Blue Chip Stocks In Focus: Hillenbrand Inc.

Image Source: Pexels

There is no exact definition for blue chip stocks. We define it as a stock with at least ten consecutive years of dividend increases. We believe an established track record of annual dividend increases going back at least a decade shows a company’s ability to generate steady growth and raise its dividend, even in a recession. As a result, we feel that blue chip stocks are among the safest dividend stocks investors can buy.

This installment of the 2022 Blue Chip Stocks In Focus series will analyze Hillenbrand, Inc. (HI).

Business Overview

Hillenbrand, Inc. is an industrial conglomerate that operates through its three segments: Advanced Process Solutions, Molding Technology Solutions, and Batesville.

Advanced Process Solutions provides a variety of industrial solutions for companies’ manufacturing systems, Molding Technology Solutions is heavily involved in plastic processing and is exposed to the oil industry, and the legacy Batesville segment is a burial care business that provides burial caskets and services.

Hillenbrand has been diversifying away from its legacy Batesville segment (21.8% of 2021 sales) because even though burial care is an industry with high barriers to entry and good returns on capital for legacy businesses, the demand for caskets has been declining with the rise in popularity of lower cost cremation options.

The business has diversified into Advanced Process Solutions (43.5% of 2021 sales) and the Molding Technology Solutions segment (34.8% of sales), which was formed from the company’s acquisition of Milacron in 2019. Molding Technology Solutions is on track to achieve $75 million in cost synergies within three years of the acquisition. They have already recorded $58 million in cost synergies by the end of the fiscal year 2021.

Hillenbrand generates around $2.86 billion in annual revenues and is headquartered in Batesville, Indiana. On Aug. 3, 2022, Hillenbrand reported its fiscal Q3 results for the period ending June 30, 2022. Revenues grew 3.7% year-over-year for the quarter to $720.6 million, driven by healthy industrial demand.

Adjusted earnings-per-share grew 8% year-over-year in the quarter to $0.92, and even though inflation and the impact of foreign currency exchange affected the business, favorable pricing, higher volume in the company’s industrial segments, and lower shares outstanding more than offset these headwinds.

Source: Investor Presentation

Management narrowed their guidance for fiscal 2022, now expecting adjusted earnings-per-share to land between $3.85 and $3.95.

Growth Prospects

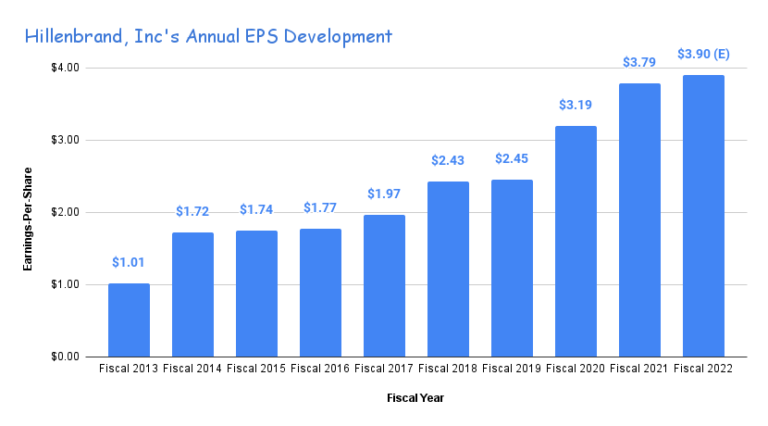

This business has seen steady growth in earnings-per-share, and we expect growth to continue. Over the past nine years, Hillenbrand has seen earnings-per-share grow at an average annualized rate of 9.5%.

In 2022, we expect Hillenbrand to deliver $3.90 in earnings-per-share (the midpoint of management guidance), and we forecast that earnings-per-share will increase 4% annually over the intermediate-term to reach our 2027 estimate of around $4.74 in earnings-per-share.

Source: SEC filings, Author

Over the past nine years, the business has grown dividends per share at a rate of one cent per year. Following this trend, we expect that dividends per share will increase to $0.92 per share in 2027.

This increase of one cent per year works out to about 1% annual dividend growth, which is slow growth. Hillenbrand features a 14-year dividend growth streak, nonetheless.

Source: SEC filings, Author

The pace of divided increases is not particularly attractive, but we like Hillenbrand’s conservative approach. Combined with a resilient business model, we believe that Hillenbrand should continue to comfortably grow the dividend for many years to come.

Competitive Advantages & Recession Performance

Hillenbrand has averaged a payout ratio of 42% over the past nine years and has averaged a 32% payout ratio over the past five years. The business has a low payout ratio, and we expect that dividends will continue to be safe over the intermediate-term.

Additionally, we believe the business has a strong balance sheet after deleveraging from the 2019 Milacron acquisition. Furthermore, much of Hillenbrand’s operating cash flows come from recession-proof businesses, such as the burial services segment.

We believe that the company will continue generating rather resilient results, even during a recession. Hillenbrand’s ability to generate strong profits even during harsh economic environments was proven during the last prolonged recession.

You can see a rundown of Hillenbrand’s earnings-per-share from 2007 to 2011 below:

- 2007 earnings-per-share of $1.59.

- 2008 earnings-per-share of $1.49.

- 2009 earnings-per-share of $2.66.

- 2010 earnings-per-share of $1.49.

- 2011 earnings-per-share of $1.71.

It’s also worth noting that Hillenbrand’s businesses feature robust pricing power characteristics, as proven in the company’s latest results. This is a great advantage in a highly inflationary environment like the current one.

Valuation & Expected Returns

Over the past five years, Hillenbrand, Inc. has averaged a P/E ratio of 14.7, and over the past nine years, the business has averaged a P/E ratio of 16.1. We estimate that a P/E ratio of 14 is about fair for the business under normal conditions, so this guided our 2027 P/E estimate.

Today, the stock offers a low 1.9% dividend yield, and the dividend is only expected to grow at ~1% annually over the intermediate-term. Even though this business does have a stable history of dividend payments, the stock’s low yield may make it an unsuitable choice for investors that prioritize dividend income.

If the price-to-earnings multiple expands from 10.7 to 14, future returns would be boosted by 5.5% per year over the next five years. Combined with our EPS & DPS growth rates, as well as the current dividend yield, we project annualized returns could amount to 11.2% through 2027. Accordingly, we rate Hillenbrand a buy.

Final Thoughts

Hillenbrand has proven itself to be a blue chip stock with a noteworthy track record of annual dividend increases. The company offers investors an opportunity to invest in an industrial conglomerate that is investing its legacy cash flows into growth industries to diversify the company.

We rate this stock a buy because we estimate that the stock offers total return prospects of 11.2% annually over the next five years. Investors might be interested in this stock because of the growth opportunities the business is pursuing and the favorable return prospects that the stock offers. Still, the pace of dividend growth is likely to remain at humble levels.

More By This Author:

Blue Chip Stocks In Focus: Axis Capital Holdings

Blue Chip Stocks In Focus: The Kroger Co.

Blue Chip Stocks In Focus: First Of Long Island Corp.

With all this in mind, we created a list of 350+ blue-chip stocks which you can download by clicking the link provided. more