Warren Buffett Stocks: Formula One Group

Warren Buffett, Image Source: Pixabay

Warren Buffett’s Berkshire Hathaway (BRK.B) has an equity investment portfolio worth more than $360 billion, as of the end of the first quarter of this year, making it one of the largest investors of any kind in the world.

Berkshire Hathaway’s portfolio is filled with quality stocks, and generally ones that pay dividends. You can learn from Warren Buffett’s stock picks to find ones for your individual portfolio. That’s because Buffett (and other institutional investors) are required to periodically show their holdings in a 13F Filing.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

As of March 31st, 2022, Berkshire owned just over 7.7 million shares of Formula One Group (FWONK), for a market value exceeding $500 million. That makes Berkshire a sizable owner of Formula One at about 3.8%, although the half-billion dollar position is a very small fraction of Berkshire’s total portfolio.

In this article, we’ll examine the business of Formula One, as well as its future growth prospects and expected total returns.

Business Overview

Formula 1 is a motor racing series that has events held across the globe. The company holds the commercial rights for the Formula 1 World Championship, a motor racing competition that spans about nine months of the year where drivers compete for the drivers’ championship, and the teams compete at the constructors level.

Formula 1 has been in continuous existence since 1950 when the first World Championship was held. Today, the Championship is 23 races in 21 countries across five continents and reaches hundreds of millions of fans globally.

Formula One Group is a subsidiary of Liberty Media Corporation (LSXMA). The former trades with what is called a “tracking stock” rather than a traditional listing, as do all of Liberty’s subsidiaries. Liberty owns interests in various assets, including Formula One Group, and lists tracking stocks that are intended to track the economic performance of a business, rather than the economic performance of the company as a whole (Liberty, in this case). Formula One Group has three classes of tracking stock, as do Liberty’s other listed assets; Series A shares have 1 vote per share, Series B shares have 10 votes per share, and Series C shares are non-voting.

Formula One generates about $2.5 billion in annual revenue and trades with a market cap of more than $15 billion.

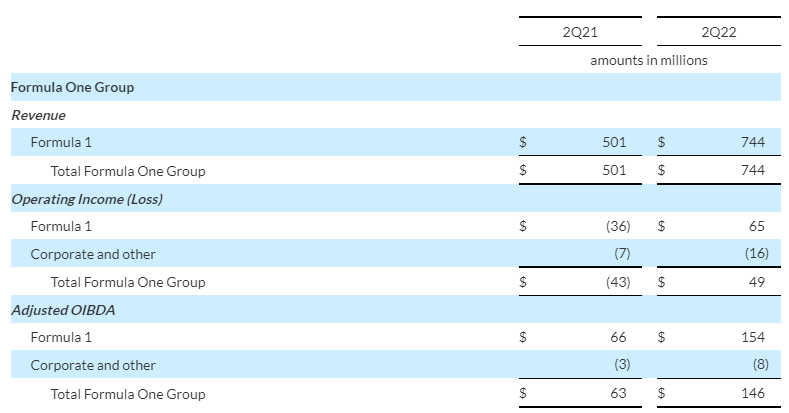

The Group’s most recent earnings report was for the quarter ended June 30th, 2022, which was released on August 5th, 2022.

The group reported strong revenue and even better adjusted operating income, but we note that the comparable period last year still contained COVID restrictions in certain parts of the world for in-person sporting events. As such, the Group had easy comparables for this year’s Q2.

Source: Q2 earnings release

Even so, revenue was up sharply, adding 49% year-over-year. The gain was made from a 35% increase in what the Group calls “Primary” revenue, which is derived from race promotion revenue, media rights fees, and sponsorship fees. That rose due to contractual fees, media rights through F1 TV subscriptions, as well as rights of outside parties broadcasting F1 events.

The second category of revenue, which the Group calls “Other” revenue, soared more than 200% in Q2. This was driven by an increase in freight revenue from the number of events held outside of Europe in Q2, which is away from most of the teams’ home bases. In addition, hospitality revenue from the Paddock Club, which was closed in 2021’s Q2, helped drive in-person revenue at events.

Operating income soared from a loss of $43 million in the year-ago period to a gain of $49 million in this year’s Q2. The Group also repurchased $146 million in 1% cash convertible notes that were due next year, which effectively retired 3.95 million shares of common stock.

Let’s now turn our attention to the company’s growth prospects.

Growth Prospects

Formula One’s growth has been quite erratic in recent years, as COVID-19 took a heavy toll on the sport’s ability to monetize its events. Going forward, we see normalized growth of about 8% per year from a recovery that still isn’t complete from COVID. We think sponsorship and media rights revenue will drive these gains, and that items that are temporarily subject to inflationary pressures, like freight revenue, will moderate.

Source: Company website

The company notes that it has significantly increased its social media reach and that it is attracting an average of 71 million viewers per race. The audience is truly global, and the Group is finding more and more ways to monetize those users over time, both in-person and digitally. As the sport continues to gain popularity, the Group’s revenue should rise over time.

Competitive Advantages & Recession Performance

Formula One’s competitive advantage is quite simple in that it is the pinnacle of circuit racing globally, and has been for seven decades. This gives it a moat that is untouched by other racing series, and with the sport growing more each year, we only see that advantage growing. This is particularly true as the sport goes more mainstream with alternative outlets such as the Netflix Drive to Survive series generating interest among previous non-viewers of the sport.

That said, like most sports, Formula One is highly reliant upon advertising and consumer discretionary spending, both of which tend to suffer during recessions. We see the next recession as unkind to the Group’s earnings, and likely the share price as a result. This is not a recession-resistant stock.

Valuation & Expected Returns

Since Formula One doesn’t have reliable earnings, we’ll use price-to-book value instead. The Group reported book value of about $27 per share, and it trades at 2.3 times that value today. However, its average over the past five years is a price-to-book multiple of 1.7, which means it’s significantly overvalued today. That could drive a 6% headwind to total returns in the coming years, nearly fully offsetting our estimated growth of 8%. Formula One does not pay dividends to shareholders.

Final Thoughts

We see Formula One as a very unique and highly desirable media property. However, the company’s history of inconsistent earnings, lack of a dividend, and high valuation have us steering clear for now. With total expected returns of under 2%, we rate Formula One a sell.

More By This Author:

Warren Buffett Stocks: Snowflake Inc.

3 Energy Stocks For Dividend Investors

Blue Chip Stocks In Focus: T. Rowe Price Group