mines and production facilities in Australia are second only to those in Africa.

4. Philippines – Mine production: 4,500 MT

The Philippines is fourth in terms of production and, good news, it is also a large nickel producer. Here is a nation that enjoys the rule of law, has had its difficulties with China, and is friendly with the US. During the Duterte presidency, the Philippines was not mining-friendly. There is a good chance that will likely be changed markedly under the new Marcos government.

5. Canada - Mine production: 4,300 MT…including Cuba add 3,900 MT.

Canadian cobalt comes mostly from large nickel and copper mines that produce cobalt as a by-product of their normal operations. Thanks to the outdated, unworkable and unenforceable US embargo of Cuba, Canada is also working closely with Cuba. The Cuban cobalt is worked by a joint venture with the (of course) state-owned nickel company and Canada’s Sherritt International (S: CA) (OTCPK: SHERF).

The news for a world in need of more cobalt is much better than these production numbers might indicate, for two reasons.

The first is that there is still so much of the earth that is unexplored. Right now, for instance, there is well-financed exploration activity on the island of Greenland. Like the Swedish rare earth find I discussed in my previous article, who knows what we may find as we travel further into territory that was overlooked because of the easy availability in the Central Africa Copper Belt?

The second reason is that, while the DRC has the world’s biggest known reserves, at 3,600,000 MT, they are not alone. The cobalt reserves numbers below are again based on the US Geological Survey’s most recent data.

Australia is second only to the DRC in known reserves, and they have barely scratched the surface. Oz may have only produced 5,600 MT in the most recent year available – but their known reserves are a whopping 1,400,000 MT! Can you say “The Lucky Country”?

Indonesia comes next, with at least 600,000 MT of known reserves, followed by Cuba with 500,000 MT and The Philippines with 260,000 MT.

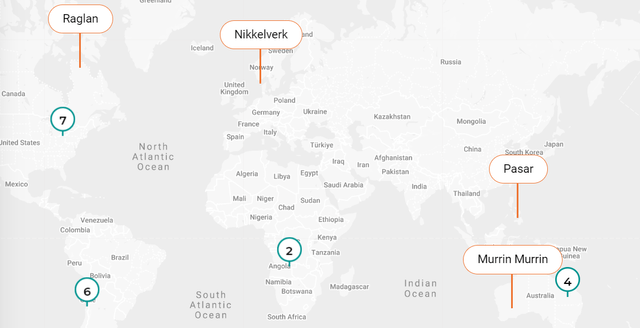

Glencore was not originally established as a mining company. It began as a trading firm focused on ferrous and non-ferrous metals, minerals and crude oil. Glencore then expanded its purview via the 2013 merger with multiple-metals miner Xstrata. Glencore, like all other mining firms, is now sourcing their product in locations well beyond the DRC. In addition to their two mines and facilities in the DRC, here are their others:

Glencore website

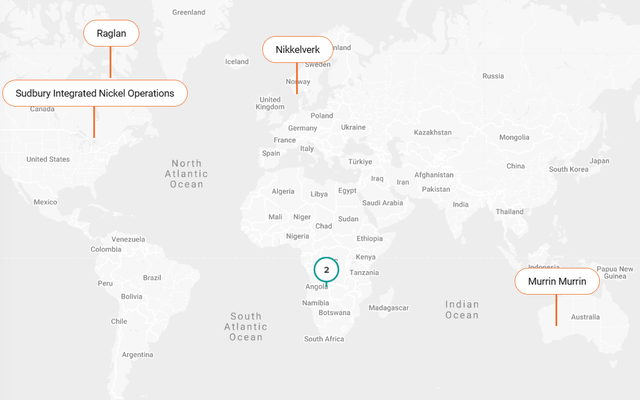

And reinforcing that cobalt is most often produced as a by-product of nickel and copper mining, here is where Glencore gets its copper and nickel:

Glencore website

My first choice in analyzing a company as a possible investment is to review the company’s website. That is no easy task at Glencore! With typical Swiss efficiency, every metric that the mind of man can conceive is tossed into the Glencore website. However, trying to navigate it and keep 11 tabs open simultaneously to get the big picture is not something I recommend for the faint-hearted.

I did, however, conclude my quest on the Glencore website, and beyond, and have decided to add Glencore to my other “CCLANG” holdings in lithium, aluminum, graphite, nickel, and copper.

(Rather than link to all these, for a limited time you can just type “CCLANG” in the Seeking Alpha search box and you will easily find them.)

Here is what I like best about Glencore...

- Glencore is one of the largest miners in the world that supply copper and nickel, two of my essential CCLANGs for the future of electrification.

- In cobalt, a Chinese state-owned firm is also quite large, but Glencore is still the largest producer of cobalt in the free world.

- Glencore’s original trading business is still a powerhouse and is used by numerous other mining and processing firms that know Glencore can do more for them in the trading arena than they could themselves.

- Glencore’s trading arm is a huge trader of oil. Indeed, it is one of the best and most experienced oil traders on the planet. Volatility in the oil markets benefits their bottom line. Up, down or sidewise, there is always someone on either side of the bet. Glencore is there to profit from their trading.

- Glencore’s trading and marketing arm is directly advantageous to the mining side. They see a lot of opportunities that others are creating anew.

- Glencore just re-opened its huge Antapaccay copper mine in Peru, which was shut down following violent attacks by local protesters. There is a cost of doing business in volatile parts of the world. This is not Glencore’s first rodeo.

- Glencore has done a brilliant job of reducing its debt burden over the past many months of low interest rates to arrive at the point where they do not have to borrow now that rates are higher to sustain their business.

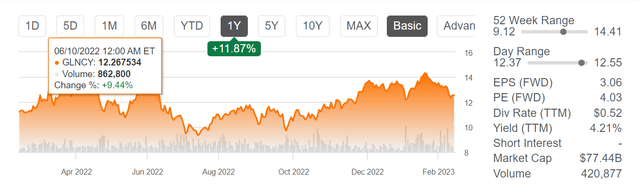

- Glencore trades at a forward PE of just above 4, lower than many of its competitors, and pays a trailing dividend of greater than 4%. It trades with sufficient volume to ensure reasonable bid-ask spreads.

SA

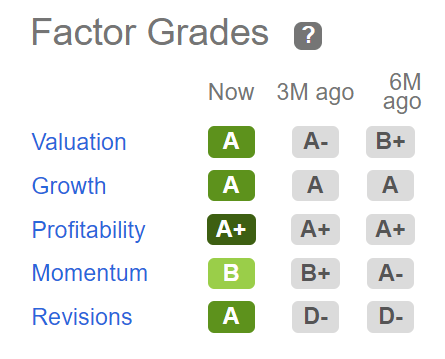

- Glencore receives the following Factor Grades from Seeking Alpha:

SA

For its holdings in copper and nickel, for its superb trading capabilities, and for its key position in cobalt worldwide, I am buying Glencore as my CCLANG choice for cobalt. Along with my other holdings I also now have a decisive position in nickel.

Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

More By This Author:

COPX: Copper Is The 'Conductor' Of The CCLANG Orchestra

FAANGs, No! CCLANGs, Yes! Norsk Hydro, First Among Equals

The Energy Sector Is Now The Way To Go

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase ...

more