Ultralife: Stock To Outperform With Growth From Multiple Industries

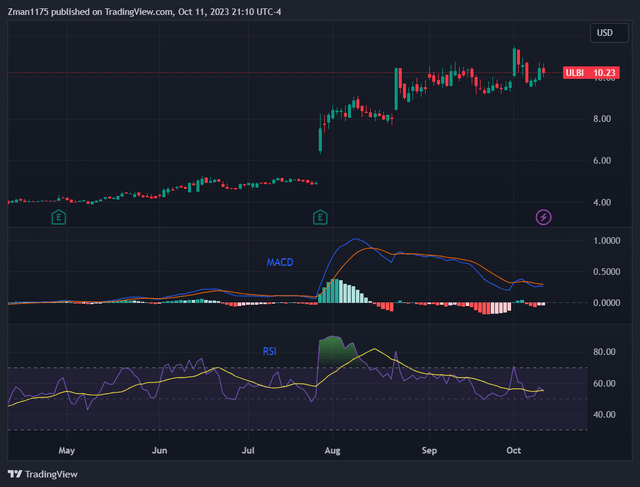

Ultralife (ULBI) stock chart w/ MACD & RSI (tradingview.com)

In my ongoing quest to find small under-covered growing companies, I have discovered Ultralife (Nasdaq: ULBI). Ultralife is known as a power company that produces lithium-ion batteries and power supplies for a variety of critical applications where reliability is paramount. The company also provides communications systems for military operations.

Ultralife looks intriguing from an investment standpoint as the company has strong expected growth and a reasonable valuation. Given these factors, the stock has a good chance to outperform over the long-term.

About Ultralife

Ultralife produces lithium-ion batteries/power supplies and for a variety of applications including: medical, energy, safety/security, industrial, and government/defense. ULBI also provides products for communications systems. It is important for Ultralife's products to have strong reliability because power failure is not an option for these critical applications.

In the medical field, Ultralife supplies a variety of batteries for use in powered medical carts & beds, defibrillators, RFID tags/units, blood analyzers, medical delivery pumps/devices, portable ultrasound/CPAP/BIPAP machines, TENs units/RTLS, remote patient monitoring, handheld dental devices, powered surgical drills, surgical headlights, and digital x-ray imaging.

In the Energy field Ultralife supplies products for energy storage, disaster relief, remote locations/portable lighting, military telecon, energy stand-by generation, marine applications, emergency response, back-up power, renewable/off-grid applications, construction sites, forward operating bases, and UPS replacement.

For safety/security, Ultralife provides products for smoke/carbon monoxide detectors, intrusion detection systems, smart security cards, bank theft tracking systems, emergency lighting systems, search & rescue devices, RFID, and backup power.

In the Industrial field, the company has solutions for smart/utility metering, toll pass/telemetry, pipeline inspection, GPS/asset tracking, tire pressure monitoring systems, industrial motive, personal transport, and robotics.

For government/military, Ultralife provides soldier-worn power for communications, portable vehicle-based charging systems, emergency rescue power, detectors/imaging, surveillance, back-up power, AUVs/UUVs, robotics, rugged portable electronics, and communications systems.

Most of these applications have a critical need to be reliable without failures. Ultralife is a key provider of these solutions, giving the company strong ongoing growth potential.

Growth Catalysts

At the end of Q2 2023, Ultralife had a record backlog of $111 million, which was 2.6% higher than at the end of Q1 2023 and 40% higher than Q2 2022. For context, the amount of the backlog is 77% of Ultralife's trailing 12 month revenue of $144 million. The increase in the backlog will help drive revenue growth in future quarters.

The company achieved a 33% increase in consolidated revenue in Q2 2023 to $42.7 million over Q2 2022. Ultralife had strong growth in both of its segments. The Battery & Energy products segment achieved a 12.3% revenue increase in Q2 while the Communications Products segment had a four-fold increase from $2 million in Q2 2022 to $8.8 million in Q2 2023.

Ultralife achieved double-digit revenue strength in government/defense sales, medical battery sales, and oil & gas sales. However, this was offset by a decline in commercial sales (mostly in China due to the timing of some industrial sales).

The backlog for the Battery & Energy segment increased 12.1%, which provides some insight into where growth will come in the near future. The Communications Systems segment backlog decreased 39%. This decline was a result of Ultralife working on existing orders and waiting to secure the next round of defense program orders. The Battery & Energy segment is what matters most for Ultralife as it comprises 95% of total revenue. Therefore, the decline in the Communications Systems segment's backlog is not a huge factor - it is just more of a timing issue.

Continue reading on Seeking Alpha.

More By This Author:

PGT Innovations: Heavy Storms Driving Growth, Stock Likely To Outperform

PayPal's Stock Could Be A Big Turnaround Story (Technical Analysis)

Mama's Creations: Small Stock With Strong Long-Term Growth Potential

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Disclaimer: The ...

more