Block: Stock Is Set Up For A Large Move (Technical Analysis)

Image Source: Unsplash

I found that Block, Inc. (NYSE: SQ) has a good technical set-up for the stock which is supported by a positive earnings report, higher guidance, an attractive valuation, and strong expected long-term growth.

The positive Q3 2023 results are a likely catalyst for the stock to run higher at least until the next earnings report or major catalyst. This catalyst appears to have anchored the stock in a bottom and recovery formation. This can place the stock on an upward journey to make up a lot ground that was lost over the past two years.

Q3 Earnings Report as a Catalyst

Block achieved net revenue growth of $5.62 billion over consensus estimates of $5.43 billion. This was 3.5% higher than estimates and 24% higher than Q3 2022. Block also achieved EPS of $0.55 for Q3 2023 over analysts' estimates of $0.46. That's 19.6% higher than estimates and 30.1% higher than EPS of $0.42 from Q3 2022.

Transaction-based revenue increased 9% over Q3 2022 to $1.66 billion. However, Block did fall a little short of Visible Alpha's estimates of $61.1 billion for gross payment volume and ended up with $60.1 billion for Q3. On the bright side, gross payment volume was still 10.5% higher than Q3 2022.

Adjusted EBITDA for Q3 came in at $477 million which was 46% higher than Q3 2022. This marked a record high for quarterly EBITDA for the company. Block reiterated its guidance for adjusted EBITDA to be $1.5 billion which is a bit lower than Visible Alpha's estimate of $1.52 billion. The company also gave guidance for 2024 adjusted EBITDA to be $2.4 billion which is higher than Visible Alpha's estimate of $1.94 billion. The $2.4 billion in adjusted EBITDA would be about 40% higher than Block's guidance of $1.66 billion for 2023. So, significant growth is expected for 2024.

These achievements were largely the result of strong performance for Square and Cash App during Q3. Square's gross profit increased 15% to $899 million while Cash App's gross profit increased by an impressive 27% to $984 million.

These positive results and guidance can act as a catalyst to drive the stock higher over the next few months or until the next catalyst arrives. The next catalyst would likely be the next earnings report on February 22, 2024 unless Block has other significant developments between now and then.

Strong Technical Set-up

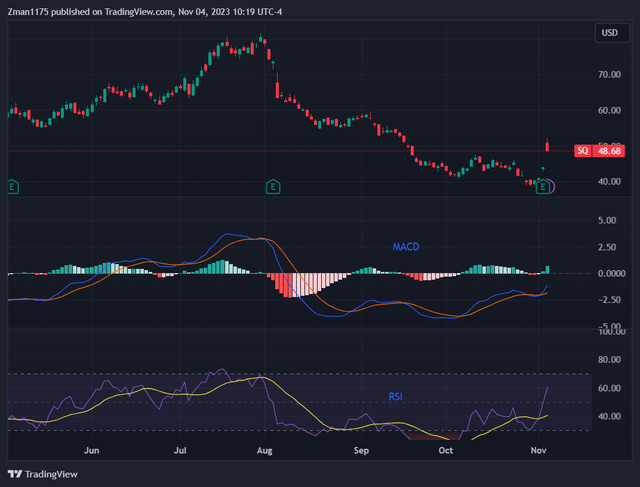

Block Inc. (SQ) Daily Stock Chart w/ MACD & RSI (tradingview.com)

Continue reading on Seeking Alpha.

More By This Author:

Heritage Insurance Is My Best Value Idea

Vertiv Holdings: Stock Poised To Benefit From Strong AI And Margin Growth

Ultralife: Stock To Outperform With Growth From Multiple Industries

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Disclaimer: The ...

more

$SQ looks good!