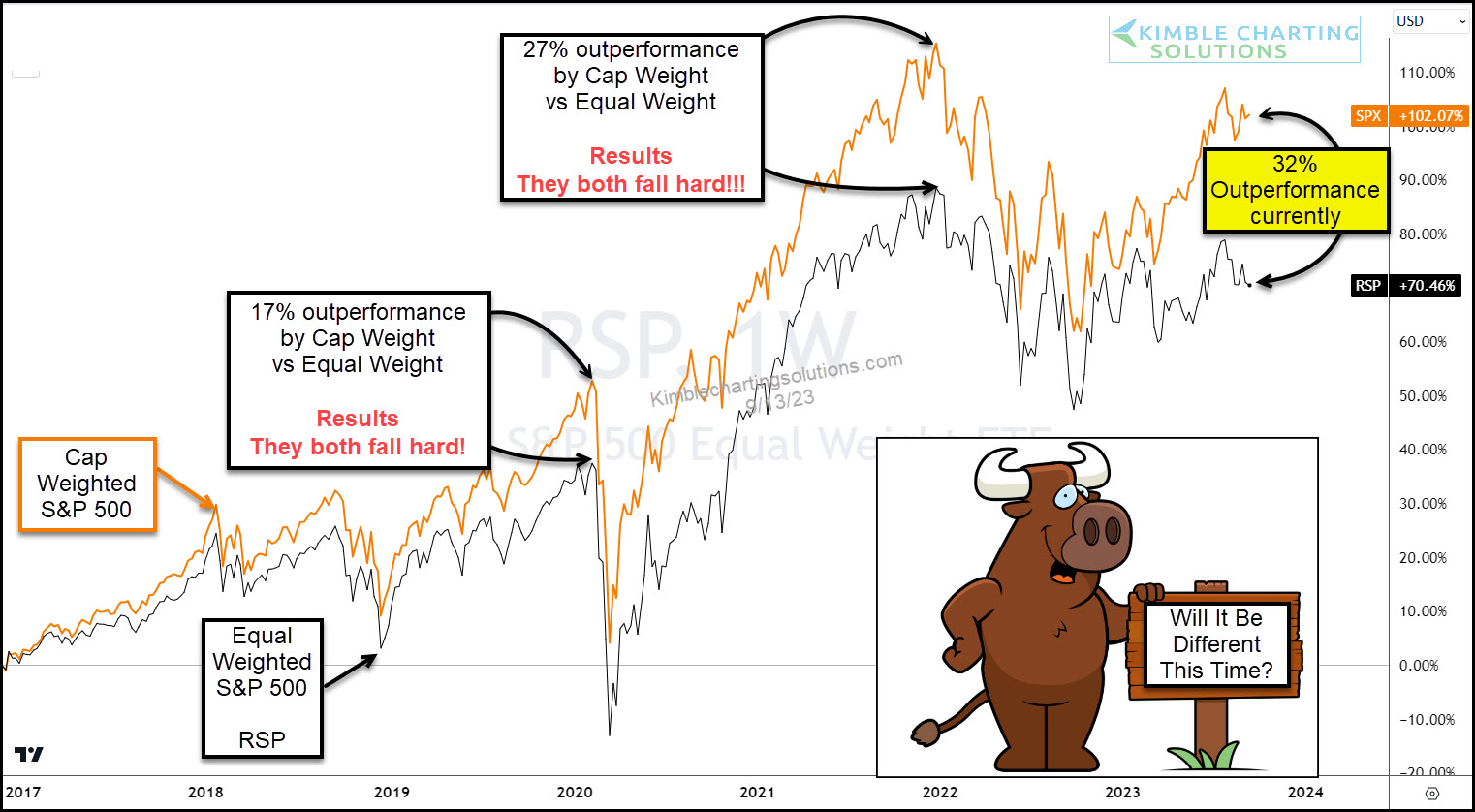

Cap Weight Vs Equal Weight Divergence, Sending Sell Signal Warning Signal?

We often watch the performance of cap-weighted indices versus the equal-weight counterpart.

Why? Because divergences in performance often signal market turns.

Today is no different as we display the performances of the S&P 500 cap weight index versus the S&P 500 equal weight index.

And, as you can see, there is a wide divergence brewing.

The past 2 times that the cap-weighted index was performing much stronger than the equal-weighted index, stocks were near a short-term high. And shortly thereafter they declined sharply.

We are seeing the largest spread in the past 6 years between the two indices right now and the question we should be asking ourselves is: Will the result be different this time?

Might be time to monitor your risk trading profile.

(Click on image to enlarge)

More By This Author:

Tech Stocks Near Major Decision Point: Something Has To Give Soon!Are Utilities Sending Ominous Message To Broader Market?

Will Semiconductors Double Top Take Stocks Down?

Disclosure: Sign up for Chris's Kimble Charting Solutions' email alerts--click here.