Vertiv Holdings: Stock Poised To Benefit From Strong AI And Margin Growth

Vertiv Holdings (NYSE: VRT) looks like a promising long-term stock as the company has strong, above-average growth with an attractive valuation. The strong expected growth for the Data Infrastructure market should provide a positive tailwind for Vertiv through the decade and beyond.

Vertiv is involved in the designing, manufacturing, and servicing of critical digital infrastructure and life cycle services for data centers, communication networks, and commercial/industrial environments in the United States and internationally. This includes the powering, cooling, securing, and maintaining of the electronics that process, store and transmit data. The company aims to create technology with high reliability.

Positive Growth Outlook

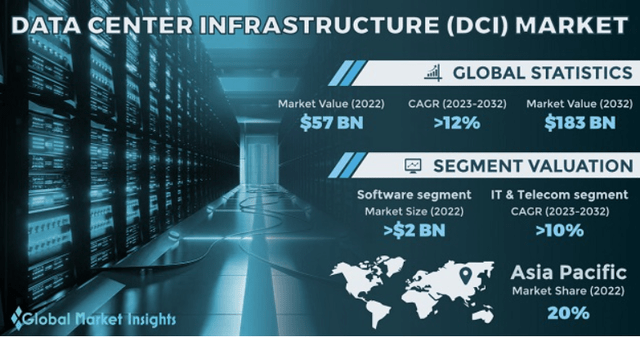

One of the driving forces for Vertiv's growth is the 12% projected annual growth for the Data Center Infrastructure market. This market is expected to grow to from $57 billion in 2022 to $183 billion by 2032.

Projected Growth for the Data Center Infrastructure Market (gminsights.com)

Vertiv fits right into this projected growth since the market shifted towards edge computing which demands faster and more efficient data processing. Vertiv's power, cooling, and monitoring solutions can help customers achieve these demands. The company also provides racks/enclosures and services which are likely to experience strong demand during this industry growth.

AI (artificial intelligence) is one of the growth drivers for Vertiv. The company believes that AI will increase Vertiv's total addressable market. Vertiv stated that it is beginning to get orders for AI-related infrastructure.

Vertiv has solutions for air cooling AI-related data centers. Vertiv also has solutions for liquid-cooling servers and racks, which a portion of the market may shift to within the AI market. Vertiv is positioned well for a hybrid solution as it has the widest selection of thermal technology available and a high level of expertise to deploy these solutions.

Continue reading on Seeking Alpha.

More By This Author:

Ultralife: Stock To Outperform With Growth From Multiple Industries

PGT Innovations: Heavy Storms Driving Growth, Stock Likely To Outperform

PayPal's Stock Could Be A Big Turnaround Story (Technical Analysis)

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 ...

more