Wingstop's Past Growth Can't Be Extrapolated Into The Future

Photo by Jay Wennington on Unsplash

Introduction

Wingstop (WING) has set out to become a top ten restaurant brand in the world. To do this, the company has a goal to open 4000 locations domestically and 3000 abroad. Wingstop is focusing on providing high returns and same-store sales along with this expansion. The company is expanding fast but still needs to open 5000 more stores to meet these goals. It will be a challenge to keep the same-store sales numbers positive with this much growth in the food industry. With an over-leveraged balance sheet, there is a lot of risk in assuming this plan will come to full fruition.

Historical Financial Performance & Goals

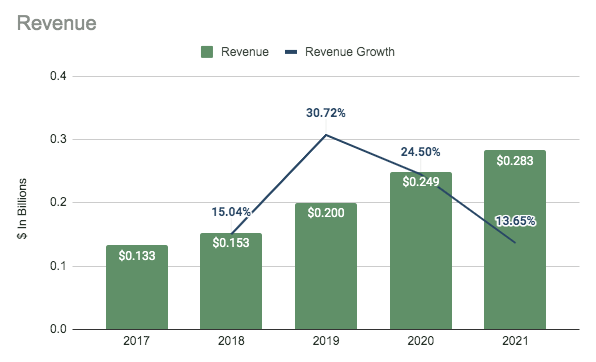

Wingstop Revenue (SEC.gov)

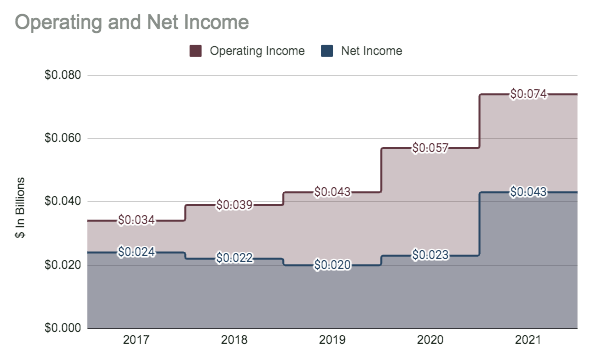

Wingstop Operating & Net Income (SEC.gov)

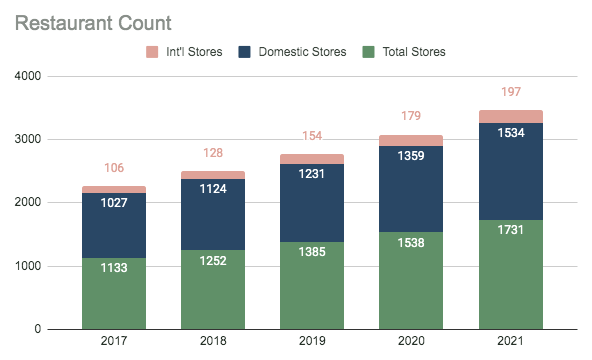

Wingstop Store Count (SEC.gov)

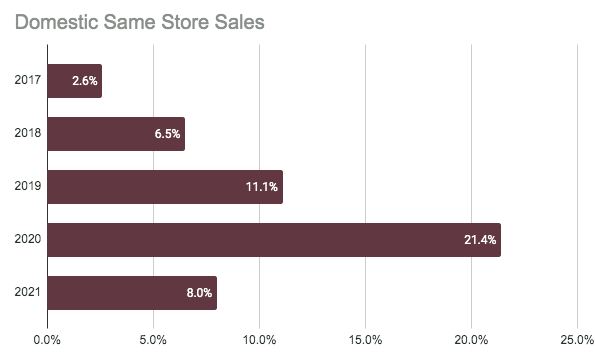

Wingstop Same Store Sales (SEC.gov)

Over the past five years, Wingstop has seen significant growth. Total revenues for the company have grown at double-digit rates each year and have a five CAGR of 16.3% per year. Trickling down, operating, and net income has grown at rates of 16.8% and 12.4% per year. The growth is due to the fast-paced rollout of new restaurants. Wingstop has some lofty goals that include having 4000 domestic stores and 3000 international stores. In 2021, the business had just 1534 and 197 each but saw total growth rates close to 50% and 85% since 2017. So while the restaurant's goals look high it may be possible in due time with the rate the company is expanding at. Another key goal is to have same-store sales growth over the long term. As can be seen above, Wingstop has had great success with this in the past five years, with no year showing a decline. This shows that new and existing restaurants have strong demand. Of course, this same store sale growth every year gets exponentially harder with the store count goals stated. It will be key to see if Wingstop can expand at this rapid rate and keep same-store sales positive in the long term. Overall, Wingstop is doing great and is focused on expanding to become a top-ten restaurant brand in the world.

This Year

As of the nine months reported for 2022, Wingstop has seen continued growth. Revenue this year is up 20%, with the total store count growing by 9.6% at the end of 2021. The domestic store count has increased by 9% and international by 14%, at the same pace as in prior years. On top of that, the company has seen 1.6% same-store sales growth so far this year. Overall, consistent operating performance in the past years. Operating income over the nine months is up 5.9%, but net income is down 1.1%. This is attributable to debt extinguishment and a 42% increase in interest expenses.

Balance Sheet

Speaking of debt and interest expense, Wingstop doesn't have the most incredible balance sheet. The business has a ton of liquidity but has funded growth on the back of debt. The current ratio is very high at 3.68x. As for the debt-to-equity, Wingstop has $818 million in debts and -$407 in equity. This business needs to control the debt load, or you better hope same-store sales never decline. The times' interest earned ratio for Wingstop for the nine months is 3.96x, which is good, but with the expansion of the company, the balance sheet could get out of hand quickly.

Valuation

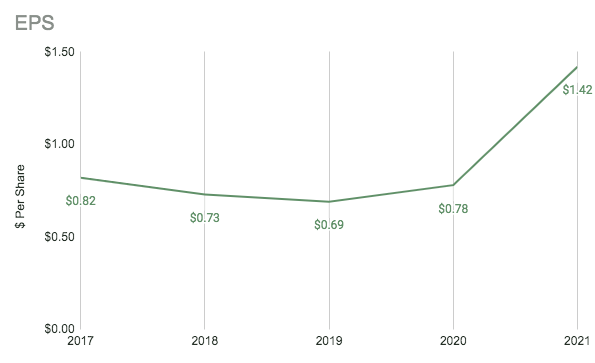

Wingstop EPS (SEC.gov)

As of writing, Wingstop trades around the $175 level. At this price point, the company has a P/E of 106x using the 2022 EPS estimate of $1.65 per share. With a growth rate of 12%, that's a PEG of 8.8x. This is a pretty wild valuation for this business, especially with such a weak balance sheet. The food industry can be fickle, and by no means should the past growth be extrapolated to the next 5000+ restaurants they want to open in the future.

Conclusion

While Wingstop has seen a very good run in the past five-plus years, the overarching goals are extremely lofty. I can't assume that the company can add 5000 stores are keep same-store sales positive in this highly competitive industry. At the current valuation, Wingstop has baked in the successful completion of these goals making it uninvestable.

More By This Author:

CBRE: A Stable Business Now At A Better Value

Inflation Has Caused Poor Results For Allstate, But It Should Be Temporary

Traeger: Not Cooking Up Much Profit Growth

Disclosure: I/We have no stock, option, or similar derivative position in any of the companies mentioned, and no plans to initiate any such position within the next 72 hours.

Disclaimer: I ...

more