Baidu Stock: Buy The Dip Now Before It Goes Much Higher

Baidu (BIDU) is a well-diversified Chinese internet/technology conglomerate. The company operates the most popular search engine in China and has one of the country's best and fastest-growing cloud businesses. Additionally, Baidu owns a majority stake in China's innovative, market-leading streaming entertainment service iQIYI (IQ). Moreover, Baidu is a leader in the rapidly expanding AI industry that should provide substantial growth in future years.

Baidu is expected to bring in around $19.6 billion in revenues this year, and the company's EPS should come in at about $8.60. Next year, consensus estimates are for revenues of $22.4 billion and EPS of approximately $10.30. Now, would you believe me if I told you that you can buy into Baidu at a market cap of only about $56 billion right now?

Yes, that's right, Baidu is remarkably cheap here. One of China's leading internet/technology/AI companies trades at a valuation below $60 billion, or less than three times sales, or only approximately 15 times consensus forward earnings estimates. And the company has growth potential, possibly substantially more than many analysts expect right now. Any way you look at it, Baidu's deeply depressed valuation makes little sense here. Therefore, Baidu's stock will likely go much higher as the company advances into 2022 and beyond.

Technical View: Why I Want To Buy BIDU Stock On This Dip Now

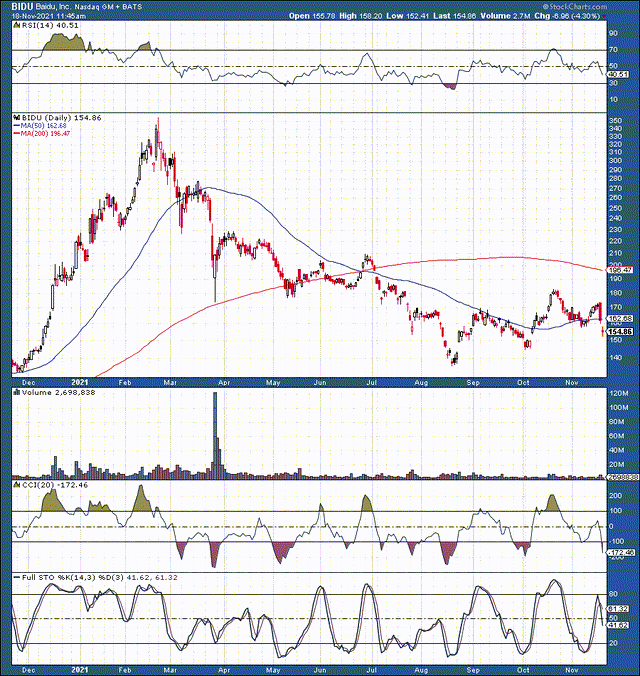

Source: stockcharts.com

Baidu is down by around 12% post-earnings. Now, I'll explain a bit later why I think that the company's recent earnings report is nothing to worry about. However, technically, we see that Baidu likely bottomed below $140 last summer and has made higher highs and higher lows since. This latest decline closes the gap at $150, and I expect shares to start moving higher once again. The company's next substantial resistance point should come around $200, roughly 33% higher from here.

Let's Look At Baidu's Earnings

Baidu recently came out with its Q3 2021 earnings results. Let's take a quick look at its numbers and see the key takeaways.

- The company's total revenues came in at $4.954 billion, a 13% YoY increase.

- Baidu Core revenues came in at $3.83 billion, up 15% YoY.

- Online marketing revenues came in at $3.06 billion, up by 6% YoY.

- Cloud and other AI-powered business revenues came in an $806 million, a 76% YoY surge.

- iQIYI revenues came in at $1.178 billion, a 6% YoY increase.

- Non-GAAP income came in at $790 million.

- Non-GAAP EPS came in at $2.28, 12.3% beat over the $2.03 estimate.

- YoY EPS decreased by 26%.

- Cost of revenues increased by 26% YoY to $2.5 billion.

- The increases in the cost of revenues were attributed to increased traffic acquisition, increased content, and increased investment in AI businesses.

- Research and development were $957 million, a 35% YoY increase.

- SG&A expenses came in at $1.14 billion, a 56% YoY increase.

- The increase in SG&A was attributed to increased channel spending, promotional marketing, and losses pertaining to legal proceedings.

The Takeaway

Revenues look healthy and growth remains relatively robust at Baidu. We see that the company's primary search business continues to do well. Moreover, the company's cloud and AI segments are expanding rapidly. Now, we see some transitory operational difficulties in the quarter. Higher costs due to content creation, marketing, and new business investment were the primary reasons for higher SG&A expenses. R&D spending is not necessarily bad, and legal proceedings-related expenses should not be an ongoing burden. Also, the company beat EPS estimates by over 12%, so in general, the image is favorable here. The company's Q4 revenue guidance is $4.81 to $5.27 billion, roughly in line with analysts' expectations. This revenue would represent about a 2-12% YoY increase. While growth may seem relatively muted right now, I think Baidu will show more growth in the future.

Why I Own The Stock - Baidu Search

Baidu has a vast search business in China. Most of its revenues (62%) still come from its lucrative online marketing segment.

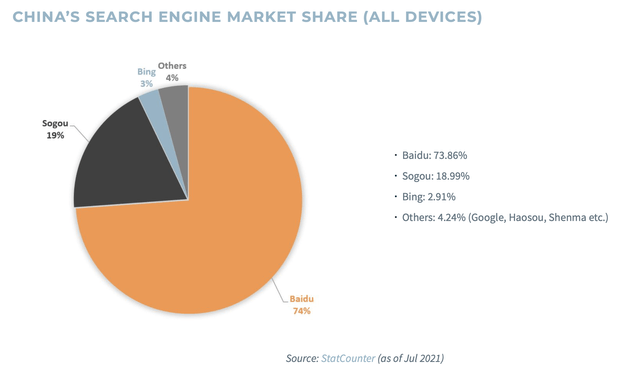

Source: theegg.com

When we look across all devices, Baidu's 74% market share is an impressive achievement. Moreover, Baidu has consistently led amongst China's search engines and has maintained its dominance in search for many years.

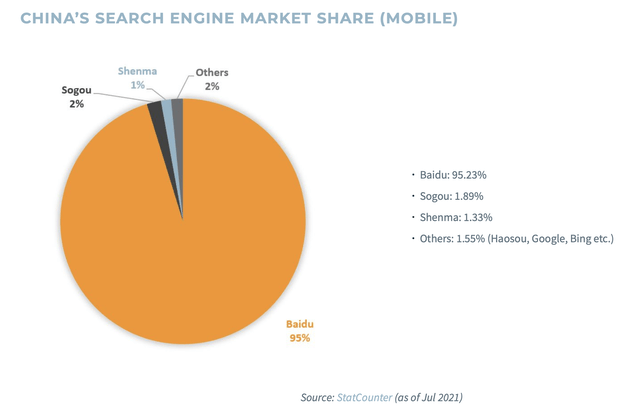

Source: theegg.com

When we look at mobile search, Baidu's dominance is unparalleled. With over 95% share, Baidu dwarfs all its competitors. Baidu should continue to maintain its dominance in China's lucrative search market. While revenues only expanded by about 6% YoY in this segment, higher growth in future years seems probable as China's consumer economy continues to grow. Additionally, Baidu's primary business segment is highly profitable and enables it to develop its secondary businesses in streaming, entertainment, cloud, AI, and more.

iQIYI - Should Become More Profitable With Time

While Baidu spun off iQIYI in 2018, it retained a majority ownership position in the new company. Therefore, iQIYI still accounted for nearly 24% of Baidu's revenues last quarter. With about 480 million monthly active users, iQIYI is a vast streaming/entertainment platform with substantial monetization potential in China. It's often referred to as China's Netflix (NFLX) as it creates high-quality original content.

However, iQIYI is still developing, and the company needs to work on monetization. iQIYI was a drag on earnings last quarter as the segment showed an operating loss of $212 million. Nevertheless, revenues should increase notably in future years, and iQIYI will likely become better monetized and more profitable as the company advances. This dynamic should transform iQIYI into a promising and profitable segment for Baidu in future years.

Baidu AI Cloud - Growing Quickly

Baidu AI Cloud has enormous potential. We see tremendous growth here as the company reported 73% YoY growth last quarter. This revenue surge is even higher than the previous quarter's 71% YoY increase. Moreover, Baidu AI Cloud won a bid for a lucrative government contract worth $27.7 million in Q2. Baidu's explosive growth in cloud coupled with its favorable relationship with the Chinese Communist Party ("CCP") implies that Baidu's cloud segment should continue to expand and become more profitable in future years.

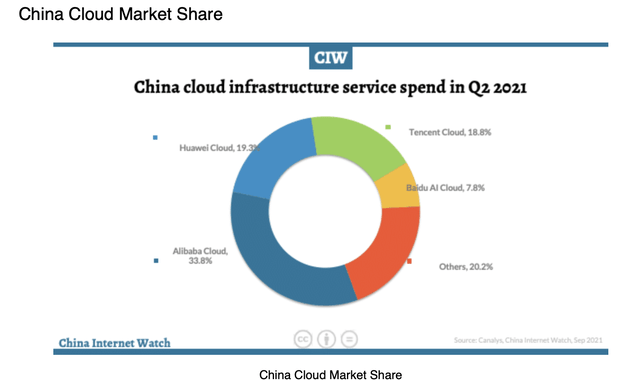

Source: chinainternetwatch.com

Baidu has one of the largest and fastest-growing cloud segments in China. By size, Baidu AI Cloud is in fourth place right now. However, the company's cloud segment is growing revenues and market share more rapidly than its key competitors right now and should continue to expand well into the future from here.

Baidu AI: Enormous Potential

Baidu is a leading AI innovator. The company has been investing in its AI program for years, a segment that's now starting to deliver substantial growth. Last quarter, the company's AI-powered businesses had revenues of $806 million, a significant 76% YoY surge. The AI segment should continue to develop and could be the primary driver of growth for Baidu in future years.

Baidu's Apollo Moon Mission

One of Baidu's most promising AI projects is the company's Apollo self-driving program. The per-unit manufacturing price for Baidu's Robotaxi is about $75,000, roughly one-third of the average cost for an autonomous vehicle in the ride-hailing service, Baidu said. Arcfox and Baidu recently reached a new strategic cooperation agreement to roll out a fleet of 1,000 Apollo Moon Robotaxis in three years.

Additionally, Baidu recently launched its advanced second-generation Kunlun AI chip and unveiled an advanced prototype of its autonomous "robocar" vehicle. Partnered with China state-owned BAIC Gropu, Baidu plans to commercialize a robotaxi service across China eventually. Again, we see Baidu's partnership and favor with the Chinese government, implying that the company should continue to win government contracts in the future. Furthermore, having one of the most advanced AI segments should enable Baidu to enter new business segments and grow revenues as the company advances.

Here's What Baidu's Financials Could Look Like In Future Years

| Year | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenues $Bs | 22.3 | 25.5 | 29 | 32.5 | 36.4 | 40 | 44 | 47.5 | 51.3 |

| Revenue growth | 14% | 14% | 14% | 12% | 12% | 10% | 10% | 8% | 8% |

| EPS | $10.3 | $12.7 | $15.8 | $19 | $22.5 | $26 | $30 | $34.5 | $40 |

| Forward P/E ratio | 18 | 20 | 22 | 25 | 24 | 23 | 22 | 21 | 20 |

| Price $ | $228 | $316 | $418 | $563 | $624 | $690 | $760 | $840 | $900 |

Source: Author's Material

Now, I don't think that I'm being overly optimistic in my estimates. My near-term expectations are roughly in line with consensus figures. My longer-term projections are relatively modest relative to the kind of growth Baidu could have due to its expanding businesses. Additionally, Baidu's multiple could expand further than my projections suggest, implying that more rapid stock appreciation is possible. Furthermore, the company could hit a home run with some of its AI projects, and shares could appreciate notably past my projections. Regardless, it appears like Baidu's stock should move substantially higher in future years.

Possible Risks To Baidu

While I remain committed to my bullish assessment, there are some risks that investors should consider before putting their money into Baidu. The company's stock has been up marginally over the last decade. Baidu has only appreciated by about 20% in the previous 10 years, which is a poor return on investment relative to many other stocks. Therefore, future performance may also be worse than I expect. Additionally, there are regulatory and political risks. For instance, the Chinese government could impose stricter guidelines relative to tech businesses in China, negatively impacting Baidu's shares. In addition, there's even a chance of delisting from U.S. stock exchanges in a worse case outcome. Such a dire scenario could cause Baidu's stock price to crash and make shares challenging to unload in time. Finally, the company could underperform, not produce significant growth, and go down in history as a poor investment from here. The underlying risks are possible and should be considered before buying into Baidu shares.

Disclosure: I/we have a beneficial long position in the shares of BIDU either through stock ownership, options, or other derivatives.

Disclaimer: This article expresses solely my ...

more