Blue Chip Stocks In Focus: Fresenius Medical Care AG

When examining blue chip stocks, rarely do international companies get brought up. American stocks have historically exhibited an edge when it comes to shareholder value maximization. However, there are multiple overseas companies with an established track record of value creation and robust performance even during the harshest times.

One such company is Fresenius Medical Care. Since the German company has grown its dividend for nearly 2.5 decades, Fresenius Medical Care fits our criteria to classify it as a blue chip stock. Sustaining prolonged dividend growth track records is not as common internationally as it is in the United States. Thus, investors who are looking for such companies outside of the United States in order to diversify their holdings have limited options.

As a result, companies such as Fresenius Medical Care (FMS) are rather rare to encounter.

Business Overview

Fresenius Medical Care is the world’s leading provider of products and services for individuals with renal (kidney) diseases in terms of revenues and number of patients treated. The company specializes in dialysis care and related services to patients who suffer from ESKD, among other health care services. Fresenius also develops, manufactures, and distributes a broad range of health care products.

United States investors can prompt an ownership stake in Fresenius Medical via American Depository Receipts that trade on the New York Stock Exchange under the ticker FMS. Note that two ADR shares equal one share of the underlying company.

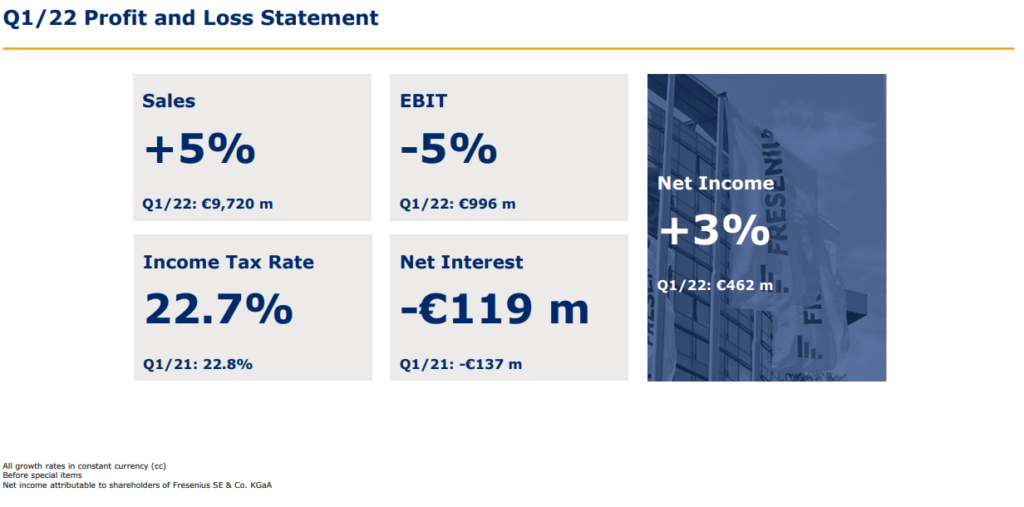

Despite the issues prevalent in the current trading environment (e.g., surging inflation, global growth rates slowing down, etc.) that could adversely impact the financials of various companies, Fresenius operations should be able to remain concrete due to its necessity type (for those in need) business model. This was illustrated in the company’s most recent quarterly results.

Fresenius’ Q1 results were rather robust, with organic revenue growth coming in at 2%. In constant currency, revenue was up 3%. Specifically, Health Care Services was up 3% due to higher demand for in-center disposables and renal pharmaceuticals, offset by weaker sales for machines used for chronic treatments. North American organic sales were flat (up 2% at constant currency). Further, gains in Health Care Products were offset by weakness in Health Care Services.

Still, internationally the company performed well, with EMEA experiencing growth of 2% (same as at constant currency) while Asia-Pacific grew by 4% (up 5% at constant currency) due to strength in Health Care Services.

Most impressively, Latin America experienced revenue growth of 16% (up 15% at constant currency), driven by strong growth rates across the board. The company featured 4,153 dialysis clinics (down 0.4% sequentially) and 344K patients (down 0.2% sequentially). The closures were likely to optimize the performance of the company’s locations.

We expect the company to post EPS of $2.01 for the year, implying year-over-year growth of 2% compared to fiscal 2021.

Growth Prospects

The company’s expansion was quite consistent up until 2017 when the company featured a 10-year revenue growth CAGR of 8.2%. Since then, revenue growth has lagged, with the company reaching a late-stage maturity phase, having already dominated a great chunk of its total addressable market.

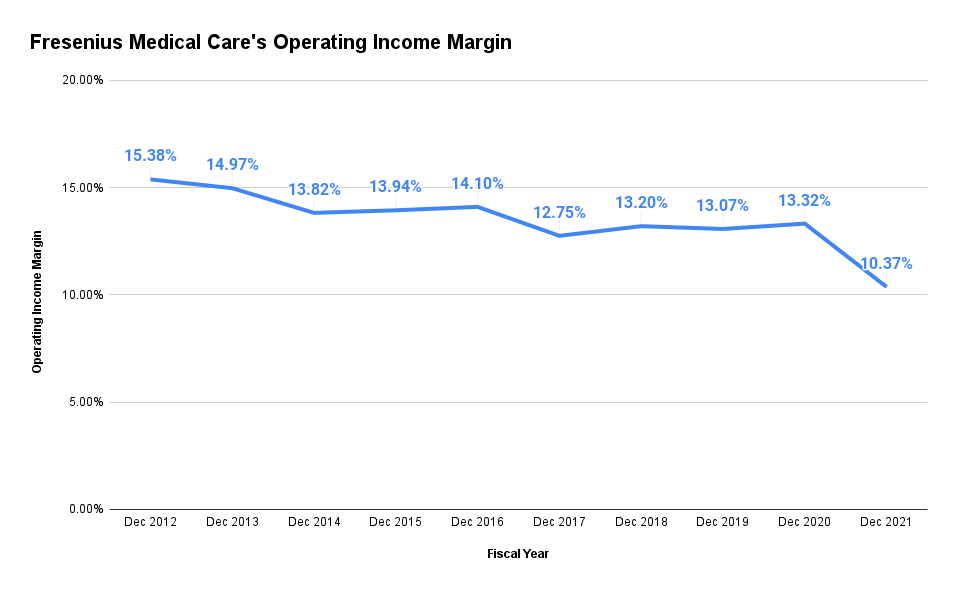

Further, for various reasons, the company’s pricing has failed to offset the growth in operating expenses over the years, resulting in descending operating margins over the past decade.

Source: SEC filings, Author

For this reason, despite the company’s consistent revenue growth up until 2017, earnings-per-share are currently hovering at around the same levels they did a decade ago. Still, we are forecasting 6% annualized earnings-per-share growth over the next five years.

We expect this growth to be powered both by an increase in revenues as Frensus pursues clinic expansion opportunities in China, as well as share repurchases.

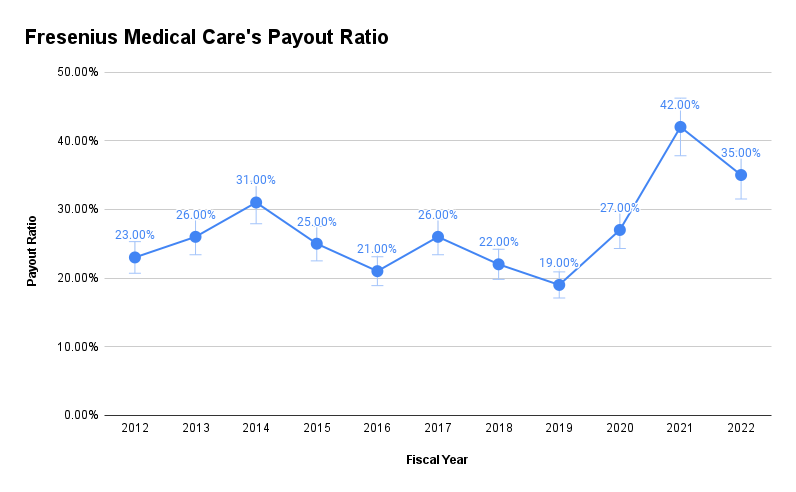

The company’s earnings-per-share growth may have stagnated over the past decade, but dividends per share have been growing invariably over the past 24 years. That is, in local currency, as FX swings in EUR/USD influence results for U.S.-based investors.

In local currency, the dividend per share has, in fact, increased at a 10-year CAGR of 11.25%. As you can imagine, this rate of growth is not sustainable over the long term, with EPS crawling behind. Thus, we expect a dividend per share growth of 6% over the next five years, in line with our EPS estimate.

Competitive Advantages & Recession Performance

Fresenius Medical’s fundamental competitive advantage lies in its sheer industry dominance. The company is an international leader in the space of dialysis and has more locations worldwide than any of its competitors. Consequently, Fresenius Medical functions as a one-stop shop for customers requiring dialysis-related treatments.

The company’s products make it so that patients can control a potential kidney failure. Therefore, Fresenius operations are uncorrelated with the events of the underlying economy, and thus, cash flows are mostly recession-proof. This became evident during the Great Financial Crisis when Fresenius earnings-per-share kept on advancing despite the underlying state of the economy.

You can see a rundown of Fresenius Medical’s earnings-per-share from 2007 to 2011 below:

- 2007 earnings-per-share of $2.43

- 2008 earnings-per-share of $2.75

- 2009 earnings-per-share of $2.99

- 2010 earnings-per-share of $3.25

- 2011 earnings-per-share of $3.54

It’s worth noting that despite the company’s dividend-per-share growth outpacing the (lack of) growth in earnings-per-share, Fresenius’ payout ratio has remained at rather healthy levels due to payouts starting to grow from a relatively low base in the first place.

Source: SEC filings, Author

Taking into account the company’s payout ratio, overall qualities, and critical for its patients’ business model, we believe that the dividend is safe. In our view, investors should not have to worry about a cut even during a recession, as was the case during the Great Financial Crisis.

It’s worth noting that dividends are paid on an annual basis. Further, unless revised by various treaties between countries, dividend income from German companies is subject to a flat tax rate of 25% plus a 5.5% solidarity surcharge, which is basically withheld at the source.

Valuation & Expected Returns

Fresenius shares have traded with an average price-to-earnings ratio of 18.4 over the last decade. We have set our 2027 target P/E at 16. While the company’s growth prospects may warrant a lower multiple, investors are likely to be willing to pay a premium for Fresenius’ qualities, moat, and 3.1% yield, which is rather hefty for European standards. The stock is currently trading at a P/E of 11.6.

Assuming the price-to-earnings multiple expands from 11.6 to 16, future returns would be amplified by 7.1% per annum over the next five years. Combined with our expectations for EPS & DPS growth of 6% each year and the 3.1% yield, we forecast an annualized return potential of 15.9% through 2027.

Accordingly, we rate Fresenius Medical stock a buy.

Final Thoughts

Fresenius Medical’s revenue growth has stagnated lately. Earnings-per-share growth has also been nonexistent over the past decade. However, the company’s moat in its field of operations is a great asset, and due to the nature of its business model, both the top and bottom line should remain unaffected even during the most trying of economic periods.

With shares trading at a relatively attractive valuation, we believe that Fresenius Medical makes for a great blue chip stock, especially for investors looking to diversify their portfolio by allocating capital to international companies.

More By This Author:

Blue Chip Stocks In Focus: Ameriprise Financial Inc.

Warren Buffett Stocks: Occidental Petroleum

Blue Chip Stocks In Focus: Lowe’s Companies Inc.