Heritage Insurance Is My Best Value Idea

In the search for a great value idea, I found Heritage Insurance Holdings (NYSE: HRTG) as an undervalued Property & Casualty insurance company. Heritage Insurance is priced significantly below the industry and below book value, leaving plenty of upside potential for the stock. The company has a solid strategy for growth and cost efficiencies which has a good chance of driving strong increases in net income going forward.

Company Background

Heritage Insurance provides property and casualty insurance as a holding company. Heritage offers policies to residential and commercial customers. The company covers multiple states including: personal residential insurance in Alabama, California, Connecticut, Delaware, Florida, Georgia, Hawaii, Maryland, Massachusetts, Mississippi, New Jersey, New York, North Carolina, Rhode Island, South Carolina, and Virginia; and commercial residential insurance in Florida, New Jersey, and New York.

Heritage is vertically integrated as the company manages all aspects of the insurance process including: risk management, underwriting, claims processing/adjusting, actuarial rate making/reserving, customer service and distribution.

Improving Financials

Heritage is bouncing back from having two full years of negative net income in 2021 and 2022. The company achieved positive net income for the past three quarters and is on track to achieve positive net income for the full fiscal year of 2023. The operating income margin increased from negative 10% in 2022 to a positive 0.70% for the trailing 12 months.

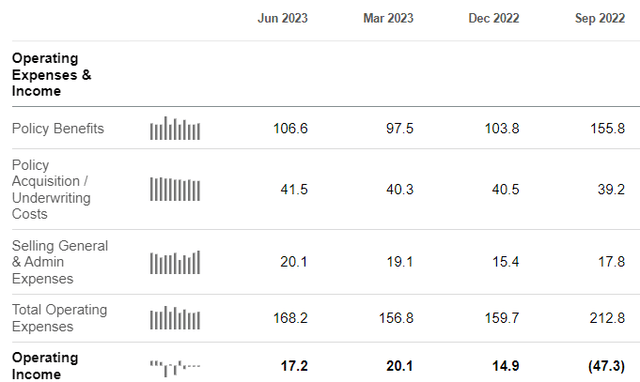

Heritage Insurance Holdings (HRTG) Operating Income (in millions) (Seeking Alpha)

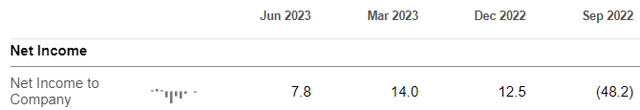

The net income margin also turned positive over the past three quarters going from a negative 29% in Q3 2022 to positive margins of 7.5% for Q4 2022, 7.9% for Q1 2023, and 4.2% for Q2 2023. The dip in net income margin from Q1 to Q2 was a result of higher policy benefit payouts and slightly higher underwriting and SG&A costs in Q2.

Heritage Insurance Holdings (HRTG) Net Income (in millions) (Seeking Alpha)

Positive Q2 2023 Results

Heritage's improved performance was highlighted during Q2 2023. Heritage achieved an increase in premiums & annuity revenues of 18.5% in Q2 2023 over Q2 2022. This was achieved while decreasing policy count by 11.1%.

This success was largely attributed to gains in the Florida market where the company's commercial residential in-force premiums increased 75.5% while total insured value for that market increased by 75.5% in Q2 2023 over Q2 2022.

Continue reading on Seeking Alpha.

More By This Author:

Vertiv Holdings: Stock Poised To Benefit From Strong AI And Margin Growth

Ultralife: Stock To Outperform With Growth From Multiple Industries

PGT Innovations: Heavy Storms Driving Growth, Stock Likely To Outperform

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Disclaimer: The ...

more