Blue Chip Stocks In Focus: The Kroger Co.

Business Overview

Kroger (KR) is a grocery retailer that operates in the US. The company has a large network of food and drug stores, as well as a small non-grocery business. Kroger’s grocery stores are full-service, big-box style grocery stores with fresh food, frozen, pantry items, prepared food and deli items, pharmacies, outdoor products, toys, automotive products, and even fuel.

Image: Kroger.com

Kroger operates under almost 30 different brands, of which Kroger is just one, that collectively have more than 1,600 fuel centers, 2,700 supermarkets, and 420,000 employees. Kroger was founded in 1883, produces about $148 billion in annual revenue, and has a market cap of $34 billion.

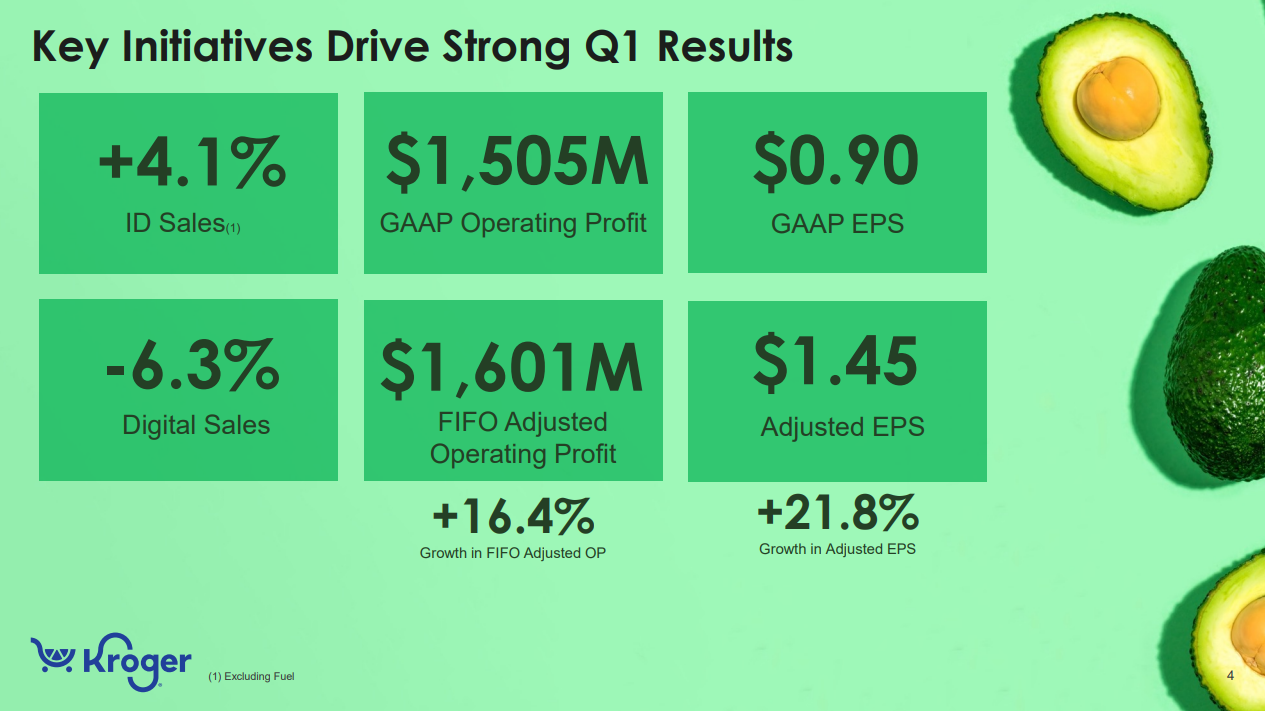

On June 16th, 2022, Kroger released first quarter earnings and full-year guidance, with both Q1 results and guidance ahead of expectations..

Source: Investor presentation, page 4

Total sales were $44.6 billion in Q1, up from $41.3 billion in the year-ago period. Excluding fuel sales, total sales were up 3.8% year-over-year.

Gross margin was 21.6% in Q1, with the FIFO (first in, first out inventory method) excluding fuel gross margin rate falling 26 basis points. This was due to strategic price investments and higher supply chain costs.

Operating and other costs declined 46 basis points, excluding fuel and adjustments, reflecting sales leverage, execution of cost savings, and lower contributions to pension plans, somewhat offset by higher compensation expense.

The company posted $665 million in share repurchases, with $301 million remaining on its current authorization.

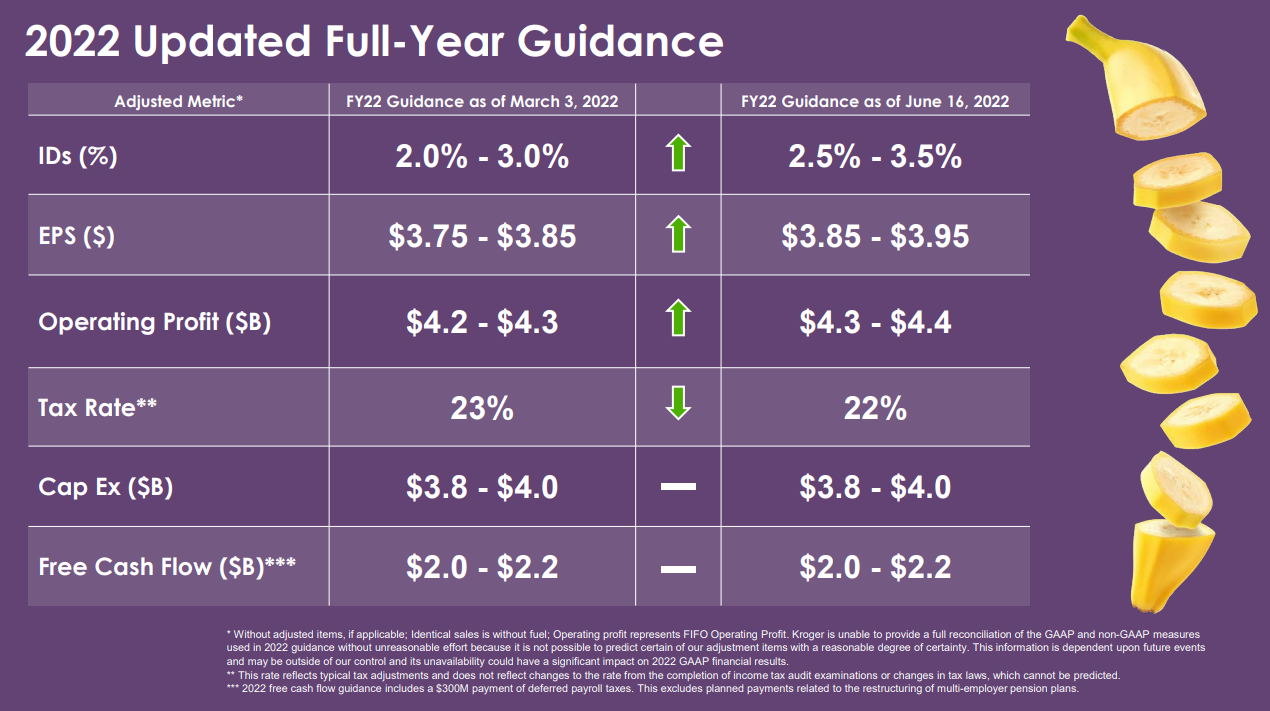

Source: Investor presentation, page 8

Based upon the above guidance, we now expect to see $3.90 in earnings-per-share for this year.

Let’s now take a look at the company’s growth prospects.

Growth Prospects

Kroger’s growth in the past decade has been pretty impressive at 11% annually. This is particularly true given it is a grocery chain, and organic growth is typically quite low. However, the company has managed this through a huge number of share repurchases, as well as some benefit from COVID-related behavior shifts from consumers. While the latter has already unwound for the most part, the share repurchases remain a key catalyst going forward.

We see 3% earnings-per-share growth from 2022 levels, mostly reflecting the fact that earnings soared in 2020 on pantry-stocking behavior during COVID. Kroger’s base of earnings is still extremely high, and we think it will be somewhat challenging to continue to grow at high rates from here.

As mentioned, the company spends a lot of capital on share repurchases, so even if dollar-based earnings struggle to move, on a per-share basis, Kroger should see earnings move in the right direction.

The dividend has also grown at about 14% annually in the past decade, which is very impressive for a grocery chain. And given the fact that earnings and the dividend have grown at almost the same rate, the company’s payout ratio hasn’t really budged, remaining in the mid-20s. We see 7% payout growth in the coming years, helping to indefinitely extend Kroger’s 16-year dividend increase streak.

Competitive Advantages & Recession Performance

Kroger’s competitive advantage is in its massive scale, and diverse group of brands that cover a variety of retail categories. In grocery retail in particular, the name of the game is scale, and Kroger has that, being the largest grocery chain in the US, particularly with its Kroger and Harris Teeter brands.

Recessions tend to be okay for Kroger because, as mentioned, the majority of its revenue is on everyday items that consumers need, not necessarily want. That means demand remains pretty steady through recessions, and we have no concerns that a recession would cause Kroger to cut its dividend. Indeed, the payout ratio remains extremely low today, even after a decade of strong increases in the dividend.

Valuation & Expected Returns

Kroger has traded for valuations between 9 and 18 times earnings in the past decade, and we assess fair value in the middle at 13 times earnings. This reflects the company’s strong position in its industry, but also modest growth going forward. Still, the stock trades for about 12 times earnings today, meaning we see a small tailwind to total returns from a rising valuation.

The current yield is 1.8%, and we mentioned 3% expected growth above, so all told, we see 6.5% total expected returns for Kroger in the years to come. That’s good enough for a hold rating for the stock.

Final Thoughts

While Kroger is certainly not among the fastest growing stocks available in the market today, it has a defensive, diversifying component, as well as terrific capital returns. Kroger may surprise some investors as a first-rate dividend growth stock, but it has proven willing and able to raise the payout quite quickly over time, including its most recent raise of 24% for 2022.

The stock is essentially fairly priced today, but for investors interested in a defensive stock with high rates of dividend growth, Kroger may just hit the target.

More By This Author:

Blue Chip Stocks In Focus: First Of Long Island Corp.

Blue Chip Stocks In Focus: Target Corporation

Warren Buffett Stocks: Formula One Group