Blue Chip Stocks In Focus: The Andersons Inc

There is no exact definition for blue chip stocks. We define it as a stock with at least 10 consecutive years of dividend increases. We believe an established track record of annual dividend increases going back at least a decade, shows a company’s ability to generate steady growth and raise its dividend, even in a recession.

As a result, we feel that blue chip stocks are among the safest dividend stocks that investors can buy.

The first installment of the 2022 Blue Chip Stocks In Focus series will analyze The Andersons Inc. (ANDE).

Business Overview

The Andersons is an agriculture stock that conducts business in North America. It operates through the following segments: Trade, Renewables, and Plant Nutrient.

The Trade segment includes commodity merchandising and the operation of terminal grain elevator facilities. The trade segment contributed over 70% of the company’s revenue in 2021. The Renewables segment produces, purchases, and sells ethanol and co-products.

The Plant Nutrient segment manufactures, and distributes agricultural inputs, primary nutrients, and specialty fertilizers, to dealers and farmers, along with turf care and corncob-based products. The $1.3 billion company was founded in 1947 and has about 2,500 employees.

On May 4th, 2022, The Andersons released its first-quarter 2022 results. For the quarter the company reported revenue of $3.98 billion, an increase of 53% versus Q1 2021, and adjusted earnings per diluted share of $0.18, down 48% versus Q1 2021. Plant Nutrient and Renewables had strong first quarter results offset by a decline in the Trade Group’s year-over-year results. Trade Group reported pre-tax income of $3.7 million compared to $14.3 million in the same period of 2021.

Source: Investor Presentation

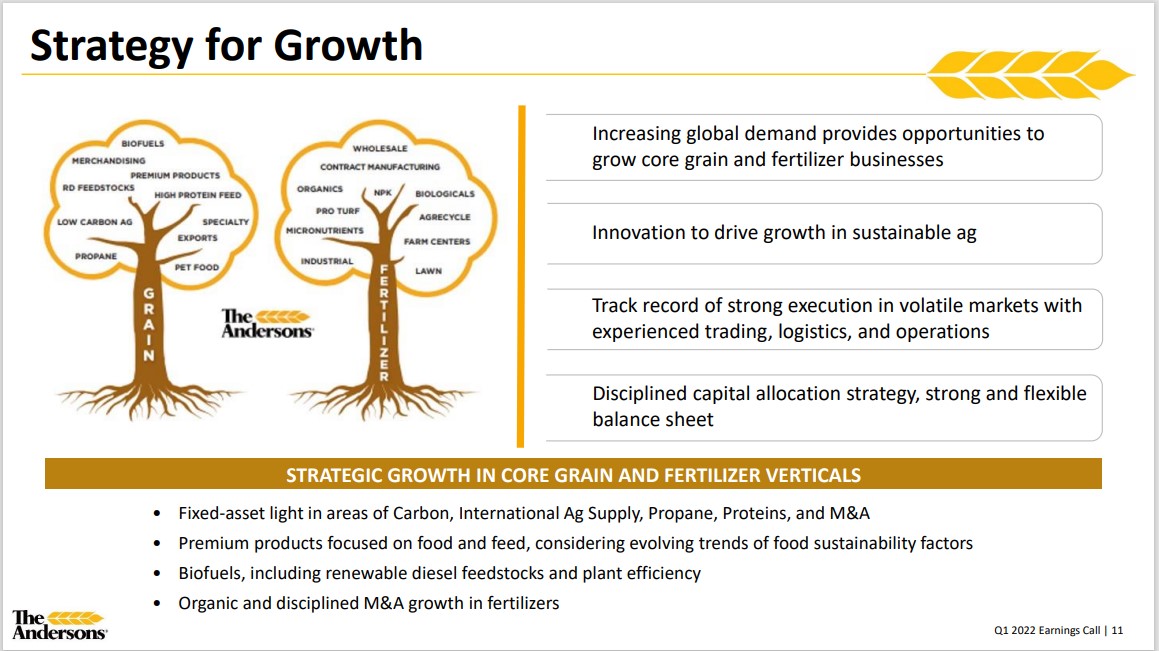

This is mainly due to a significant run-up in commodity prices resulting from the conflict in Ukraine and drop in basis values, primarily in corn and soybeans. The Andersons has a modest growth ambition for the coming years. Management presented a “strategy for growth” plan with an adjusted EBITDA between $375 – $400 million in 2025.

Growth Prospects

The Andersons’ long-term earnings growth track record has been volatile due to its industry (commodity trading) and due to the COVID-19 impact. Over the last five years, the average EPS growth rate is -1.3%.

We expect the company to grow its earnings-per-share by 5% per year on average over the next five years. The company has a good track record in volatile markets with experienced trading, logistics, and operations. Increasing global demand, product innovation and M&A growth in fertilizers are key to success.

Source: Investor Presentation

The company has a long history of paying dividends and has increased its payout for 26 consecutive years. In December 2021, the quarterly dividend increased by 3% from $0.1750 to $0.18 per share. Over the last five years, the average annual dividend growth rate is 2.1%.

Competitive Advantages & Recession Performance

As an agriculture company, there is always a certain level of demand for The Anderson’s products. This provides the company with steady earnings, even during recessions. The company performed relatively well during the “Great Recession” of 2008-2009.

You can see a rundown of The Anderson’s earnings-per-share from 2007 to 2010 below:

- 2007 earnings-per-share of $3.75

- 2008 earnings-per-share of $1.79

- 2009 earnings-per-share of $2.08

- 2010 earnings-per-share of $3.48

- 2011 earnings-per-share of $5.09

While earnings-per-share fell significantly in 2008, the company quickly recovered. By 2011, earnings-per-share were well above the 2007 level.

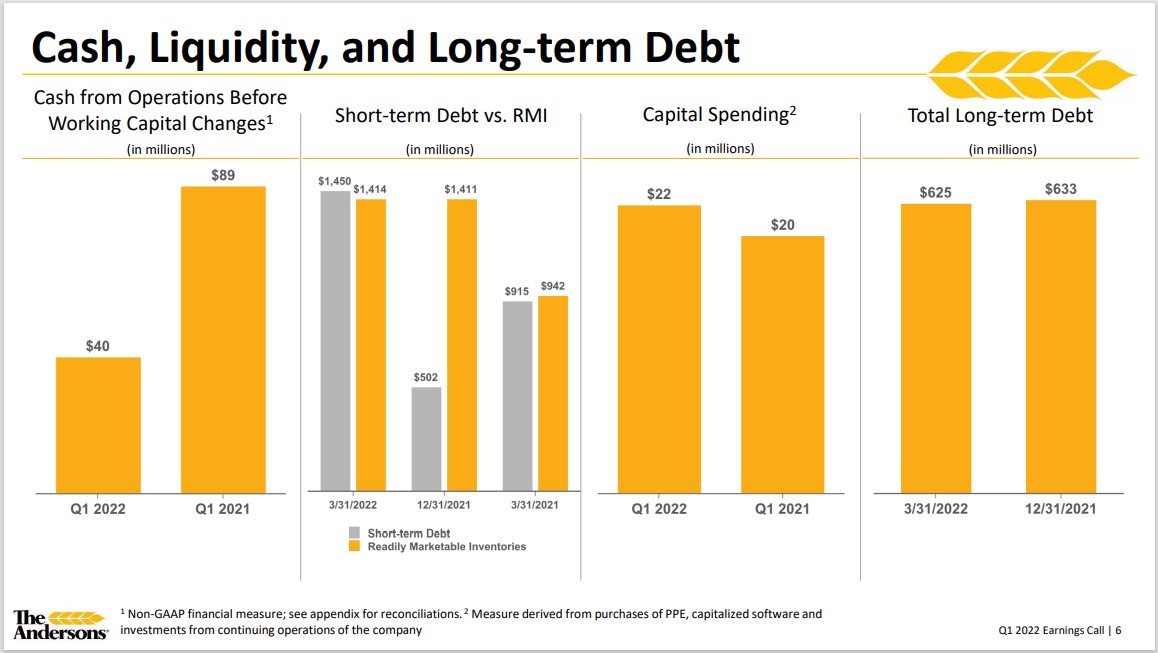

In addition, The Andersons has a solid balance sheet, with ample cash, sufficient liquidity, and manageable debt levels.

Source: Investor Presentation

During the past five years, the company’s dividend payout ratio has averaged around 103%. This high payout ratio is mainly related to low earnings-per-share in 2019 and 2020, while the company maintained its dividend growth policy. We expect that earnings growth will be modest but stable, meaning that there is still room for the dividend to continue to grow with a payout ratio below 30%.

The Andersons presented four robust back-to-back quarter results in 2021 and started to surge on the back of the Ukraine crisis. The company has been picked up by investors when the Ukraine crisis started as it was seen as a consumer defensive stock and a commodity stock.

Valuation & Expected Returns

During the past decade shares of The Andersons Inc. have traded with an average price-to-earnings ratio of about 33

times earnings and today, it stands at 12.3. We are using 22 times earnings as a fair value baseline, implying the

potential for a valuation tailwind. The average industry price-to-earnings is 22.5.

If the price-to-earnings multiple expands from 12.3 to 22, future returns would be boosted by 12.3% per year over the next five years. In addition, we expect 5% earnings-per-share growth each year. Lastly, shares have a current dividend yield of 2.2%.

This leads to total expected returns of 19.5% per year through 2027. We rank The Andersons stock as a buy.

Final Thoughts

The Andersons is a profitable company operating in the agriculture industry. The company has increased its dividend for over 25 years in a row, while the current yield is well above the market average.

We believe that the company’s earnings and revenue could continue to grow modestly in the coming years. Revenue is predominantly dependent on the Trade segment, which has a volatile profile.

Still, with five-year expected returns above 19% per year, shares earn a buy rating.

More By This Author:

3 REITs With Very High Dividend Yields

Warren Buffett Stocks: General Motors

Warren Buffett Stocks: Visa Inc.