CIA: Further Distribution Growth And Earnings Beat, Maintain Buy-Long-Term Rating

TM Editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

Image Source: Pixabay

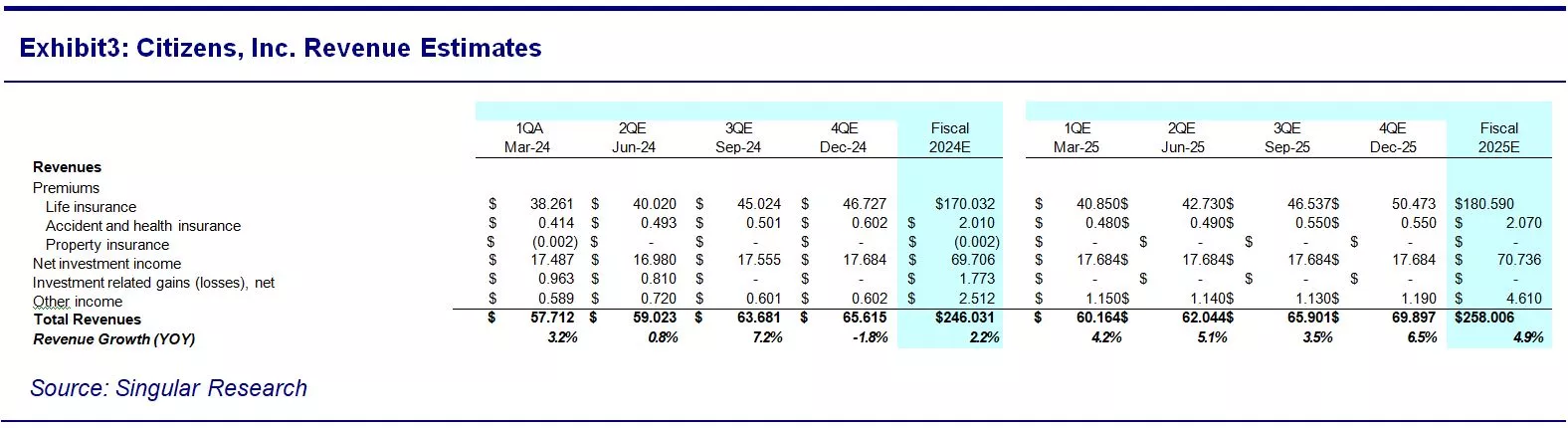

Citizens, Inc. (CIA) is a specialty insurer offering U.S. dollar life insurance in Latin America and Asia, leveraging its language and cultural expertise. CIA also offers whole-life policies in the U.S. for final expenses. Citizens increased the number of agents a further 20% in Q1:24 and beat estimates for both revenue and earnings. We maintain a Buy-long-term rating with an increased price target of $3.70. Citizens, Inc. (CIA) is a specialty insurer offering U.S. dollar life insurance in Latin America and Asia, leveraging its language and cultural expertise. CIA also offers whole-life policies in the U.S. for final expenses. Citizens increased the number of agents a further 20% in Q1:24 and beat estimates for both revenue and earnings. We maintain a Buy-long-term rating with an increased price target of $3.70.

Q1:24 Highlights

- Citizens, Inc. offers U.S. dollar life insurance in Latin America and Asia, providing currency protection as well as life protection in a single package. The Company also offers whole-life final policies in the U.S. for final expenses.

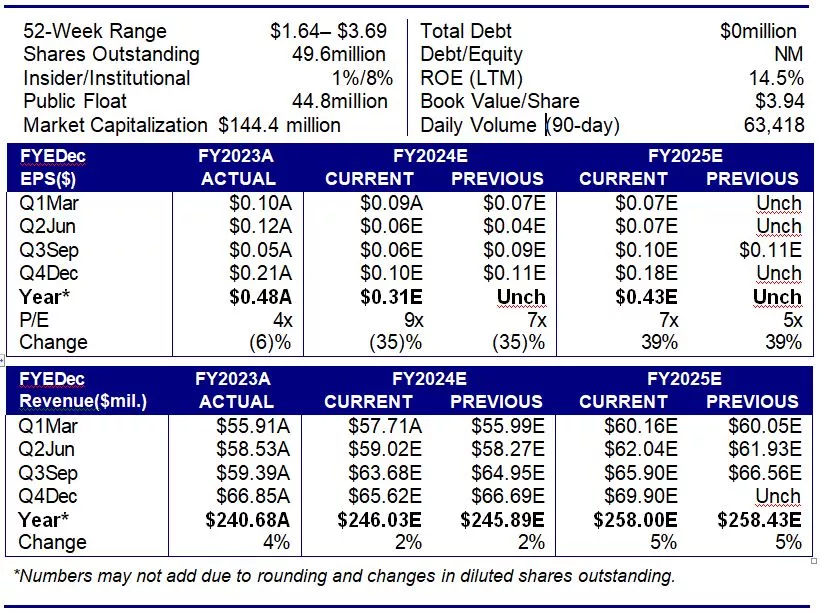

- Citizens continue to grow the issuance of new insurance policies at a rapid pace. InQ1:24 issuance of new policies grew 61% YOY to reach $274.5 million, after doubling issuance from FY:20 to FY:23. Issuance growth has been driven by new white-label products and growth in the number of producing agents, now standing at a record high.

- Both internationally and in the U.S., Citizens engages established, independent local distributors who share a common language and culture with potential clients. Citizens’ worldwide network of local agents grew a further 20% in Q1:24.

- Q1:24 revenue was $57.7 million, beating estimates by 3%. EPS was $0.09, beating estimates by $0.02.

- With its focus on specialized markets, Citizens’ international business faces few direct competitors. In the U.S. there is more competition, but Citizens’ white-label strategy effectively creates niche markets which the Company can dominate.

- Citizens have delivered positive operating cash flow since FY:04,20 straight years.

- In our view, Citizens’ shares are significantly undervalued, trading at a 65% discount to the Company’s life insurance peer group. Further revenue and earnings growth offer the potential for a significant upside in CIA shares.

Primary Risks

- Are turn to the arising interest rate environment could hurt the Company’s share price.

Investment Thesis

Citizens Inc. is a specialty life insurer experiencing rapid distribution growth. In turn, increased distribution has driven significant growth in the issuance of new insurance policies (see Exhibit 1). In Q1:24 the value of new insurance issued grew 61% YOY, while the number of new policies grew 109%. Rapid growth in new policies has driven significant growth in first-year premium revenue, which rose 42% YOY in the quarter-the sixth consecutive quarter of growth. Distribution also continues to grow, with the Company increasing the number of producing agents by 20% in the recent quarter, bringing the number of agents to a record high. In our view, FY:24 marks an inflection point for Citizens, with the cumulative impact of expanding distribution driving faster growth in insurance issuance, revenue, and earnings going forward.

Citizens operate primarily in two markets:

- Citizens’ largest market is outside the U.S., where the Company offers U.S. dollar-denominated life insurance to high-net-worth and upper-middle-class clients in Latin America and Asia. By issuing policies denominated in U.S. dollars, Citizens effectively combine life protection and currency protection in a single package. Citizens’ international offerings made up 74% of FY:23 premium revenue.

- In the U.S., Citizens offer whole life insurance for final expenses. Citizens’ offerings in the U.S. made up 26% of FY23 premium revenue.

Citizens has built its distribution strategy on the skills and success of its independent distribution force. Country by country, the international business relies upon independent, local agents, and distributors who share the language and culture of potential clients. This strategy increases market penetration and loyalty while keeping the CIA’s own staffing costs low. Citizens have also invested in local language websites and telephone support, important additional tools for building client loyalty. Citizens have developed deep expertise in servicing clients in Spanish, Portuguese, and Mandarin. Citizens has further expanded its distribution strength through customized, white-label product development.

Citizens’ stock prices suffered from rising interest rates in 2022 and 2023, along with many other financial companies. While CIA shares have since recovered somewhat, the Company’s share price is still well below recent highs. In our view, Citizens’ business is significantly undervalued, with a price-to-sales ratio of 65% less than peers. With further growth expected in distribution, issuance, revenue, and earnings, we see the potential for significant appreciation in CIA shares.

We maintain a Buy-Long-Term rating with an increased price target of $3.70.

Q1:24 Financial Performance

Revenue in the quarter was $ 57.7 million, up 3.2% YOY and 3% above our estimate. In comparison to Q1:23,

- Life premium was $38.3 million, up 3.8% YOY

- Accident & Health premium was $0.4 million, up 15.6%

- Net investment income was $17.5 million, up 2.4%

- Net investment gain/loss was $1.0 million,swinging positive from a loss in the prior year

- Other income was $0.6 million, down (33.0)%

Cost of Insurance Benefits Provided was $35.1 million, in line with our estimate but up 12.1% YOY. Increased claims and surrenders drove the variance.

Expenses other than benefit costs were $52.8 million, up 7.3% YOY. Increased commissions driven by increased sales were largely responsible for the variance.

Pre-tax income was $4.9 million, down (26.7)% YOY but 9.2% above our estimate. Increased benefit costs and increased commissions drove the variance.

The operating margin was 8.5%, down 350 basis points YOY.

GAAP Net Income was $4.5 million, down (6.8)% YOY. Net income benefitted from a much lower tax rate in the quarter, an effective rate of 7.8% compared to 27.4% in the prior year.

Diluted EPS was $0.09 per share, down (10.0)% YOY but $0.02 above our estimate.

Adjusted Operating Income was $4.0 million, down (43.0)% YOY.

Operating Cash Flow was $6.8 million. The Company has delivered positive operating cash flow for 20 straight years.

Cash on the balance sheet stood at $27.0 million at year-end, up from $23.0 million in December 2022.

Q1:24 Highlights

- Distribution continued to increase, with the number of producing agents up 20% since year-end, reaching a record high in Q1:24.

- In the quarter Citizens issued $274.5 million in new insurance, up 61% YOY and a new record for the Company. The rapid increase in producing agents is driving the growth in insurance issuance. New white-label products have proven especially effective in gathering new policies.

- The Company reached a record level of insurance in force, now standing at over $5 billion.

- CIA sees FY:24 as an inflection point, with new insurance issuance beginning to “outrun” the maturities of older policies.

- Revenue was $57.7 million in the quarter, up 3% YOY.

- First-year Life and Accident & Health premiums increased 42% YOY, the sixth consecutive quarter of growth.

- Net income was $4.5 million, or $0.09 per share, down $0.01 from the prior year.

- Operating cash flow was $6.8 million. CIA has delivered positive operating cash flow since 2004 -20 straight years.

- CIA has zero debt.

- Book value increased 28% YOY to $3.94 per share. (We should note that while book value is not a meaningful figure for many companies, CIA’s balance sheet has zero goodwill and zero intangible assets -there are no “fluff” assets distorting the Company’s book value.)

Recent Life Insurance Industry News

- On April 30, 2024 competitor American Equity Life Insurance was acquired by Brookfield Reinsurance.

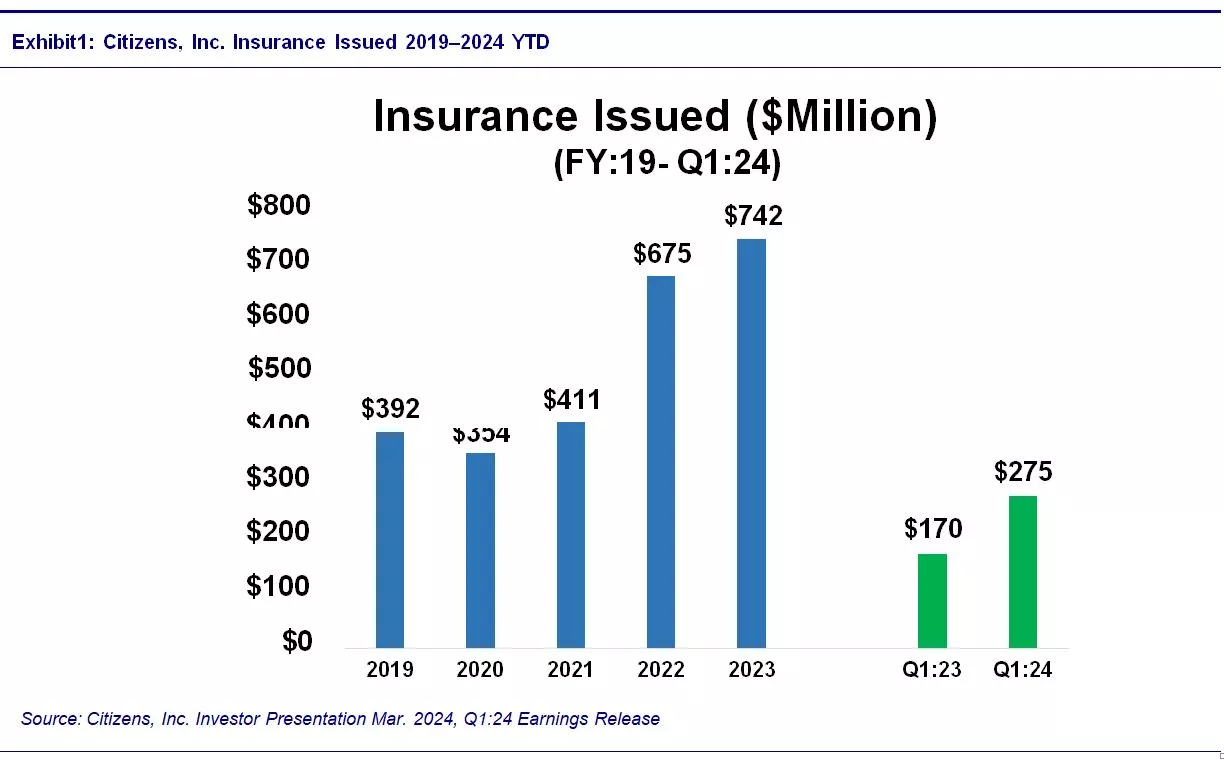

Key Shareholdings

In its April 2023 proxy statement, the Company reported 49.86 million shares outstanding. A summary of key shareholders and their percentage holding is shown in Exhibit 2 below.

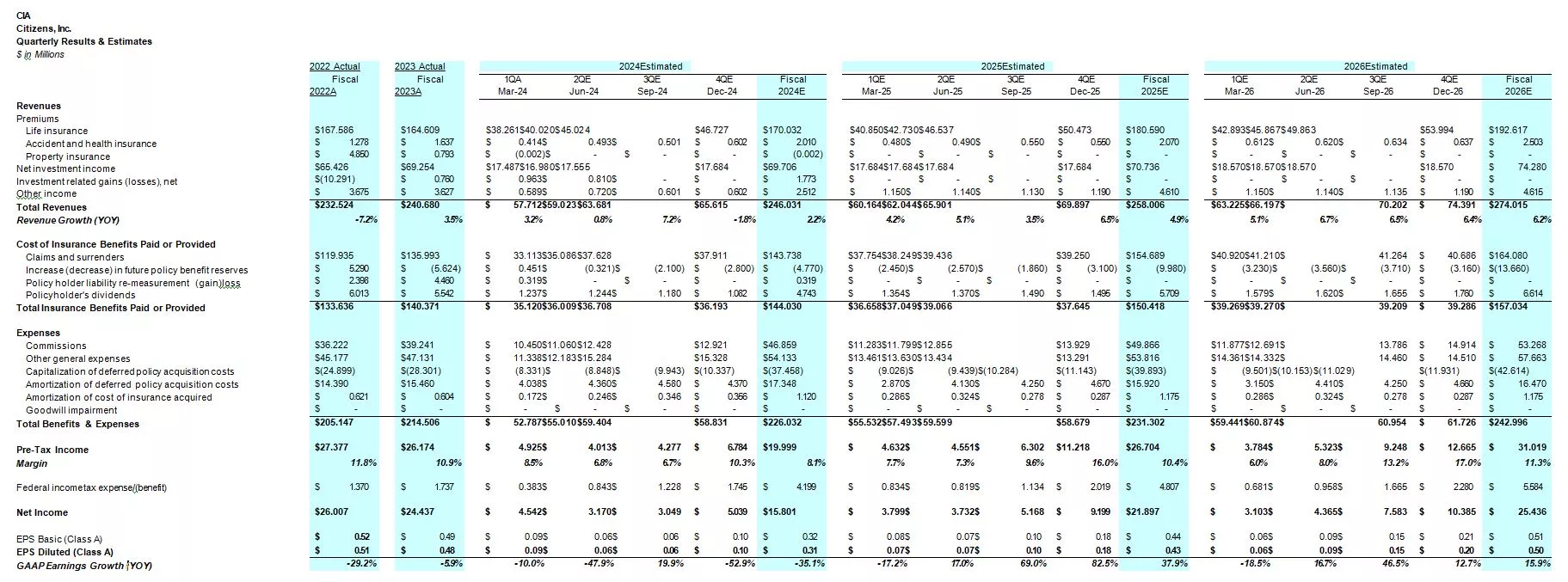

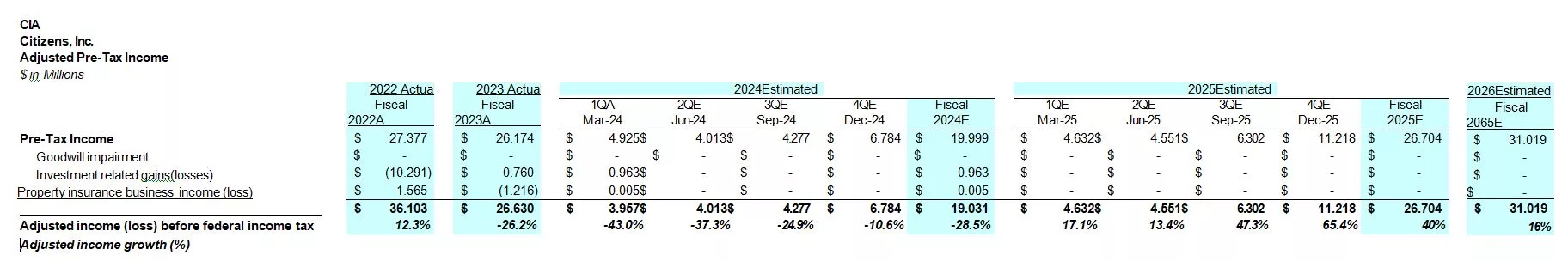

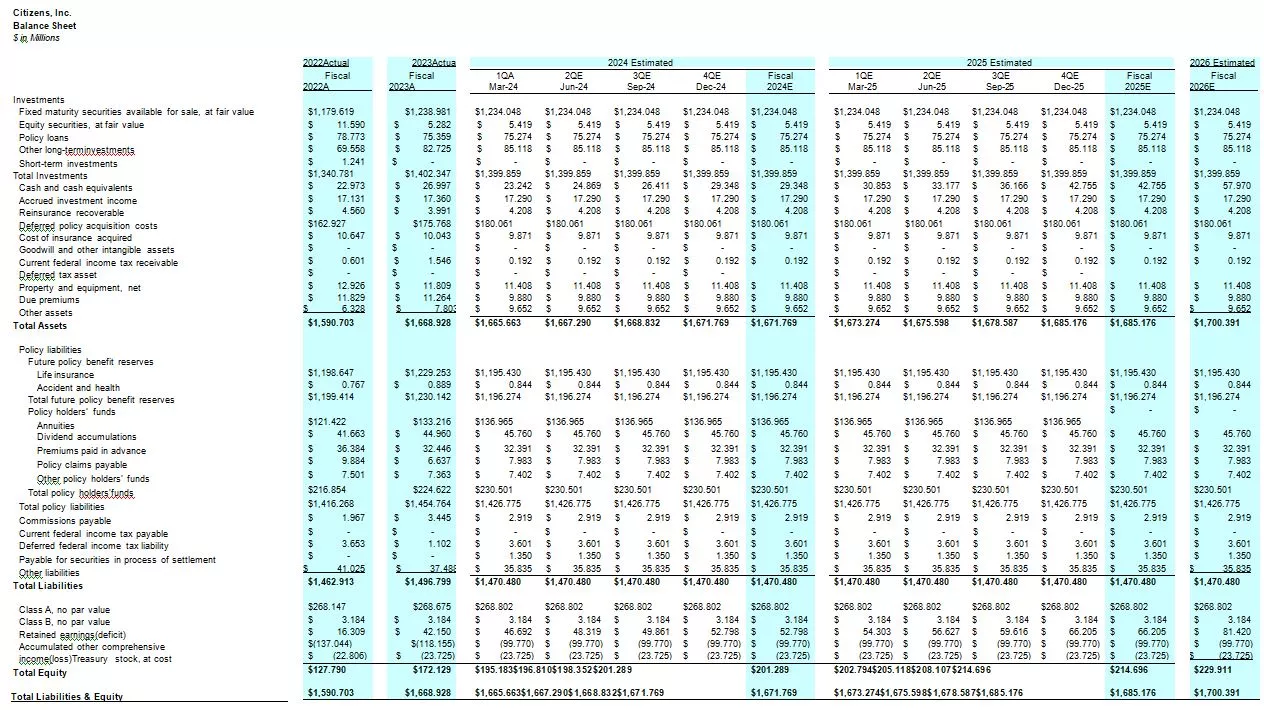

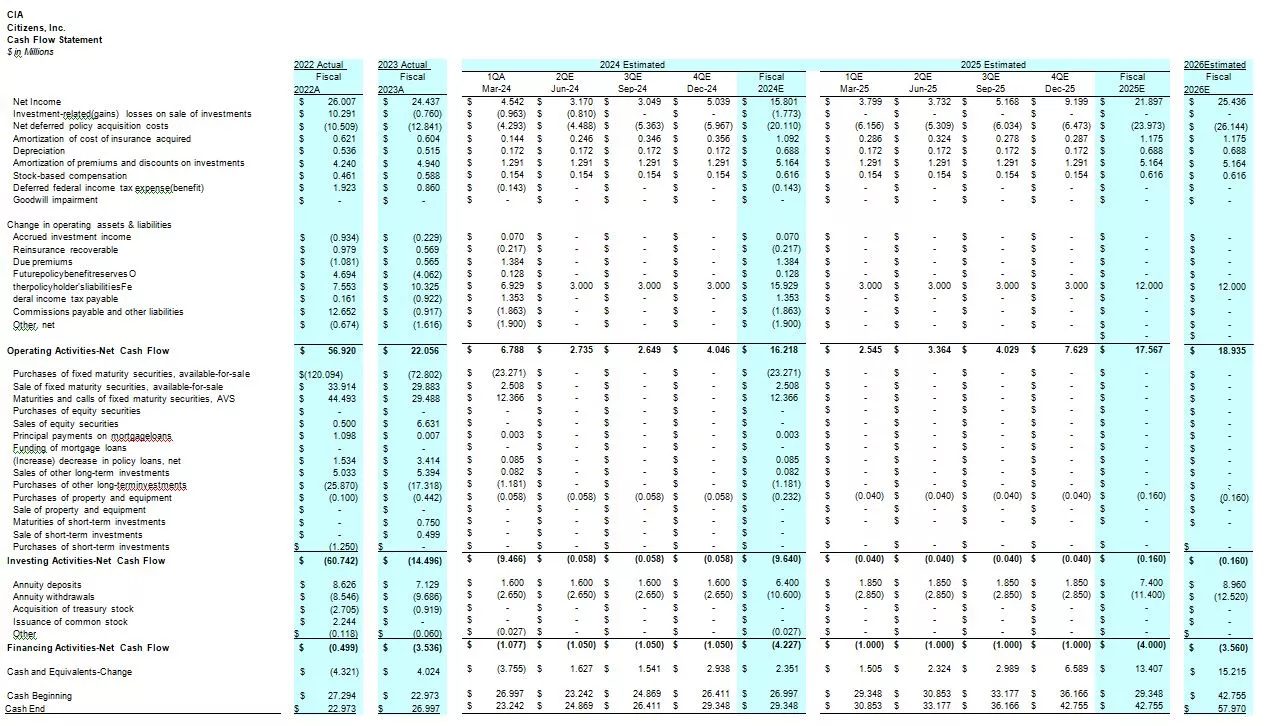

Modelling Assumptions

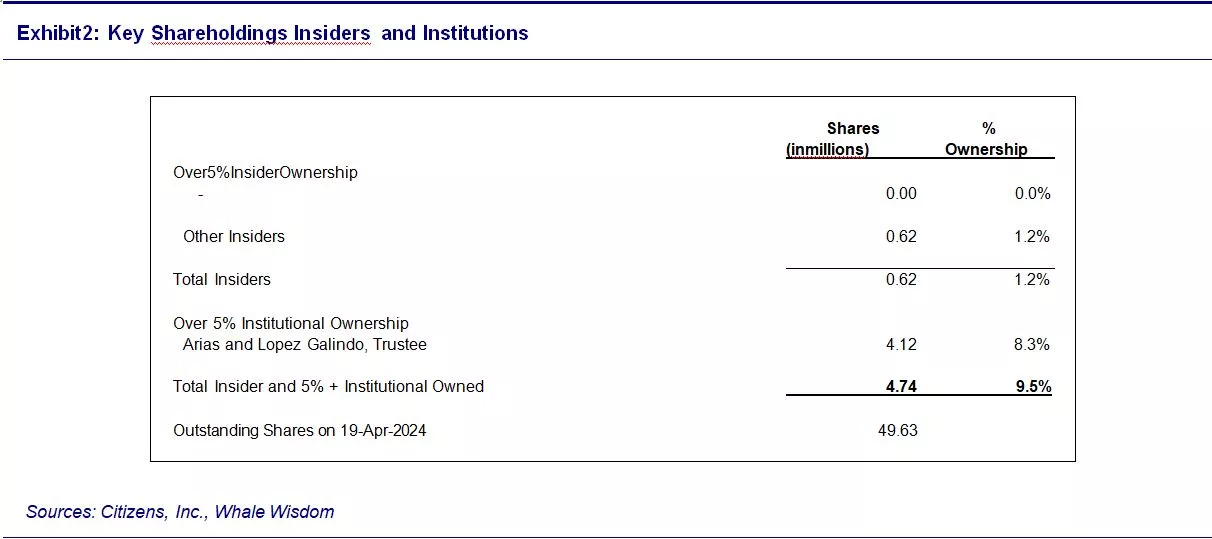

Estimates of Citizens’ future revenues are shown in Exhibit 3 below.

(Click on image to enlarge)

Since there are many factors that impact the Company’s future revenues, we summarize below the assumptions used for our estimates:

- Life and Accident/Health premiums will grow 3.5% in FY:24 and 6.1% in FY:25.

- Net investment income will stay at the current level of $70 million per year.

- Investment-related gain/loss will net to $0 each year.

- Other income will stay flat at $2.6 million in FY:24, rising to $4.6 million in FY25.

Valuation

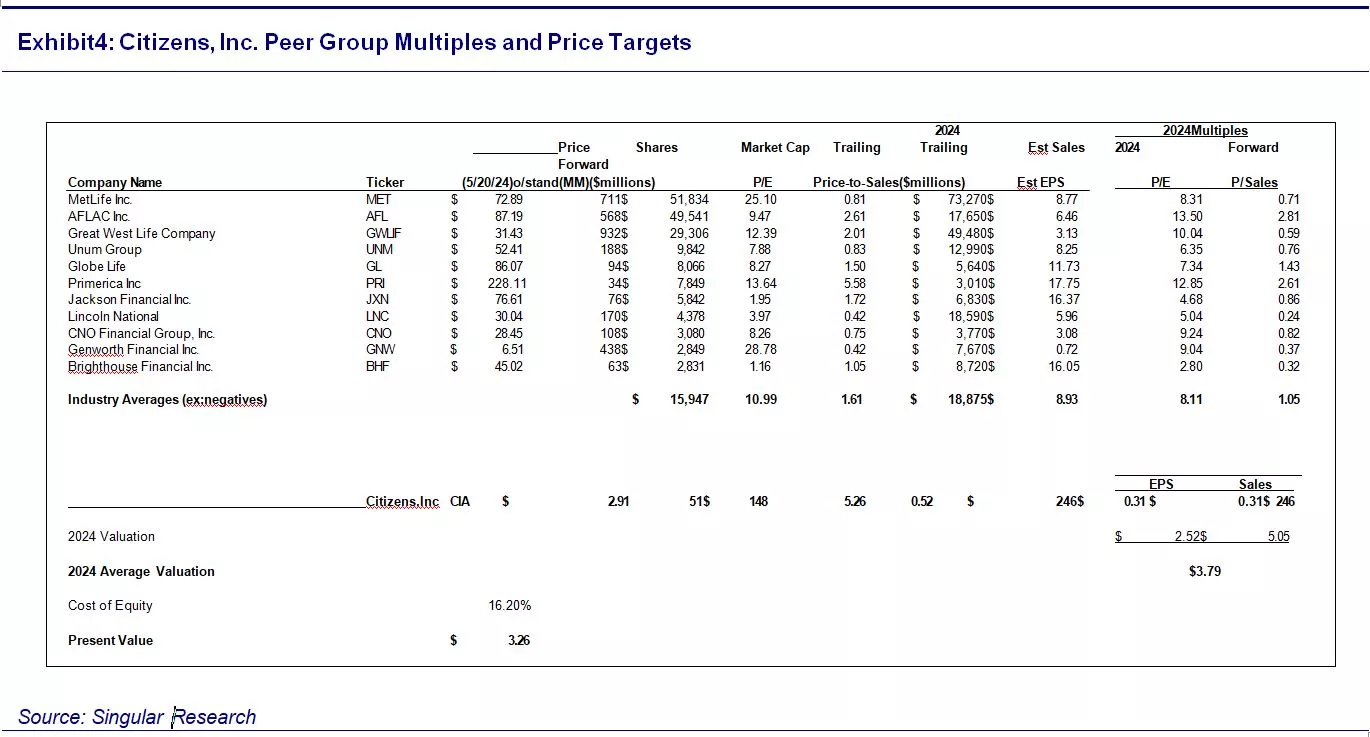

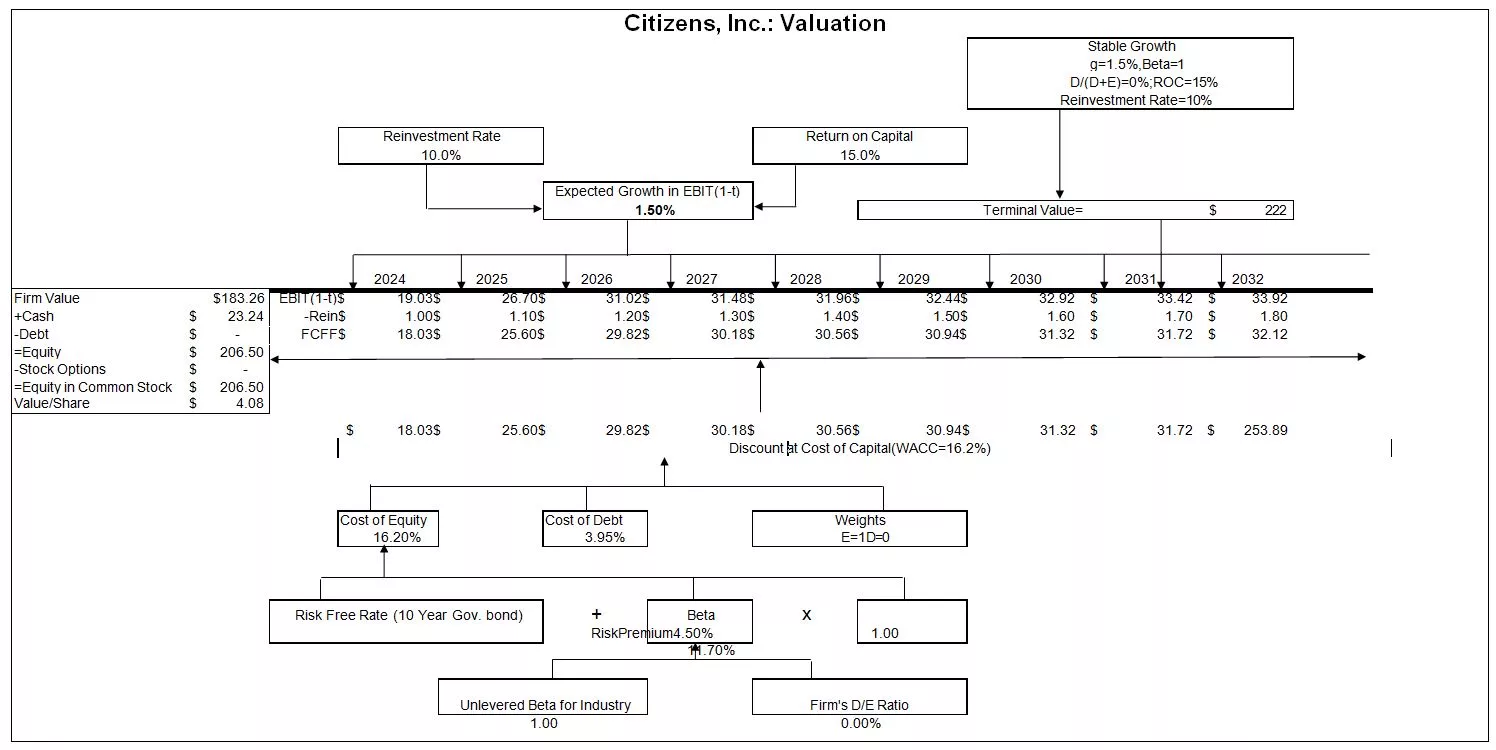

We value Citizens, Inc. by two methods: a comparison to peers and a Discounted Cash Flow model (DCF). For our peer comparison, we selected eleven publicly traded companies with exposure to the life insurance sector (see Exhibit 4). Across the peer universe, we compare each company’s Price/Sales and Forward Price/Earnings and derive an average multiple for each valuation measure. We then apply the multiple for each measure to our forecast revenues and earnings for Citizens. Averaging the two prices suggested by each multiple, we come to an average forecasted price of $3.79 per share. As a final step, we discount this value by CIA’s cost of equity to derive a present value of $3.26.

(Click on image to enlarge)

Our Discounted Cash Flow (DCF) model uses income statement values for years one through three, and we assume EBIT grows at a compound annual growth rate (CAGR) of 1.5% per year for years four through eight. This DCF model produces a value of $4.08 per share.

We then average the two price targets of $3.26 produced by the relative valuation and $4.08 produced by our DCF model to come to an initial target price of $3.67, which we round to $3.70.

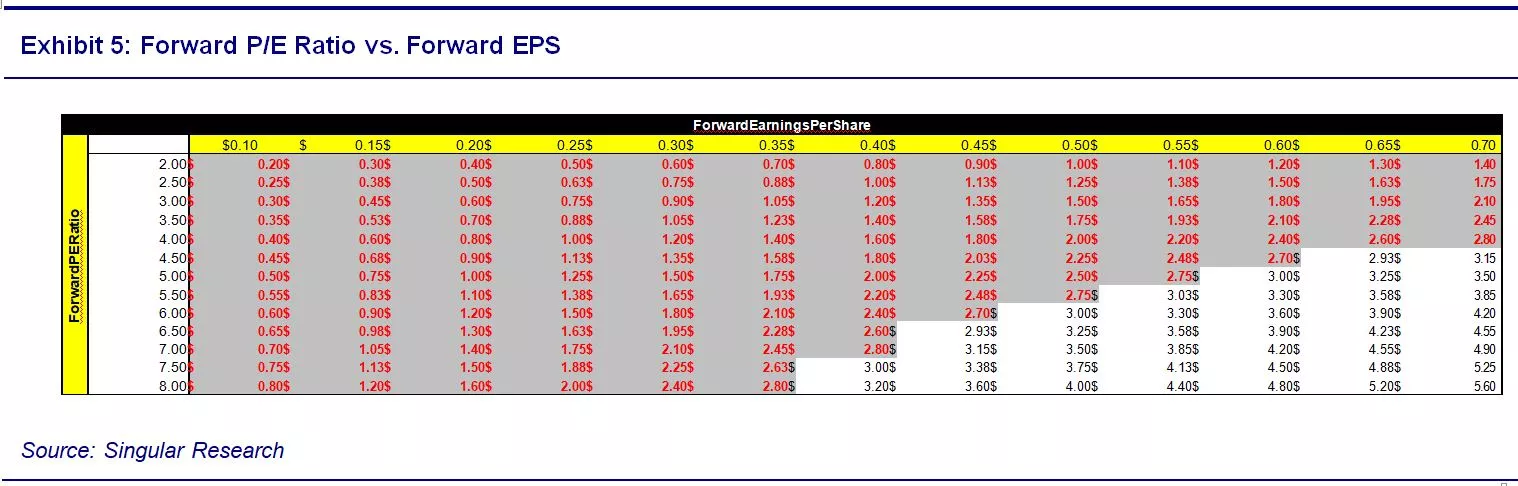

The Exhibit below shows stock price targets using various combinations of forward EPS and P/E multiples. Our EPS estimates for FY:24 and FY:25 are $0.31 and $0.43, respectively. The portion of the chart not shaded shows resulting price targets at various forward P/E multiples that are above the current price of $2.91 on May 21, 2024.

(Click on image to enlarge)

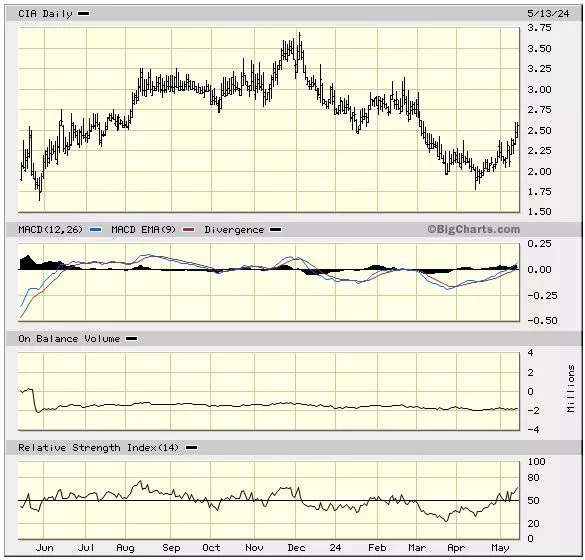

Technical Analysis

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

Rating Definitions

BUY, 30% or greater increase in the next 12 months.

BUY-Long-Term, near-term EPS horizon is challenging, attractive long-term appreciation potential.

BUY-Venture, initial stages with little to no revenue and the potential for outsized returns with higher amounts of risk and volatility.

HOLD, perform in line with the market.

SELL, 30% or more declines in the next 12 months.

More By This Author:

QNST: Auto Insurance Ramp Up Gaining Momentum, Increase Target Price To $20.00

Three Undervalued Micro-Caps With An Emerging Catalyst

Why GOOG Is A $1900 Stock

Disclosure:

This report has been prepared by Singular Research, a wholly owned subsidiary of Millennium which is an investment advisor registered in the State of California. Singular ...

more