Warren Buffett Stocks: McKesson Corporation

Image Source: Unsplash

Berkshire Hathaway (BRK-B) has an equity investment portfolio worth more than $360 billion as of the end of the 2022 first quarter. Berkshire Hathaway’s portfolio is filled with quality stocks. You can ‘cheat’ from Warren Buffett stocks to find picks for your portfolio. That’s because Buffett (and other institutional investors) are required to periodically show their holdings in a 13F Filing.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

As of March 31, 2022, Buffett’s Berkshire Hathaway owned just over 2.9 million McKesson Corp. (MCK) shares for a total market value exceeding $965.53 million. McKesson Corp. currently constitutes over 0.3% of Berkshire Hathaway’s investment portfolio.

This article will thoroughly examine McKesson Corp’s prospects as an investment today.

Business Overview

McKesson Corporation traced its lineage to 1833, when its founders began to offer wholesale chemicals and pharmaceuticals in New York City. In the 189 years since, McKesson has grown into a powerhouse in the pharmaceutical and medical distribution industry and today generates about $266 billion in annual revenue and trades with a $47 billion market capitalization.

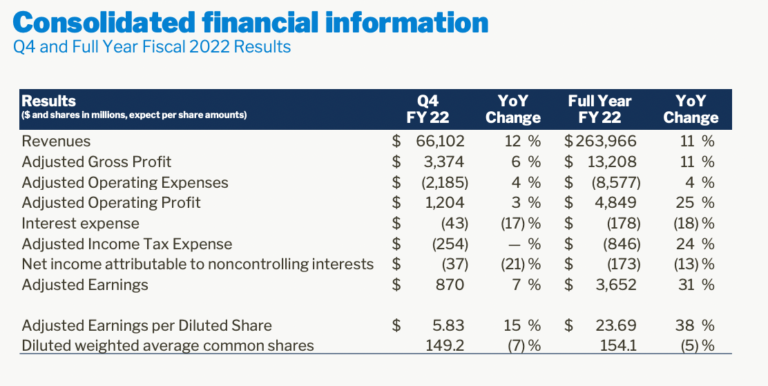

On May 5, 2022, McKesson Corporation reported fiscal year and fourth quarter results for FY2022. The company ends its fiscal year at the end of March. Revenue was up 11.8% for the quarter compared to the fourth quarter of FY2021. Total revenue for the quarter was $66.1 billion compared to $59.1 billion in Q4'21.

Revenue for the quarter beats expectations by $2.28 billion. This was primarily driven by growth in the U.S. Pharmaceutical segment due to increased volumes of specialty products, including higher volumes from retail national account customers, and market growth, which was partially offset by branded to generic conversions.

For the year, revenue was up 11% versus the fiscal year 2021. The company reported revenue of $263 billion for 2022, whereas the company earned $238 billion for 2021.

On an earnings basis, the company reported Adjusted Earnings per Diluted Share of $5.83, an increase of 15% compared to the fourth quarter of 2021. This was driven by a rise of 6% in adjusted gross profit and a decrease in interest expense of 17% year-over-year, also driven by growth across the business and a lower share count. For the year, Adjusted Earnings per Diluted Share was $23.69, an increase of 38% compared to FY2021.

Source: Investor Presentation

For the full year, McKesson returned $3.8 billion of cash to shareholders, which included $3.5 billion of common stock repurchases and $277 million of dividend payments. During the fiscal year, McKesson generated cash from operations of $4.4 billion and invested $535 million in capital expenditures, resulting in Free Cash Flow (FCF) of $3.9 billion.

Growth Prospects

MCK’s growth has been excellent over the past ten years. For example, the company grew earnings from $7.20 per share in FY2013 to $23.69 per share for FY2022. This represents a Compound Annual Growth rate (CAGR) of 14%. Over the past five years, the growth rate has been even better. Over the past five years, earnings CAGR has been 17.1%.

We expect this to slow down to 7% over the next five years. This is still a solid growth rate for a mature company such as MCK. This expected growth can be attained from continued revenue gains as it continues to acquire growth in bolt-on acquisitions with companies that supplement its current offerings. Also, share buyback should continue to meaningfully reduce the float over time, which we see as a critical driver of earnings-per-share growth.

We remain somewhat cautious due to an increasingly hostile regulatory environment for drug wholesalers like McKesson. In addition, constant pressure on pricing from regulators and strong generic conversion are headwinds. However, recent results have been quite supportive of long-term growth. We note that the COVID-19 tailwind from last year and this year will potentially lessen in fiscal 2023 and beyond.

Additionally, increased utilization of high-price specialty pharmaceuticals and an aging U.S. population are tailwinds to long-term revenue growth.

The dividend has never been a priority for McKesson, and that is not likely to change anytime soon. For example, the company dividend growth rate over the past ten years has only been 8.9% compared to the earning growth of 14%.

Source: Investor Presentation

Competitive Advantages & Recession Performance

McKesson Corporation's competitive advantage is in its willingness to adapt and shift to the changing needs of its customers, its desire to buy growth, and its immense scale, which affords purchasing power.

This is aided by the prices associated with prime seller contracts and its relationship with its largest customers, particularly its joint project with Walmart and its long-status distribution agreement with CVS Health’s mail-order.

The company is also very resilient during recessions. For example, during the Great Recession, the company grew earnings by 15% in 2008, and earnings increased 23% in 2009. The following year, earnings came back strong with another increase of 13% in 2010.

However, the company’s share price took a significant downturn of almost 58% during this period. This was mainly because the company was overvalued before the Great Recession.

Also, the company performed well during the COVID-19 pandemic. In FY 2021, earnings grew by 15%, and in FY2022, they grew 38%. Thus, the company performs well during challenging times in the economy.

Valuation & Expected Returns

The company looks overvalued at the recent price of $330.44 per share. For example, the company has averaged a PE of 13.2x earnings over the past ten years. We expect the company to earn $23.30 per share for FY2023. At the recent price, the company has a PE of 14.0x earnings.

If the company were to return to its ten-year average PE, we would see a headwind of a 6.9% price decrease. Adding the expected growth of 7% and a current dividend yield of 0.6%, we will have a total expected return over the next five years of about 1%.

Final Thoughts

McKesson offers a modest growth outlook, a robust share repurchase program, and a valuation over our fair value. We are forecasting 1% annual total returns going forward, consisting of the current 0.6% yield, 7% earnings-per-share growth, and a headwind from a contracting valuation.

Thus, we would recommend investors interested in buying shares of this company to wait for a significant decrease in price before buying shares of a great company.

More By This Author:

Blue Chip Stocks In Focus: The Andersons Inc

3 REITs With Very High Dividend Yields

Warren Buffett Stocks: General Motors

You can see all Warren Buffett stocks (along with relevant financial metrics like dividend yields and price-to-earnings ...

more