Inflation Has Caused Poor Results For Allstate, But It Should Be Temporary

Image Source: Allstate.com

Introduction

Allstate (ALL) has not made me feel in good hands this year, with the company seeing underwriting losses due to high inflation. But the company's historical financials are great, and the company has recognized the issue, making me believe it can be fixed this year. With a growing dividend and a current 2.6% yield, I will continue to buy Allstate at this price level.

Financial History

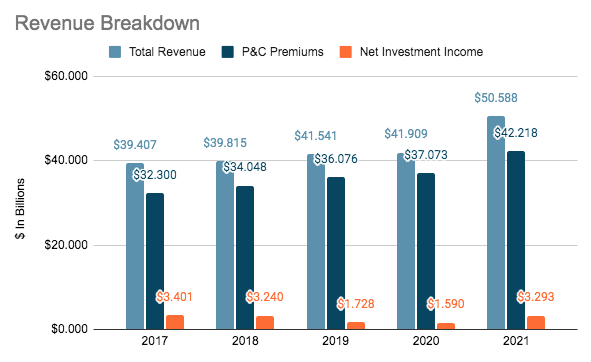

Allstate Revenue Breakdown (SEC.gov)

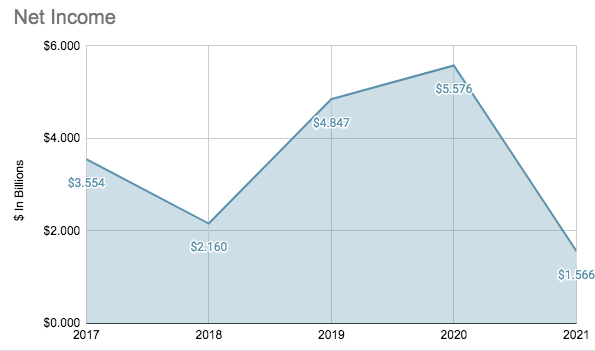

Allstate Net Income (SEC.gov)

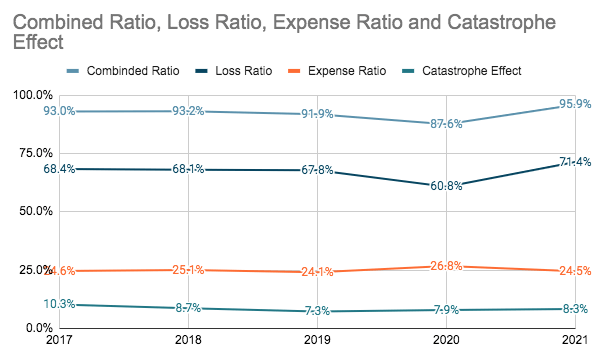

Allstate Combined Ratio (SEC.gov)

Over the past five years, Allstate has performed well. Premiums and total revenue each grew at rates of 5.5% and 5.12% per year. Very steady growth for the company. Net income on the other hand, fluctuates much more. This is in part to the fluctuation of net investment income but mostly underwriting efficiency. In 2021, the main factor for the large decline in net income was the divesture of the life insurance segment, which the company took a $4 billion loss from. If we look at net income from continued operations, Allstate would have seen just a 5% decrease.

Looking at underwriting metrics shows how efficient the operations are. The lower the combined ratio the more per dollar the insurer makes. Looking at the combined ratio over the past five years shows Allstate has done a great job of maintaining underwriting income. Allstate has kept the expense ratio very consistent and the loss ratio below 70% up until the past year. In 2021, the company saw claim amounts increase due to the rebound in travel after the pandemic but also due to rising costs. Add with this a slight uptick in catastrophes, and the combined ratio was higher. But still, Allstate made a solid underwriting profit, unlike the year so far.

This Year

So far at the midyear of 2022, Allstate has seen the inflationary trends of 2021 become worse, which is driving up claims costs. While premiums grew by 7.7% and total revenue was down just 2.2%, the business posted a $378 million loss so far. This is because the combined ratio was 102.7%, attributable to a loss ratio that increased 137 basis points to 79.2%. Pretty much, more people are driving increasing claims which are costing more due to inflation. The company has stated this inflationary environment was unforeseen and will adjust premiums going forward. It will be interesting to see how the second half of the year plays out.

Valuation & Dividend

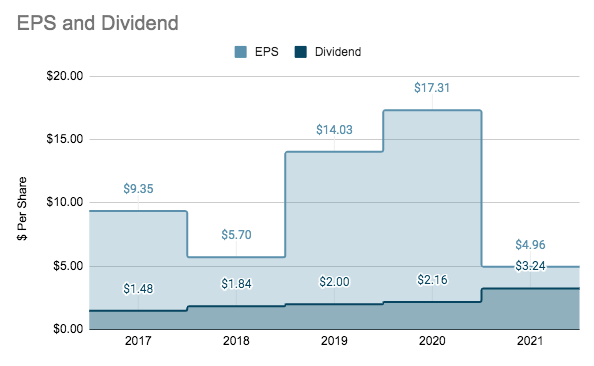

Allstate EPS & Dividend (SEC.gov)

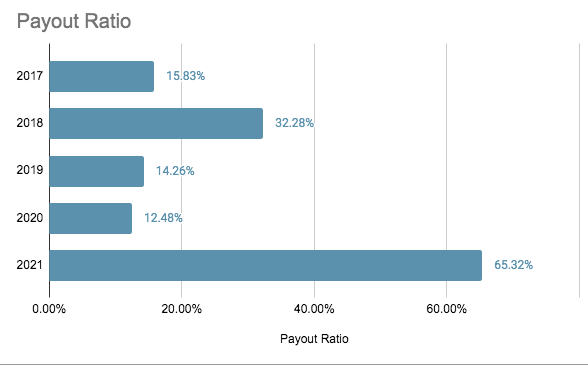

Allstate Payout Ratio (SEC.gov)

As of writing, Allstate is trading around the $125 price level. At this level, the company trades at a P/E of 12.17x using the five-year average EPS of $10.27. But this year, the book value has declined from $86 to $66 per share. This is a much better way to value the company, which is not trading at 1.9x book value. Allstate also offers a nice dividend yield of 2.6% and has room to grow. The payout ratio using the average EPS is just 33%. I think the headwinds of the insurer are temporary and fixable, and at these values is fairly valued. I will continue to dollar cost average my position over time.

Conclusion

As an owner of Allstate already, it is not great seeing the year start off in such a horrible fashion. The company has seen the inflationary economy run up claim costs and decimate underwriting profits. What I rely on is the company's recognition of the situation and historical efficiency to adjust and fix this issue. While this year's earnings may be a dud, I have faith Allstate with be fine in the long term. At the current valuation, I am still dollar cost averaging this dividend machine over the long run.

More By This Author:

Traeger: Not Cooking Up Much Profit Growth

Campbell's Is Cheap For Such A Stable Business

GoDaddy Valuation Justified By Growth

Disclosure: I/we have a beneficial long position in the shares of ALL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own ...

more