Blue Chip Stocks In Focus: Caterpillar Inc.

There is no exact definition for blue chip stocks. We define it as a stock with at least ten consecutive years of dividend increases. We believe an established track record of annual dividend increases going back at least a decade shows a company’s ability to generate steady growth and raise its dividend, even in a recession.

As a result, we feel that blue chip stocks are among the safest dividend stocks investors can buy.

This article will analyze Caterpillar Inc. (CAT) as part of the 2022 Blue Chip Stocks In Focus series.

Business Overview

Caterpillar was founded in 1925 and today competes in the manufacturing and selling of construction and mining equipment. The company also manufactures ancillary industrial products such as diesel engines and gas turbines. Caterpillar stock has a market capitalization of ~$97.8 billion, making it one of the most extensive industrial stocks in the world.

Industrial manufacturers benefited from strong demand in 2021, which fueled growth and spurred global economic activity off the low base established in 2020 amid the pandemic. Caterpillar is also explicitly exposed to the energy and mining industries, which have benefited due to increasing commodity prices.

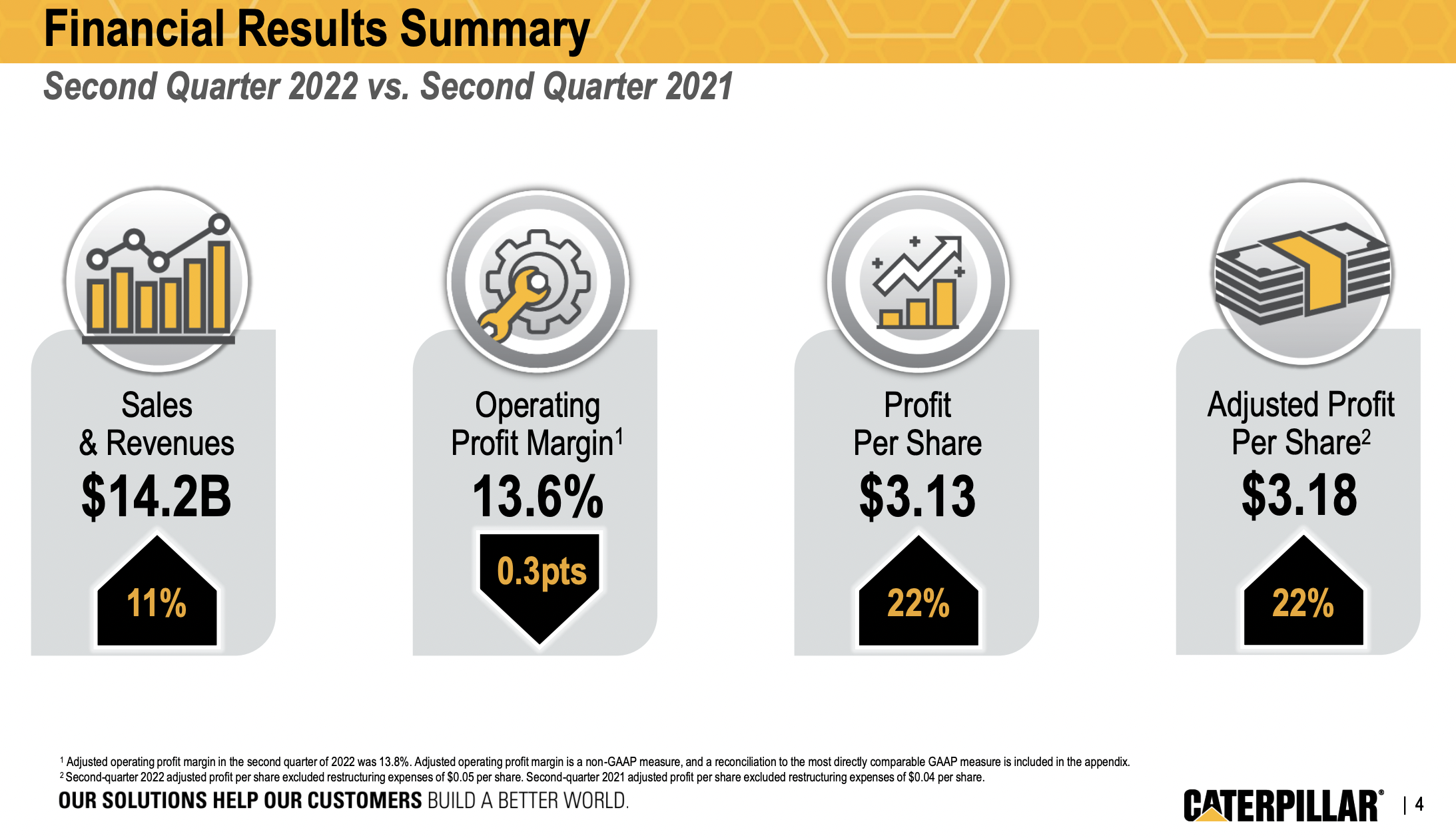

The company reported second and six months results for Fiscal Year (FY)2022. Sales for the second quarter increased 11% to $14.2 billion from $12.9 billion in the second quarter of 2021.

The operating profit margin was 13.6% for the quarter, compared with 13.9% for the second quarter of 2021. The second-quarter 2022 profit per share was $3.13, compared with the second-quarter 2021 profit per share of $2.56. Adjusted profit per share in 2Q2022 was $3.18, compared with 2Q2021 adjusted profit per share of $2.60. Adjusted profit per share for both quarters excluded restructuring costs.

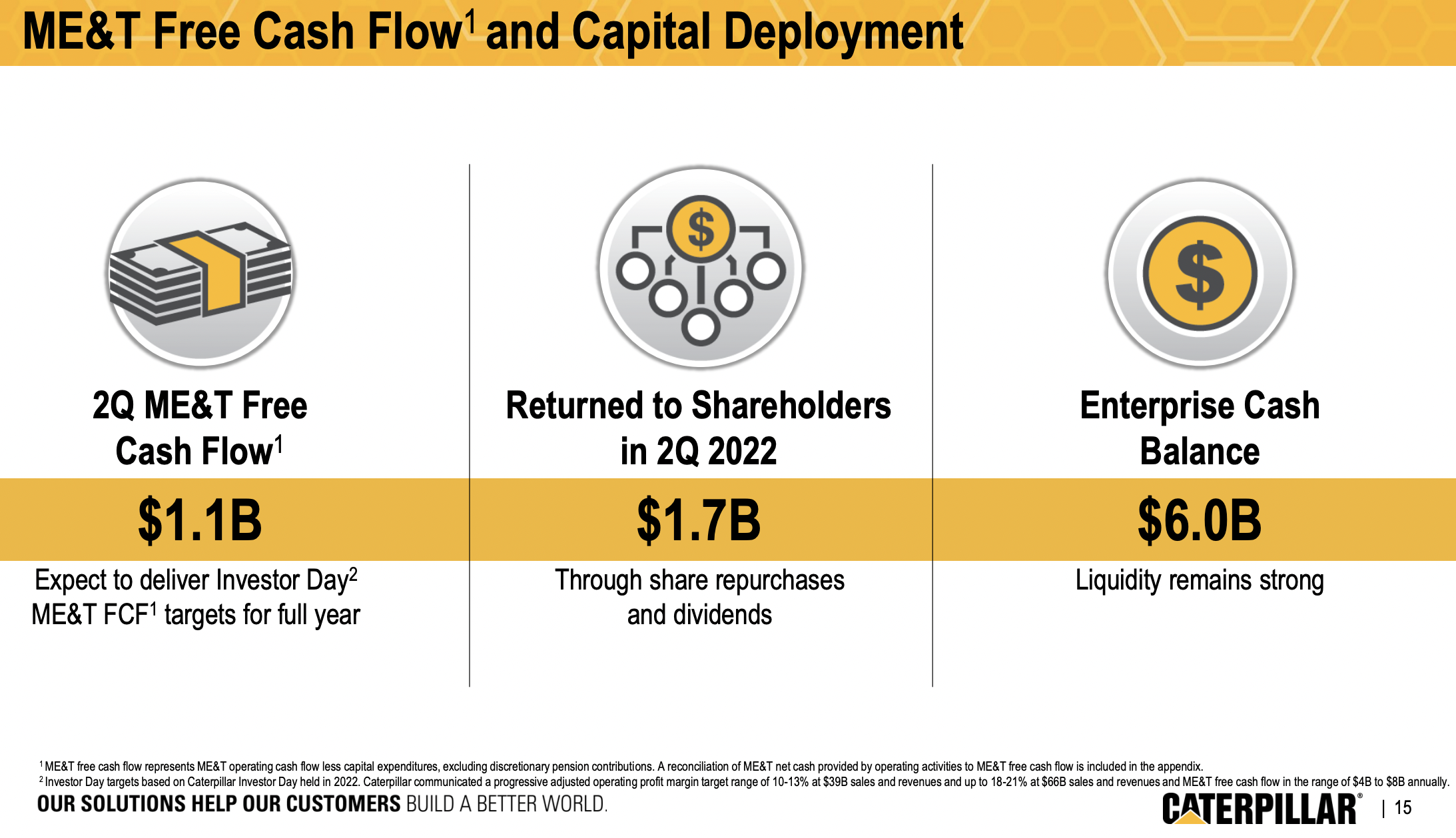

The company returned $1.7 billion to shareholders through share repurchases and dividends in the quarter. Overall, the management team was pleased with the results for the quarter. The results reflect a healthy demand across most of the company’s end markets. The company continues to focus on executing its strategy for long-term profitable growth.

For the six months of the fiscal year, sales increased 12.3% compared to the first six months of 2021. Overall profit is up slightly by 0.4% compared to the same period of 2021.

Source: Investor Presentation

Growth Prospects

Caterpillar is closely tied to global economic growth and commodity prices. Its customers extract resources from the earth and build and construct a wide variety of structures, so economic growth is critical to funding that development.

This leads to some extreme cyclicality in Caterpillar’s results, which then sees the stock swing wildly between extremes of the sentiment scale.

The coronavirus pandemic weighed heavily on the company, but investors hope the global economic recovery continues in 2022. This would be the best opportunity for Caterpillar’s fundamentals to improve.

Further, Caterpillar’s cost-cutting measures have driven operating margins higher for years. While the bulk of the gains may have been realized, we see further potential for expense reductions to boost earnings positively.

We expect earnings to improve again in 2022, with the potential to generate record results. We are forecasting $12.30 in earnings-per-share for 2022 to go along with a 5% growth rate over the next five years.

This reflects some caution regarding the cyclical nature of the business and Caterpillar’s ability to bounce back when demand returns.

Source: Investor Presentation

Competitive Advantages & Recession Performance

Competitive advantages in industrial applications can be challenging given that for most applications, there are competitors that make similar products. However, over the years, Caterpillar has built itself into one of the most significant players in lucrative end markets such as construction, energy, and mining.

During global economic downturns, Caterpillar’s business can be hit hard. This was illustrated during the Great Recession when EPS declined by 61% in 2009 and 90% in 2010. Also, during the COVID-19 pandemic, the company’s earnings dropped 41% in 2020 to $6.56 per share compared to 2019 earnings of $11.06.

You can see a rundown of Caterpillar’s earnings-per-share from 2007 to 2011 below:

- 2007 earnings-per-share of $5.37

- 2008 earnings-per-share of $5.66 (5% increase)

- 2009 earnings-per-share of $2.18 (61% decrease)

- 2010 earnings-per-share of $4.15 (90% increase)

- 2011 earnings-per-share of $7.40 (78% increase)

The company has an adequate balance sheet. The company sports a debt-to-equity ratio of 2.4 and a long-term debt-to-capital ratio of 49.7. Also, the interest coverage ratio is 20.0, which is a high ratio, meaning that the company covers the interest on its debt very well. Overall, the company sports an S&P credit rating of A, an investment grade rating.

Valuation & Expected Returns

Caterpillar’s current price-to-earnings ratio is 15.7, based on 2022 expected EPS of $12.54. This is a low valuation level for Caterpillar. Since 2012, shares of Caterpillar have traded with an average P/E ratio of about 16.5. We believe 16 is a reasonable, fair value estimate for Caterpillar, given its cyclical business and vulnerability to recessions.

Periods of cyclicality are regular for Caterpillar when it comes to valuation. At the current PE ratio, this could increase future returns; if the P/E multiple increases from 15.7 to 16.0 over the next five years, it would increase annual returns by 1.3% per year in that time frame.

The other positive aspect of stocks with lower than average valuations is that they also have a higher dividend yield. As Caterpillar’s share price has fallen this year, its dividend yield has increased to 2.4%. Dividends and earnings-per-share growth are expected to be 5% per year. This will add to shareholder returns.

Based upon the above factors, we see total returns of 8.7% per year. This leads us to rate Caterpillar a hold today.

Final Thoughts

Caterpillar is a leader in its industry, with volatile earnings. Total return potential comes at 8.7% per annum, from 5% growth, a 2.4% starting dividend yield, and a slight help from the potential for a valuation tailwind. We are cautious about the cyclical nature of the business. Shares earn a hold rating.

More By This Author:

Blue Chip Stocks In Focus: Hillenbrand Inc.

Blue Chip Stocks In Focus: Axis Capital Holdings

Blue Chip Stocks In Focus: The Kroger Co.