Blue Chip Stocks In Focus: Lowe’s Companies Inc.

Image Source: Pixabay

Driven by the elevated turmoil in the capital market as a result of a shaky macroeconomic environment and increased geopolitical risk, investors’ interest has shifted toward safer and more reliable investments lately. Such investments include blue chip stocks. We define a stock as a blue chip one when it features at least 10 consecutive years of dividend hikes.

We believe an established track record of annual dividend increases going back at least a decade exhibits a company’s ability to forge steady growth and raise its dividend, even in a recession. As a result, we feel that blue chip stocks are among the safest dividend stocks that investors can buy.

The second installment of the 2022 Blue Chip Stocks In Focus series will analyze Lowe’s Companies, Inc. (LOW).

Business Overview

Lowe’s Companies is the second-largest home improvement retailer in the US (after Home Depot). The company, which has a current market capitalization of $125 billion, was founded in 1946 and is headquartered in Mooresville, NC.

Lowe’s operates or services nearly 2,000 home improvement and hardware stores, representing around 208 million square feet of retail selling space. Specifically, Lowe’s operating locations include 1,737 stores located across 50 U.S. states, as well as 234 stores in Canada. Lowe’s trades under the ticker symbol LOW on the NYSE.

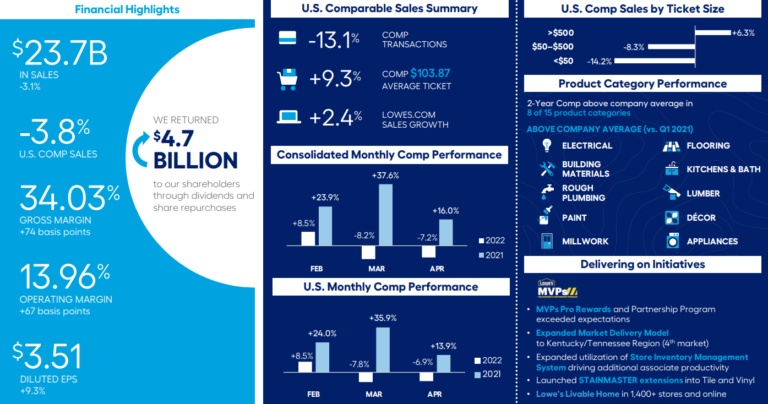

Lowe’s reported its Q1 2022 results on May 18. Total sales for the quarter came in at $23.7 billion compared to $24.4 billion in the same quarter a year ago. Comparable sales decreased 4%, while U.S. home improvement comparable sales decreased 3.8%. Of note, pro customer sales rose 20% year-over-year. Net earnings of $2.3 billion were in-line with results from Q1 2021.

As far as profitability goes, diluted earnings-per-share of $3.51 suggests a 9.3% increase from $3.21 in the prior-year period. Following another robust operating quarter despite the underlying challenges, the company repurchased 19 million shares in Q1 for $4.1 billion. Additionally, they paid out $537 million in dividends.

Source: Investor Infographic

The company remains in a strong liquidity position with $3.4 billion of cash and cash equivalents. Management reaffirmed their fiscal 2022 outlook and believes they can achieve diluted EPS in the range of $13.10 to $13.60 on total sales of roughly $98 billion. Lowe’s expects to repurchase $12 billion worth of common shares during the full year, as well.

Growth Prospects

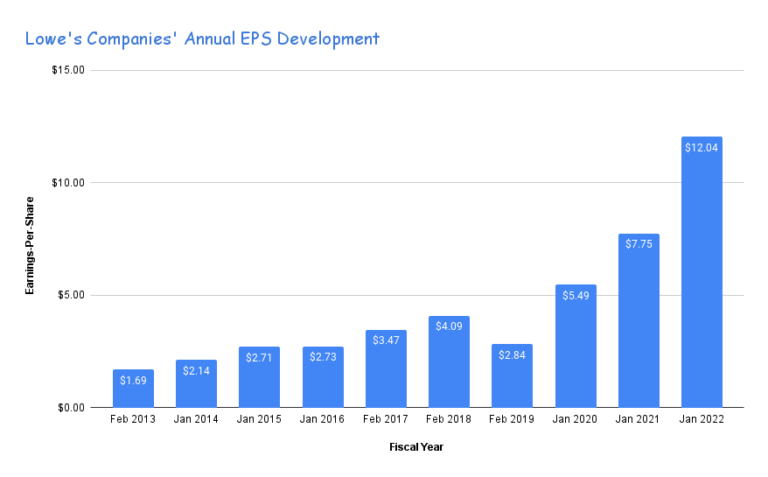

Lowe’s store-opening spree has stalled over the past few years, but the company still managed to grow its earnings-per-share at an incredibly attractive pace in the past. This is due to several factors, including a strong comparable store sales performance, which lifts revenues as well as margins.

Between 2012 and 2021, Lowe’s grew its earnings-per-share by 24% a year. In the recent five-year period, Lowe’s was able to compound earnings by 25% per year.

Earnings-per-share growth has been powered by comparable store sales growth, expanding margins, and the company’s share buybacks, which have lowered the share count by roughly 60% over the past 18 years.

Considerable buybacks mean that the company’s net income is divided over a lower number of shares, which revs growth in per-share net income. Particularly when Lowe’s valuation is below-average, these share repurchases are substantially accretive.

Source: SEC filings, Author

Lowe’s would likely ramp up its buybacks if its valuation declined meaningfully, and in the past, they have made good profits by buying back shares at a lower price. Housing has seen a large resurgence recently, and while home improvement sales have softened amid the pandemic fading, hardware stores have been doing very well.

Thus, Lowe’s should be able to grow its sales over the coming years, but its earnings-per-share growth will likely be somewhat lower going forward compared to the last couple of years.

The company has been historically praised among dividend growth investors due to its Dividend King status. This term signifies these companies that have grown their dividends annually for more than 50 successive years. Only 44 are classified as Dividend Kings.

You can see the 2022 Dividend Kings List and download the relevant excel sheet, which we update daily, here. Lowe’s now features 60 years of successive dividend hikes following the most recent dividend hike in late May.

Competitive Advantages & Recession Performance

Lowe’s extraordinarily strong dividend growth track record is a testament to the resilience of its business model. Coupled with the fact that Lowe’s dividend payout ratio is quite low at 24%, the company makes for a reliable and low-risk dividend stock where investors do not have to worry about a dividend cut. In addition, many years of dividend growth should be in front of the company.

On the one hand, Lowe’s business is rather cyclical. The company performed fairly well during the last financial crisis, nevertheless. Earnings-per-share, while suffering notably, continued to build equity value and allowed the company to keep growing its dividend.

You can see a rundown of Lowe’s Companies’ earnings-per-share from 2007 to 2011 below:

- 2007 earnings-per-share of $2.02.

- 2008 earnings-per-share of $1.89.

- 2009 earnings-per-share of $1.50.

- 2010 earnings-per-share of $1.21.

- 2011 earnings-per-share of $1.42.

Overall, the company enjoys competitive advantages from scale and brand power as it operates in a duopoly with Home Depot. Neither of the two is growing their store count notably, and neither is interested in a price war. Both should stay highly profitable, as the home improvement market in the US is big enough for both giants to make a lot of money.

Valuation & Expected Returns

Lowe’s trades at 14.7 times this year’s expected earnings-per-share right now, which is lower than the five-year average of 19.5. The current valuation is below our current fair value estimate of 19.5 times expected earnings. As a result, we estimate the potential for a strong valuation tailwind due to valuation expansion over the intermediate term.

If the price-to-earnings multiple expands from 14.7 to 19.5, future returns would be boosted by 6.0% per year over the next five years. In addition, we expect 6% and 7% earnings-per-share and dividend-per-share growth each year, respectively. Lastly, shares have a current dividend yield of 1.6%.

This leads to total expected returns of 13.6% per annum through 2027. We rank Lowe’s Companies stock as a buy as a result.

Final Thoughts

Lowe’s stock is under pressure these days as a result of the overall market sell-off, and risks are linked to consumer discretionaries due to a shaky macroeconomic environment. Nevertheless, the company’s results remain rather vigorous, management’s outlook is bright, and capital returns continue to flow down investors’ pockets.

Lowe’s earnings could be negatively impacted in the short- to medium-term if consumers’ purchasing power softens. However, this is a business to hold over the long run. With five-year expected returns above 13% per year, shares earn a buy rating.

More By This Author:

Warren Buffett Stocks: Verizon CommunicationsWarren Buffett Stocks: McKesson Corporation

Blue Chip Stocks In Focus: The Andersons Inc

We created a list of 350+ blue-chip stocks which you can download by clicking the link provided. more