PayPal's Stock Could Be A Big Turnaround Story (Technical Analysis)

Image Source: Pixabay

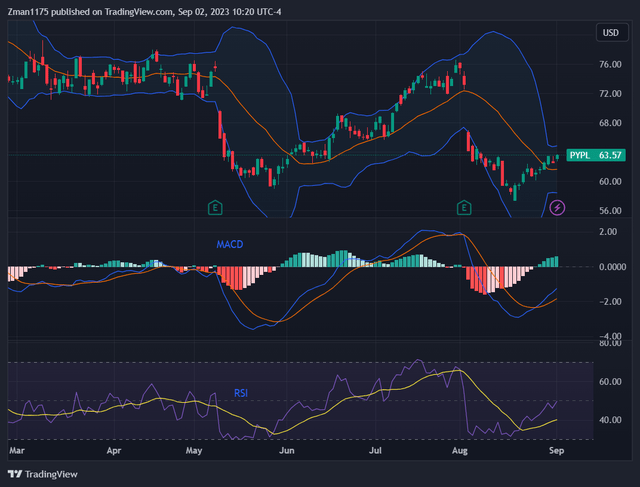

PayPal Holdings (Nasdaq: PYPL) had a significant drop since peaking around $300 in 2021. The stock had a large run-up during the COVID-related online buying frenzy that occurred in 2020 and into 2021. However, the stock took a big hit after purchasing conditions returned to normal. The stock appears to be recovering from the dip and is at the beginning of a new uptrend.

PayPal has the potential to be a strong turnaround story as the valuation is attractive and the expected growth for revenue and earnings is above average. The stock is currently at a bullish technical turnaround level. New catalysts can keep the stock increasing with new positive momentum.

Potential Positive Catalysts

The new CEO, Alex Chriss, can be a positive catalyst that might steer PayPal on a new growth trajectory. Alex Chriss takes over as PayPal's President and CEO on September 27, 2023. Chriss served as Executive Vice President and General Manager of Intuit's (INTU) Small Business and Self-Employed Group since Jan. 2019. During his leadership, customers increased by 20% while revenue increased 23%. Chriss also led Intuit's $12 billion acquisition of Mailchimp which significantly expanded business capacity and the customer base.

PayPal is investing in three main areas for growth: branded checkout, merchant solutions, and digital wallets. The company believes that these areas are key for PayPal to increase its market share in the e-commerce market. The company also strives to increase its margin dollar growth. If this strategy is successful, PayPal can grow revenue and earnings at a strong pace as the e-commerce market continues to grow.

Technical Perspective

PayPal Holdings Stock Chart with MACD, RSI indicators (tradingview.com). Data by YCharts

Continue reading on Seeking Alpha.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Disclaimer: The ...

more