GoDaddy Valuation Justified By Growth

Introduction

If you need a website for your upstarting business, one of the first names that come to mind is GoDaddy.com, where you can register a domain name, host a website, market and sell your products. GoDaddy Inc. (GDDY) is one of the leading providers of these services, offering cloud-based services that allow a person to name and build their website, sell, market, and have branded email. These in-demand products/services have allowed the business to grow at double-digit rates for the past five years. With this strong growth and expanding margins, GoDaddy has great prospects for future profitability, thus justifying the current valuation

Financial History

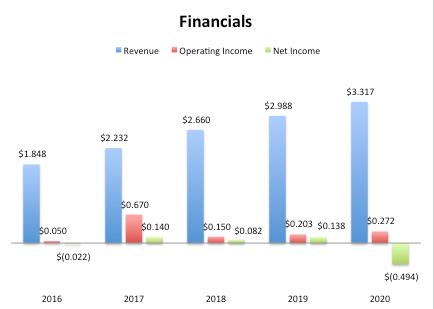

Source: SEC 10-K's

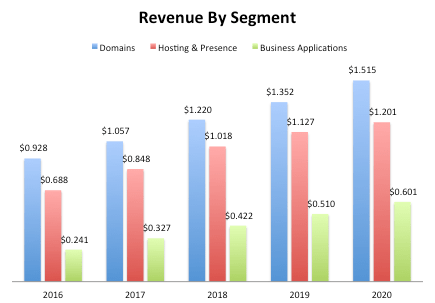

GoDaddy has since had high revenue growth over the past five years. The revenue CAGR over the period has been 12.41%. This is on the back of a total customer base that has expanded from over 6 million since 2016. Looking deeper at a segment view shows how Domains, Hosting & Presence, and Business Applications have all grown at great rates. Domains have seen a growth of 10.3% per year, while Hosting & Presence grew 11.79% per year and Business Applications grew 20.5%. Rarely do you see every segment of a business excel at this level.

Source: SEC 10-K's

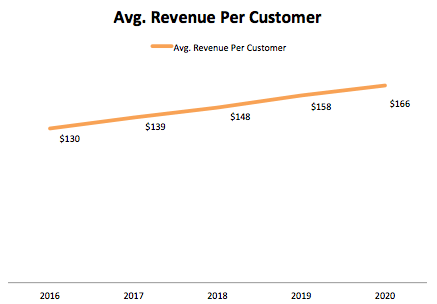

Moving down the income statement though shows that GoDaddy has struggled with profitability. Net income has been very varied each year. In 2020 net income took a large $674 million tax liability charge from a pre-IPO tax receivable agreements settlement. The good news is that the operating margin has been expanding each year. Since 2016 the operating margin has grown by 5.5%. If revenue keeps growing at the rate it has been, the margin should continue to expand and profitability along with it. Also to note is that total booking and the average revenue per customer have increased every year too. Altogether, while GoDaddy profitability isn't wonderful, the revenue and margin expansion easily make up for it.

This Year

So far in 2021, GoDaddy has been seeing the same trend as prior. Over the nine months, the company has seen total revenue growth of 14%, on par with the last few years. Growth came from all segments of the company. Domains saw growth of 18%, Hosting & Presence grew 7%, and Business Applications 21%. So far the operating margin has increased again to 9.2%, all resulting in net income growth and $0.90 per share for the period. Underlying this year's success was customer growth and increasing average revenue per customer. All around, the company is showing all improvements in all the right ways with no sight of slowing down anytime soon.

Balance Sheet

While the income statement holds up, GoDaddy's balance sheet is another story. The company has a current ratio of 0.71x, meaning it can't pay all current obligations. The company is also highly leveraged and has no stockholder equity due to the lack of earnings in past years. While this balance sheet doesn't make or break the business, it adds to the risk of the business if growth rates subside.

Valuation

As of writing, GoDaddy trades around the $73 level. At this level, the company trades a P/E of 55.73x using the average EPS for 2021 of $1.31. With the five-year operating income average growth rate of 40.32%, GoDaddy trades at a fair P/E. Even though the valuation may seem high, I believe it is justified.

Conclusion

GoDaddy has seen great growth throughout the entire income statement. Revenue growth has been in the double digits for a while and should continue to be for the foreseeable future. The operating margin has continued to grow too, thus creating a receipt for future profitability. While the valuation of the company may look hefty, the growth rates GoDaddy has posted justify the premium.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 ...

more