Acme United Corporation - Upgrade To Buy

Company Description

Acme United Corporation is one of the largest worldwide suppliers of innovative cutting devices, measuring instruments, and safety products for the school, home, office, and industrial markets. The Company has facilities in the U.S., Canada, England, Germany, Hong Kong, and China.

Solid Second Quarter; Margin Improvement Expected in H2; Upgrade to Buy.

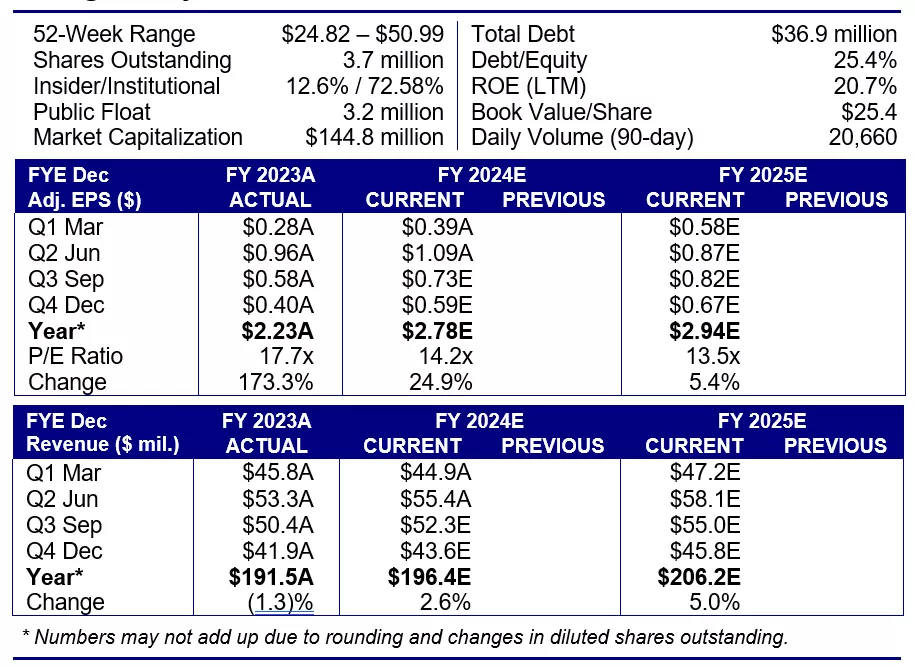

Acme United (ACU) had a strong quarter with YOY earnings growth of 29%. The Company is looking forward to a strong second half of 2024, with anticipated growth from new product placements and contribution from acquisitions. We expect margin improvement driven by productivity gains. We adjust our price target to $50.00 (previously $53.00) and upgrade our rating to Buy.

Q2:24 Highlights

- Revenue increased 8% YOY in Q2:24 after excluding the impact of Camillus and Cuda product lines, which were sold on November 1, 2023.

- The growth in Q2:24 was led by market share gains across multiple product lines (First Aid, Westcott craft products and DMT sharpeners) and new product launches.

- Net income for Q2:24 was $4.5 million, or $1.09 per diluted share, compared to a net income of $3.4 million, or $0.96 per diluted share, for the same period in 2023.

- ACU achieved significant improvement in profitability during the quarter. Gross margins were up at 40.8% as compared to 37.5% during Q2:23. The improvement was driven by productivity improvements.

- ACU is well-positioned for growth for the remainder of this fiscal year. The Company secured new opportunities to place their products, such as adding more first aid and medical items in a large drugstore chain and industrial distributor. They also introduced new Westcott cutting tools and DMT sharpeners in mass market retail stores.

- We adjust our target price to $50.00, with an implied capital appreciation potential of ~26%. We upgrade our rating to Buy.

Primary Risks

- ACU’s results can be negatively impacted by weak economic activity, rising commodity input costs, timing of customer orders, foreign exchange fluctuations, and competitor pricing.

Investment Thesis

ACU had a solid quarter with market share gains across multiple product lines. Net income for Q2:24 jumped 29% YOY to $4.5 million, or $1.09 per diluted share. Cost savings and efficiency improvement initiatives should boost margins. The Company’s bank debt less cash as of Q2:24 was $33.1 million compared to $47.5 million as of Q2:23. The Company is looking forward to a strong second half of fiscal 2024. With its strong balance sheet, management states that they continue to look for accretive acquisitions. All in all, we expect a combination of topline growth, improved margins, and lower debt to benefit ACU.

We adjust our price target to $50.00 per share (earlier $53.00) and upgrade our rating to Buy.

Q2:24 Financial Performance

Q2:24 results were solid with a 4% YOY increase in revenue and 29% YOY increase in net income. Diluted EPS rose 14% YOY.

Steady topline performance. ACU reported sales growth of 4% YOY for Q2:24. Sales for Q2:24 were $55.4 million versus $53.3 million for Q2:23. We note that revenue increased 8% YOY in Q2:24 after excluding the impact of Camillus and Cuda product lines, which were sold on November 1, 2023. The growth in Q2:24 was led by market share gains across multiple product lines (First Aid, Westcott craft products, and DMT sharpeners) and new product launches. ACU noted that the Westcott business saw improved performance due to gains in the craft market and growth in back-to-school sales. The first aid and medical business remains strong as it delivered new kits to a major drugstore chain in the U.S., expanded product range with a large industrial distributor, and grew the customer base for its alcohol wipes and lens cleaners. Furthermore, the acquisition of Elite First Aid in May 2024 expands the product line of the First Aid division.

U.S. sales (excluding the impact of Camillus and Cuda), increased 10% YOY due to market share gains with First Aid, Westcott craft products, and DMT sharpeners. European sales rose by 9% YOY in local currency due to market share gains in the office channel. Sales in Canada decreased by 4% YOY in local currency due to a decline in sales of school and office products. ACU is well-positioned for growth for the remainder of this fiscal year. The Company secured new opportunities to place their products, such as adding more first aid and medical items in a large drugstore chain and industrial distributors. They also introduced new Westcott cutting tools and DMT sharpeners in mass market retail stores.

Robust improvement in margins. ACU achieved significant improvement in profitability during the quarter. Gross margins were up at 40.8% as compared to 37.5% during Q2:23. The improvement was driven by productivity improvements in the Company’s manufacturing and distribution facilities. ACU reported net income of $4.5 million or $1.09 per share versus net income of $3.4 million or $0.96 in the prior year’s quarter.

Improving balance sheet. During the past 12 months, the focus has been on improving the balance sheet. ACU generated $8.5 million in free cash flow over the trailing twelve months ending June 30, 2024. This amount coupled with net proceeds from the sale of the Camillus and Cuda product lines totalling ~$13.0 million were used to pare down debt. The Company’s net debt at the end of Q2:24 was $33.1 million, compared to $47.5 million in the prior year’s period.

Optimistic Outlook. The Company is winning new business for FY:24 across its product portfolio including Westcott, first aid, and DMT sharpeners segments. During Q2:24, ACU acquired Elite First Aid Inc. for $6.1 million. Based in North Carolina, Elite First produces first responder kits, used to treat serious bleeding, airway obstructions, and trauma. ACU continues to look for new acquisition opportunities. The first aid business is growing faster than the overall Company and has better gross margins. On the margin front, ACU expected SG&A as a percent of sales to decline for the remainder of the year which should help to boost margins and overall profitability.

Valuation

We derive our price target of $50.00 from our blended approach of a 50/50 weighted DCF and P/E multiplier methodology. We value ACU at 17.2x FY:25 EPS of $2.94, at a discount to the peer group because of its small size and lower margins. We weight this multiple-based target to equal 50% of our price target. The multiple based target price is $50.42.

We weight the other 50% of our target using our Discounted Cash Flow target. Our DCF model uses our forecasted free cash flow to the firm over the next one year, then grows after tax EBIT at a 3% rate thereafter. We apply a weighted average cost of capital of ~7.4%. Our DCF produces a value of $49.81.

The combination of $50.42 at 50% and $49.81 at 50% results in a weighted average price target of $50.12 which we round down to $50.00.

The exhibit below summarizes our peer group multiples, while the DCF is included at the end of this report

Read the full report below:

More By This Author:

CIA: Further Distribution Growth And Earnings Beat, Maintain Buy-Long-Term Rating

QNST: Auto Insurance Ramp Up Gaining Momentum, Increase Target Price To $20.00

Three Undervalued Micro-Caps With An Emerging Catalyst

Disclosure: This research report is for our clients’ informational purposes only. This research is based on current public information that we consider reliable, but we do not represent it ...

more