Blue Chip Stocks In Focus: Parker-Hannifin Corporation

Photo by Wance Paleri on Unsplash

When filtering through our coverage universe to compile a list of blue chip stocks, our key condition was that the set would be comprised of those companies that featured at least 10 consecutive years of dividend hikes.

Of course, some companies exhibit different qualities of different degrees than others. One company that definitely stands out amongst the 350+ blue chip stocks we have gathered is Parker-Hannifin Corporation. This is due to its outstanding dividend growth track record, which spans over six decades.

Specifically, Parker-Hannifin Corporation has paid a dividend for 71 years and has grown that dividend for a phenomenal 66 consecutive years. Therefore, besides classifying Parker-Hannifin as a blue chip stock, the company is also a constituent of the Dividend Kings elite group. That group includes all companies with at least 50 years of consecutive dividend increases.

It’s also worth noting that while we have identified five more companies amongst Dividend Kings that have hiked their dividend per share for 66 consecutive years, we have encountered no other company with a longer track record.

The sixth installment of the 2022 Blue Chip Stocks In Focus series will analyze Parker-Hannifin Corporation (PH).

Business Overview

Parker-Hannifin Corporation is a global leader in the manufacturing of motion and control technologies and systems, providing precision-engineered solutions for a broad range of mobile, industrial and aerospace applications. The company has divided its operations into two reporting segments: Diversified Industrial and Aerospace Systems.

The first division, as its name suggests, is incredibly diversified. It sells products to both original equipment manufacturers and distributors who serve the replacement markets. These products are used in a myriad of industries and sub-industries, including manufacturing, refrigeration and air conditioning, packaging, processing, transportation, agricultural and military machinery, and various others.

The company’s aerospace division manufactures products mainly for the commercial and military aerospace markets to both original equipment manufacturers and to end users for spares, maintenance, repair, and overhaul. Among the major markers that Parker-Hannifin’s aerospace division products are utilized are Helicopters, Military Aircraft, Missiles, and Unmanned aerial vehicles.

Therefore, Parker Hannifin can hardly be thought of as a singular company. In fact, it resembles more of an Industrial ETF, even though that’s admittedly a stretch. In any case, however, the company’s diversified operations allow the company’s overall performance to be significantly less volatile than that of its peers. To exemplify how diverse the company is, its customer count last year amounted to 505,000 individual clients.

Further, to illustrate the quality of its cash flows, the company has never posted a money-losing quarter since Q2 of 2002. As far as our data set goes (1990), the company has also never posted a money-losing year in 32 years. This explains why Parker Hannifin has been able to comfortably grow its dividend through multiple rough environments over the past several decades.

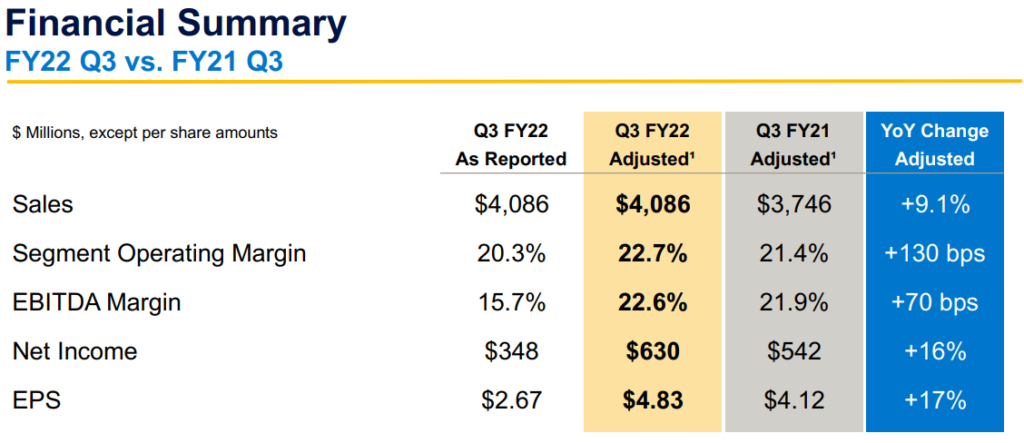

The company’s ability to deliver resilient results was once again demonstrated in its latest results. For Q1, revenues rose 9% over the prior year’s quarter, while adjusted earnings-per-share increased 17%, from $4.12 to $4.83. Positive advancements were attributed to strong demand in nearly all markets, which more than offset the headwind of cost inflation.

Source: Investor Presentation

Management also narrowed their previously wider guidance for adjusted earnings-per-share in fiscal 2022 from $17.80-$18.30 to $18.00-$18.30. We have utilized the midpoint of this range in our calculations.

Growth Prospects

As pronounced by the company’s outstanding dividend growth record, Parker Hannifin’s earnings-per-share has grown at a rather consistent pace. Specifically, over the past ten years, earnings-per-share has expanded at a CAGR of 7.68%. However, this particular period includes the COVID-19 pandemic, which had an adverse effect on industrial companies, especially those with heavy operations in aerospace. Therefore, we expect a slightly higher growth over the medium-term, excluding such one-off effects.

Specifically, we are forecasting an earnings-per-share growth of 9% through 2027. We expect this growth to be powered primarily by Parker Hannifin’s acquisition spree. For instance:

- On October 29th, 2019, Parker-Hannifin completed the acquisition of LORD, a leading manufacturer of advanced adhesives and coatings, for $3.675 billion in cash.

- On September 16th, 2019, Parker-Hannifin completed the acquisition of Exotic Metals Forming Company LLC for $1.725 billion in cash.

These two acquisitions have added ~$1.5 billion in annual revenues.

- On August 2nd, 2021, the company also agreed to acquire the London Stock Exchange-listed Meggitt, a global leader in aerospace and defense motion and control technologies, for $8.8 billion in a cash deal.

Meggitt provides technology and products on every major aircraft platform and has annual revenues of roughly $2.3 billion. Considering the deal value is about 25% of the market cap of Parker-Hannifin, it is obviously a major deal for the growth prospects of the company. The deal is expected to close in Q3-2022.

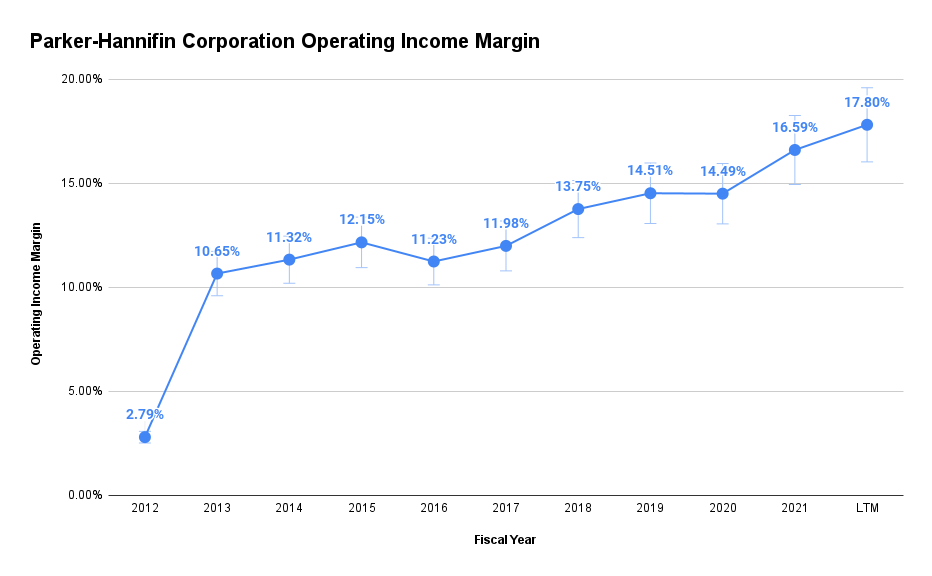

Through such acquisitions over the years, the company has managed to achieve economies of scale and unlock synergies between its subsidiaries, thus expanding its operating margins. As the graph depicts, the operating margin has expanded from 10.65% in 2013 to 17.8% as of the Last-Twelve-Month results. This, along with share repurchases, should notably contribute to earnings-per-share growth.

Source: SEC filings, Author

Regarding its dividend, one could reasonably assume that its growth pace would have slowed down lately as a result of Parker-Hannifin’s mature operations. Yet, the company’s 10-year dividend-per-share CAGR stands at a substantial 11.4%. In fact, Parker-Hannifin’s latest dividend increase was by an impressive 29.1%! Supported by consistent growth, accretive acquisitions, and expanding margins, we are forecasting that the dividend-per-share will grow by 10% per annum through 2027.

Competitive Advantages & Recession Performance

As you can already picture, due to the company’s incredibly diversified operations, Parker-Hannifin features a number of competitive advantages. These include its scale, global distribution network, and technical experience. Parker-Hannifin manufactures parts that are somewhat obscure yet vital for the operations of heavy machinery, factory equipment, aircraft, and other large industrial devices.

This is an attractive characteristic that differentiates the company from its peers as it operates in a profitable niche that helps discourage any would-be competitors. Overall, Parker Hannifin’s qualities are unquestionably mirrored in its dividend growth record, which is nearly unprecedented, especially given the high cyclicality of the industrial sector.

That said, we do warn that following Parker Hannifin’s acquisition spree, the company has accumulated rather substantial amounts of debt, with its net debt currently standing at $7.65 billion. While this could be worrying in a rising-rates environment, we believe that the company’s strong operating cash flows can easily take care of both the underlying interest payments and the scheduled debt repayments.

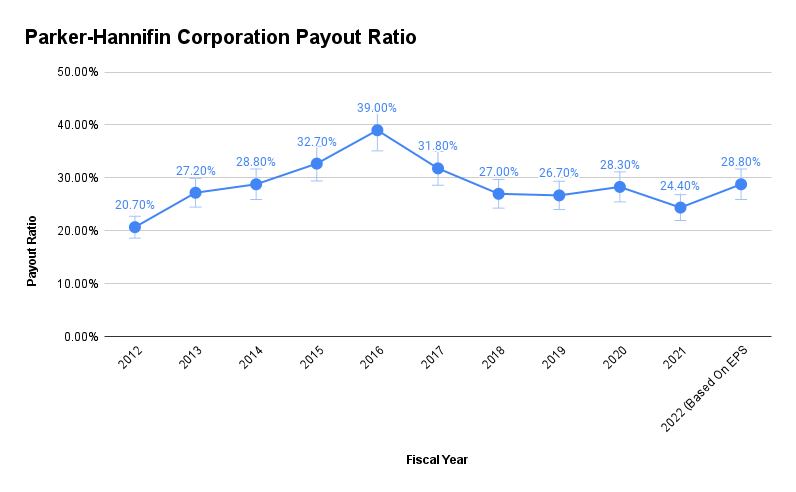

Source: Author

As a result of the company’s numerous qualities, resilient operations, and low payout ratio, we believe that investors do not have to worry about a dividend cut any time soon. Even with this year’s tremendous dividend increase, the payout ratio stands at a very healthy 28.8%.

Valuation & Expected Returns

Shares of Parker Hannifin have traded at an average P/E of 16.5 over the past seven years. Following the stock’s correction year-to-date, the P/E now stands close to 14.5. We believe shares are undervalued at the current levels considering Parker Hannifin’s growth prospects and overall status.

If the price-to-earnings multiple expands from 14.5 to 16.5, which we consider to be Parker Hannifin’s fair multiple, future returns would be boosted by 2.6% per year over the next five years.

This, combined with earnings-per-share growth expectations of 8%, dividend-per-share growth expectations of 9%, and the current dividend yield of 2%, we are forecasting annualized returns of 13.5% through 2027.

Therefore, we rate Parker Hannifin stock a buy.

Final Thoughts

Parker Hannifin has achieved something remarkable that only a handful of other companies have managed to even come close to. Its dividend growth track record is jaw-dropping, despite the sector’s cyclicalities, as its diversified operations ensure relatively low-volatility cash flows under various market landscapes.

With the recent acquisitions to further strengthen the company’s portfolio and possibly further expand operating margins, Parker Hannifin’s growth prospects remain vigorous despite its otherwise mature operations as well. Overall, we view Parker Hannifin as a high-quality blue chip stock that can be trusted by investors looking for growing dividends.

More By This Author:

Blue Chip Stocks In Focus: Fresenius Medical Care AGBlue Chip Stocks In Focus: Ameriprise Financial Inc.

Warren Buffett Stocks: Occidental Petroleum