Warren Buffett Stocks: Occidental Petroleum

Image Source: Unsplash

Berkshire Hathaway (BRK-B) has an equity investment portfolio worth more than $360 billion as of the end of the 2022 first quarter.

Berkshire Hathaway’s portfolio is filled with quality stocks. You can ‘cheat’ from Warren Buffett stocks to find picks for your portfolio. That’s because Buffett (and other institutional investors) are required to periodically show their holdings in a 13F Filing.

You can see all Warren Buffett stocks (along with relevant financial metrics like dividend yields and price-to-earnings ratios) by clicking on the link below:

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

As of March 31, 2022, Buffett’s Berkshire Hathaway owned just over 136 million Occidental Petroleum Corp. (OXY) shares for a total market value exceeding $8.3 billion. Occidental Petroleums currently constitute over 2.6% of Berkshire Hathaway’s investment portfolio.

This article will thoroughly examine Occidental Petroleum’s prospects as an investment today.

Business Overview

Occidental Petroleum is an international oil and gas exploration and production company with operations in the U.S., the Middle East, and Latin America. It has a market capitalization of $57.2 billion. While the company also has a midstream and a chemical segment, it is much more sensitive to the price of oil than the integrated oil majors.

On May 10, 2022, the company reported first-quarter results for 2022. revenue beats estimates by $470 million for the quarter. Compared to the first quarter of 2021, the company revenue was up 57% year-over-year (YoY). Earnings also beat expectations by $0.09 per share. The company reported earnings of $2.12 per share, which is an increase of 43.2% versus the $1.48 per share that the company earned in the first quarter of 2021.

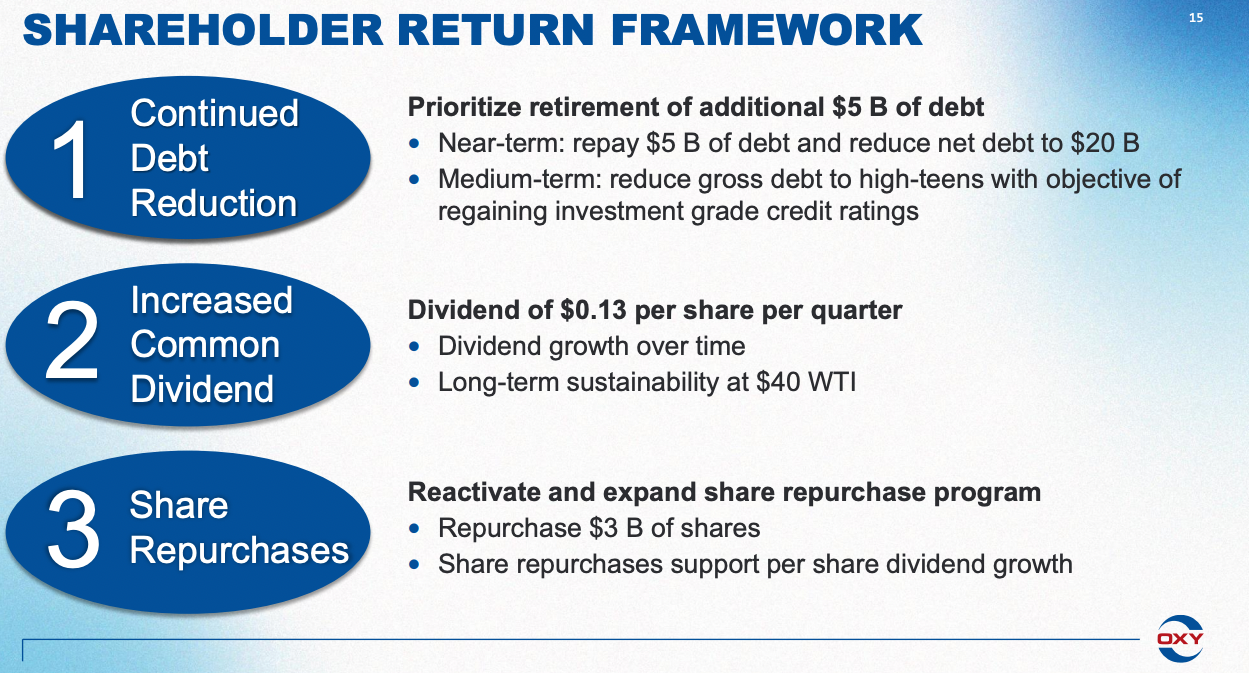

The company also repaid $3.3 billion of debt, representing 12% of the total outstanding principal. Reported cash flow from continuing operations of $3.2 billion and cash flow from continuing operations before working capital of $4.2 billion. This was significant as the company recorded quarterly free cash flow before working capital of over $3.3 billion.

The OxyChem business delivered its third consecutive record quarterly earnings as the company continues to meet the demand for the basic chemicals.

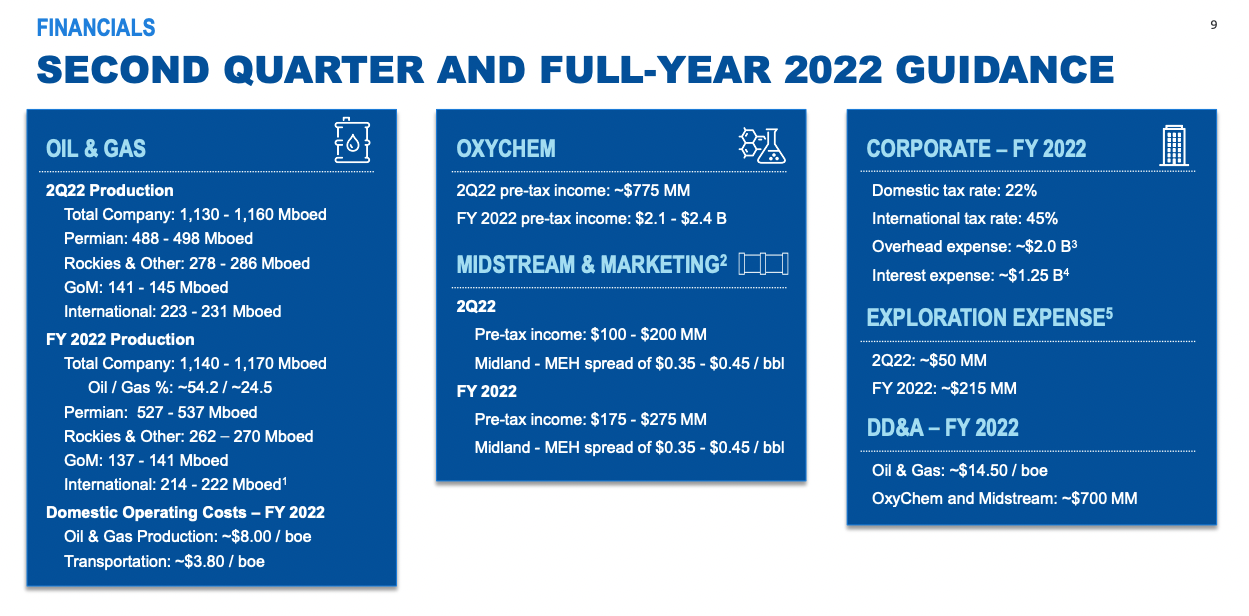

Source: Investor Presentation

Growth Prospects

The pandemic has subsided, and hence Occidental has decent growth prospects ahead. It doubled its output in the Permian in 2017-2019 and expects to double it again over the next five years, from 300,000 to 600,000 barrels per day. However, we note the high debt load of the company and its resultant sensitivity to prices. As long as the oil price remains high, Occidental will keep thriving.

The company’s earnings have been erratic throughout the years. This is due to the volatile nature of the price of Oil. For example, from 2015 to 2017, the company had negative earnings breast the price of Oil was below $40 per barrel. The $40 price per barrel is the company’s breakeven price. Thus, if oil prices stay at the current level, then Occidental Petroleum will thrive.

Another growth driver for the company will come from acquisition. For example, On August 8th, 2019, Occidental acquired Anadarko. Occidental pursued this acquisition thanks to the promising asset base of Anadarko in the Permian, which has enhanced the already strong presence of Occidental in the area, and the $3.5 billion annual synergies it expects to achieve.

Source: Investor Presentation

Competitive Advantages & Recession Performance

Occidental is very sensitive to the gyrations of oil prices. The company’s reliance on oil prices was displayed in the Great Recession, when its earnings-per-share fell by 58%, from $8.98 in 2008 to $3.79 in 2009. We reiterate that the company is much more sensitive to oil prices than its “supermajor” peers like Exxon Mobil (XOM), partly due to its high debt load.

Due to its leveraged balance sheet, Occidental has essentially become a leveraged bet for high oil prices in the future. Therefore, only investors with strong confidence in a sustained environment of high oil prices should consider this stock.

During the COVID-19 pandemic, oil prices fell below $0 per barrel. This caused the stock price to fall over 99%. Also, earnings took a big hit as the company reported earnings for 2020 of $0.82, which decreased 341%.

Thus, the company does not fare well during a recession. As mentioned above, an investment into OXY is because the investors think the oil price will continue to stay high or go higher.

Valuation & Expected Returns

Occidental is trading 8.6 times its expected earnings-per-share of $10.79 for 2022. This earnings multiple is lower than the 10-year average price-to-earnings ratio of 17.1 of the stock. However, this low valuation is due to oil being over $100 per barrel.

We do not think it will stay at this level. We think that the mid-cycle earnings-per-share of $3.00 is more realistic. Thus, if the stock reverts to its average valuation level over the next five years, it will incur a -6.5% annualized drag due to the contraction of its valuation level.

Thus, we think that the company is overvalued at the current stock price level, and we expect a total five-year return of negative 5% annually.

Source: Investor Presentation

Final Thoughts

Due to its upstream nature and its takeover of Anadarko, which quadrupled the company interest price, Occidental is extraordinarily sensitive to the price of oil. Thanks to the rally of oil and fuel expenses to thirteen-year highs, which resulted from the invasion of Russia in Ukraine, Occidental has emerged as extraordinarily worthwhile and is attempting to lessen its debt load quickly.

However, we expect poor returns over the next five years. If commodity prices remain high, the stock could maintain its positive short-term momentum and offer poor long-term returns. We rate the company as a sell at the current price.

More By This Author:

Blue Chip Stocks In Focus: Lowe’s Companies Inc.

Warren Buffett Stocks: Verizon Communications

Warren Buffett Stocks: McKesson Corporation