Fair Isaac Corp.'s Stability And Recognition Produce An Exaggerated Price Premium

Image Source: Pexels

Introduction

Fair Isaac Corporation (FICO) is a company ingrained in the financial services world. The company's FICO score has been used around the world for decades to make better financial decisions. The business not only provides these credit scores but also services to help analyze the data and scores. Most major financial institutions use a product offered by Fair Isaac Corp. This business is incredibly in demand and very inelastic. This has allowed the company to see stable and consistent growth over the long term.

While Fair Isaac Corp. is a behemoth in the industry that proves to be stable and efficient, the results are a stock that has run up a massive premium not conducive to historic growth.

A History of Consistent Performance

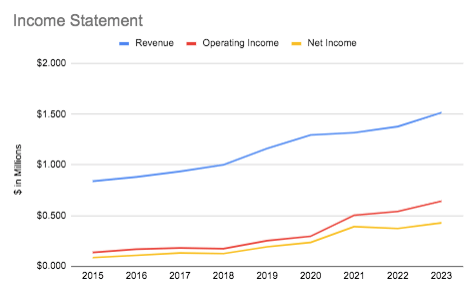

FICO Income Statement (SEC.gov)

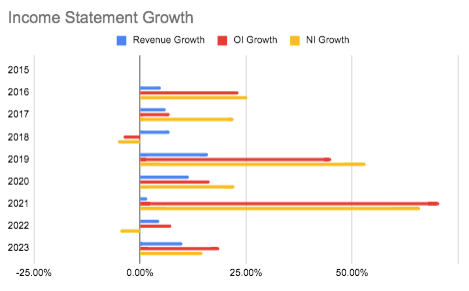

FICO Income Statement Growth (SEC.gov)

Fair Isaac Corp. has seen a very steady growth trend. As can be seen above, the company has not experienced revenue decline in nine years, has seen operating income decline only once, and net income only twice. This is a rather remarkable growth trend that is a testament to the products Fair Isaac Corp. produces.

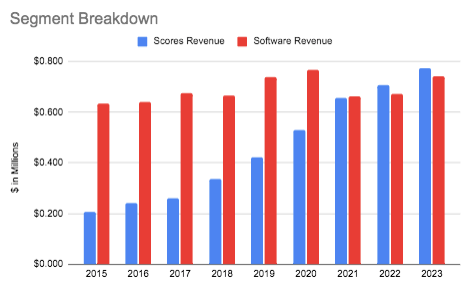

FICO Segment Revenue Breakdown (SEC.gov)

The biggest boon of growth has been the higher pricing of products in the scores segment. The scores segment has consistently grown each and every year to now become the main bread-winning segment for Fair Isaac Corp. This shows just how inelastic the company's main scores of products are, as the company has been able to generate consistent growth due mostly to pricing increases over time. From 2018-2021 a significant pricing adjustment occurred, helping usher in higher revenues these past few years in the scores segment. The CAGR of scores segment revenue since 2015 has been a whopping 15.78%. On the other hand, the software segment has had its ups and downs and has only posted a CAGR of 1.75% over the past nine years. That being said, the software segment also provides stability to the business as 86% of revenue is recurring.

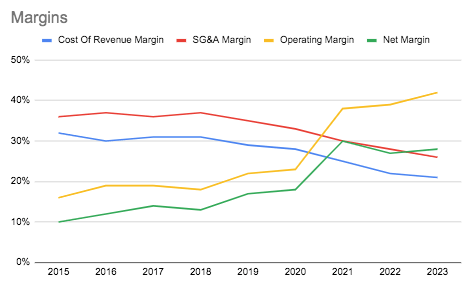

FICO Margins (SEC.gov)

Taking a look at Fair Isaac Corp.'s margins will show just again how stable and efficient this business is. Cost of revenue as a percent of total revenue has decreased by 11% since 2015. SG&A costs have declined by 10% too. This has led to operating and net margins exploding. Operating margin has seen a wild 26% increase, while net margins have recorded an 18% increase. These are incredible numbers for just under a decade.

Continued Trajectory This Year

Fair Isaac Corp. Corp. has seen all these trends continue or stay stable into 2024. So far in the first half of the year, the company has seen 13% revenue growth attributable to higher price points in the scores segment and increased on-premise & SASS revenue in the software segment.

Cost of revenue and SG&A margins have stayed stable, along with operating margins. Net income has grown by 26%, increasing the margin to 27%.

Overall, Fair Isaac Corp. has a remarkably stable business model. It seems the company has a very in-demand and inelastic product base. This has allowed for long-term growth in the business that seems very likely to carry on into the foreseeable future.

High Leverage, Great Current Position

The only negative thing I can see about Fair Isaac Corp.'s financials is that the business is highly leveraged. The debt-to-equity ratio is -3.31, meaning the company would need to increase equity 3.3 times to have a debt-to-equity ratio of 1. While this looks bad on its own, we need to remember the consistency of operations this business does. Also, the company boasts very solid short-term liquidity and operating metrics such as a 1.86 current ratio and a 6.7 times interest earned ratio.

Looking at the whole picture, Fair Isaac Corp. is highly leveraged, but it seems manageable given the consistent operating performance and ample short-term liquidity.

Hefty Valuation

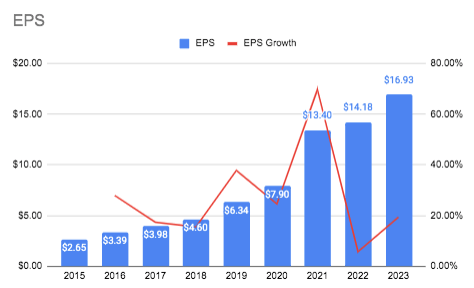

FICO EPS (SEC.gov)

As of writing, Fair Isaac Corp. trades for $1,515 per share. Therefore, the company trades at a trailing P/E of 89.5. This is a very high P/E but could be justified by the growth trends. The average growth of EPS over the past nine years has been about 27%, and therefore the company trades at a PEG of 3.28. As a general rule, a PEG over 1 is considered overvalued. Also, there is no book value associated with this business, as equity is negative. In totality, I believe the stock is overvalued. Fair Isaac Corp. has a stable and growing operation, which has to be factored into the valuation, but I do not feel the stability should move the needle past a 2 PEG. To justify the current PEG, the premium of operations stability would need to equate to 62.5% more growth in EPS than already present, which I do not see as even close to reasonable.

Conclusion

I love the business that Fair Isaac Corp. operates. With strong stability, easy growth, inelastic products, and solid liquidity, the company will easily persist. But these attributes have made the stock an easy target for premium over-exaggeration. At the current valuation, I am not investing in the stock as it offers no margin of safety.

More By This Author:

Wingstop's Past Growth Can't Be Extrapolated Into The Future

CBRE: A Stable Business Now At A Better Value

Inflation Has Caused Poor Results For Allstate, But It Should Be Temporary

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 ...

more