Three Undervalued Micro-Caps With An Emerging Catalyst

Summary

- HNNA is positioned to benefit :Stock market continues expansion, M&A activity increases, and global economies recover.

- BLX is positioned to benefit: trade ware disputes ease, and Latin American economies/trade recover.

- AMRK is positioned to benefit : Global economies slow and the Corona virus’ toll on China is worse than predicted, thus increasing volatility in the stock market.

Undervalued & Undercovered Micro-Caps Provide Compelling Opportunity

At Singular Research, we focus on small and micro-cap stocks that are undercovered on Wall Street. These stocks have a niche business model and have yet to be widely discovered. Many of the global threats in the stock market today do not affect these stocks. Currently, we cover three companies that are both, undercovered and undervalued, providing a great value investment with the right catalyst. Please see below for our review of Hennessy Advisors (HNNA), Banco Latinoamericano (BLX), and A-Mark Precious Metals (AMRK).

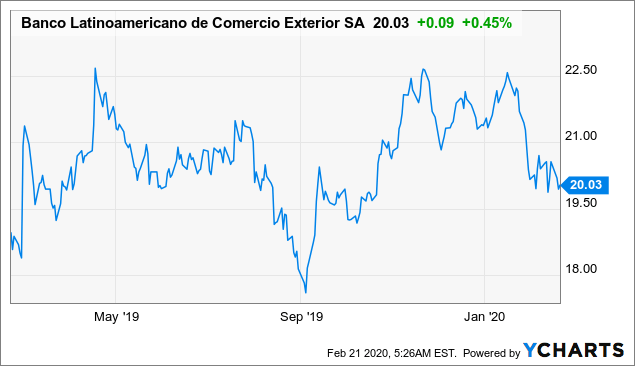

Hennessy Advisors, Inc. (HNNA)

$13.25 Price Target, Buy-Long Term, Current Price: $11.04 (2/20/20)

Data by YCharts

Hennessy Advisors, Inc is an investment management company. The Company's business activity is managing, servicing and marketing open-end mutual funds branded as the Hennessy Funds. The Company provides investment advisory services and shareholder services to the Hennessy Funds. Its investment advisory services include managing the composition of each fund's portfolio, conducting investment research, and monitoring compliance with each fund's investment restrictions and applicable laws.

Summary

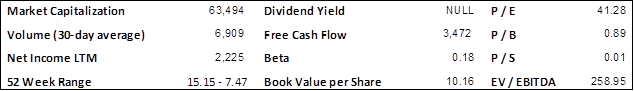

The company has a 5% dividend yield with ample free cash flow and net income to further support and increase dividends as necessary. Company is undervalued on P/E, P/B, and P/S valuation metrics as the financial service sector is 24.0, 2.8, and 4.9, for those categories, respectively. Catalyst: Stock market continues expansion, M&A activity increases, and global economies recover.

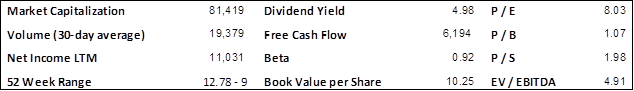

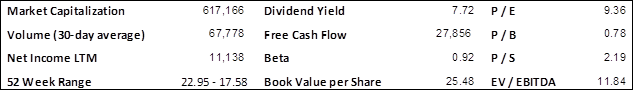

Banco LatinoAmericano (BLX)

Data by YCharts

$24.00 Price Target, Buy-Long Term, Current Price: $20.03 (2/20/20)

Banco Latinoamericano, a multinational bank, primarily engages in the financing of foreign trade in Latin America and the Caribbean. The company operates through two segments, Commercial and Treasury.

Summary

The company has a near 8% dividend yield with strong free cash flow. BLX has increased its dividend an average 5.8% per year over the last ten years. Company is undervalued on P/E, P/B, and P/S valuation metrics as the regional banks sector is 9.4, 1.2, and 4.8, for those categories, respectively. Catalyst: Stock market continues expansion, trade ware disputes ease, and Latin American economies/trade recover.

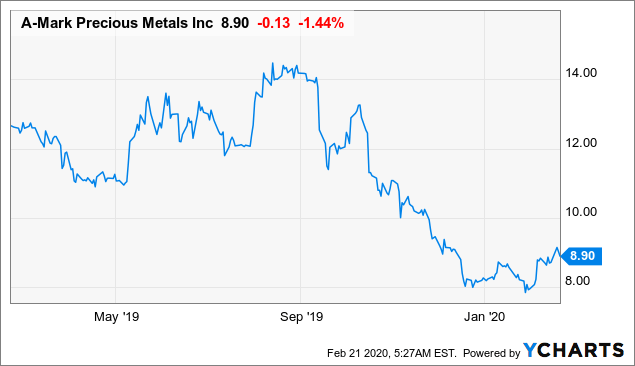

A-Mark Precious Metals, Inc. (AMRK)

Data by YCharts

9.75 Price Target, Buy Long-Term, Current Price: $8.98 (2/20/20)

A-Mark Precious Metals (AMRK) is a full-service precious metals trading company offering a wide array of products and services. Products include gold, silver, platinum, and palladium for storage and delivery in the form of coins, bars, wafers, and grain. Services include financing, leasing, consignment, hedging, and a variety of customized financial programs.

Summary

The company has a 13% discount to Book Value per Share. Management is transforming the company into one with more stable revenues and earnings. The last two quarters have both surprised to the upside as their plan appears to be working. Company is a play on turmoil in domestic and global economies and whether the Corona virus can successfully be contained. Catalyst: Global economies slow and the Corona virus’ toll on China is worse than predicted, thus increasing volatility in the stock market.

Disclosure: I am long HNNA, AMrk.

For a complimentary research report on any of these companies mentioned, please e-mail research@SingularResearch.com or call 818-222-6234. more