QNST: Auto Insurance Ramp Up Gaining Momentum, Increase Target Price To $20.00

Image Source: Pixabay

Company Description

QuinStreet Inc. (QNST) specializes in performance marketing products and technologies. The Company serves clients in high-value, high-consideration market verticals, including financial services, IT/technology, and home services.

Price (as of close May 13, 2024)

- $17.95

Rating

- Buy-Long-Term

12- Month Target Price

$20.00

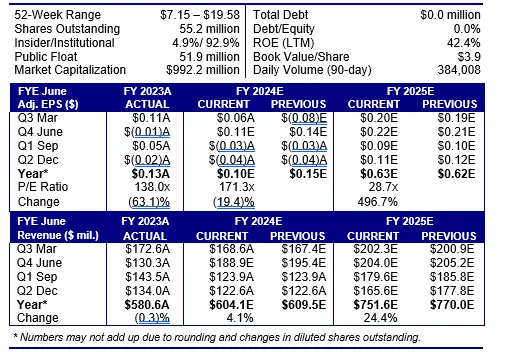

Q2:24 results were in line with our expectations. The inflection in auto insurance client spending has begun, with auto insurance revenue expected to see nearly a 100% jump in Q3:24. We increase our target price to $20.00 per share (earlier $18.25) and change our rating to Buy-Long-Term.

Q3:24 Highlights

- Q3:24 results were strong driven by the auto insurance vertical. Revenues came in at $168.6 million, slightly above our expectation of $167.4 million. Adjusted EPS was $0.06 below our expectation of $0.08.

- The financial services client vertical represented 67% of Q3:24 revenues and decreased 7% YOY to $112.2 million; the home services vertical represented 32% of revenues and grew 7% YOY to $53.9 million.

- Adjusted EBITDA in Q3:24 was $7.9 million, down compared to $8.9 million for Q3:23 on account of lower revenue. We expect adjusted EBITDA to ramp up in Q4:24 and FY:25 as revenue growth accelerates.

- Net income for the quarter was $3.4 million or $0.06 per share as compared to $6.1 million or $0.11 per share in the prior year.

- The positive inflection in auto insurance continued throughout Q3:24 and has extended into Q4:24 as well. This result should drive strong sequential revenue and adjusted EBITDA growth in Q4:24, which is expected to continue in FY:25 as well.

- QNST has guided for Q4:24 revenue growth of more than 40% YOY at the midpoint of the guidance. Adjusted EBITDA is anticipated to grow even faster.

- We increase our target price to $20.00, with an implied capital appreciation potential of ~11%. We change our rating to Buy-Long-Term.

Primary Risks

Client concentration remains a key risk. The departure or loss of a crucial client or the inability to renew a substantial contract could notably affect financial outcomes.

Investment Thesis

The ramp up in auto insurance spending is gaining traction and there are visible signs that the momentum will continue in the coming quarters. The non-insurance business continues to be strong, and management expects that it will grow handsomely for years to come. Based on the strength of the auto-insurance business, QNST has guided for strong growth in revenues and adjusted EBITDA for Q4:24. Management remains confident for the upcoming fiscal year i.e. fiscal 2025, suggesting a revenue growth in excess of 20% indicating that there is enough visibility for the business over the medium term. The Company has a long-term target of delivering EBITDA margins in excess of 10% (versus 4.7% in Q3:24).

We increase our price target to $20.00 per share (earlier $18.25) and change our rating to Buy-Long-Term.

Q3:24 Financial Performance

Q3:24 results were strong led by strength in auto insurance spending. Revenues came in at $168.6 million, slightly ahead of our expectations of $167.4 million, while adjusted EPS was $0.06 below our expectation of $0.08.

Auto Insurance spending ramp up gaining traction. QNST noted that the ramp up in auto insurance spending continued throughout Q3:24 and has extended into Q4:24 as well. The auto insurance vertical is in early-stages of positive inflection in client spending and the Company expects growth for many quarters ahead. Q3:24 results were led by the non-insurance client vertical which saw solid growth. Overall, QNST reported revenues of $168.6 million, down 2% YOY. In terms of the client verticals, the Financial Services client vertical represented 67% of Q3 revenue and was $112.2 million (down 7% YOY). The Home Services client vertical represented 32% of Q3 revenue and was $53.9 million (up 7% YOY). Other revenue was $2.4 million. Adjusted EBITDA came in at $7.9 million versus $8.9 million in Q3:23. Non-GAAP net income was $3.4 million versus $6.1 million for Q3:23 and diluted EPS was $0.06 versus $0.11 in Q3:23.

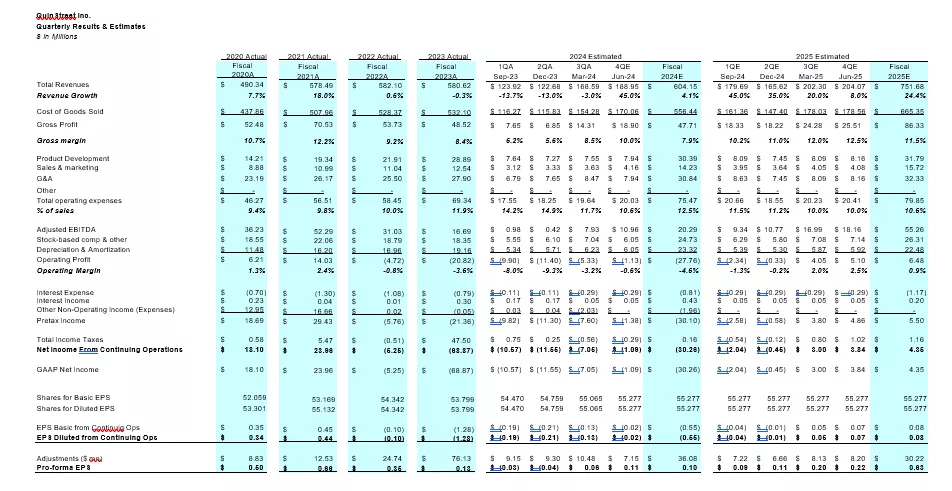

Strong growth projections for FY:25. The ramp up in auto insurance spending is expected to drive strong growth over the coming fiscal year. We anticipate that the increase in insurance spending will persist in the upcoming quarters as carriers broaden their product offerings and market presence, supported by higher rates and enhanced profitability. The fundamental shift of budgets towards digital and performance marketing research emerges as a long-term driver for increasing spending by auto insurance carriers. The higher spending is expected to drive strong sequential revenue and adjusted EBITDA growth in Q4:24, which is expected to continue in FY:25 as well.

For Q4:24, the Company expects revenues in the range of $180 to 190 million, a new quarterly record for the Company and implying a YOY growth of more than 40% at the mid-point. Adjusted EBITDA is expected to be between $10 to $11 million, implying a YOY growth of more than 400%. The annual run rate of Q4:24 revenue indicates a full year fiscal 2025 revenue to be between $720-$760 million, implying a YOY growth between 21%-26%. We find management's confidence in attaining double-digit revenue growth early in the next fiscal year (FY:25) reassuring, indicating substantial business visibility over the medium term. Furthermore, the Company anticipates the insurance business surpassing previous peak levels in the long term, with adjusted EBITDA expected to outpace revenue growth and achieve margins exceeding 10%.

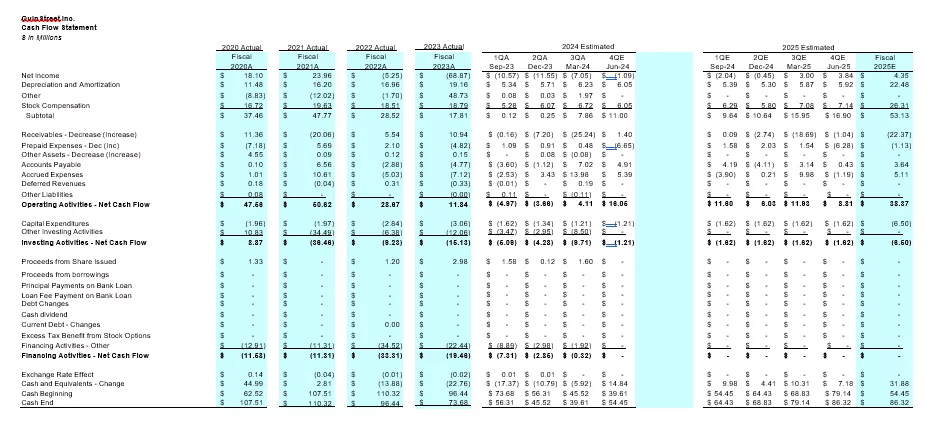

Liquidity. The Company has ample liquidity with cash & cash equivalents at $39.6 million as of the end of Q3:24. We expect the Company to generate operating cash flow of $11.5 million in FY:24, which should further strengthen its ability to repurchase shares. During the first nine months of FY:24, QNST repurchased 247,618 shares for a total price of $2.2 million. Nearly $16.8 million is still available for stock repurchases which should further provide support to the stock price.

Valuation

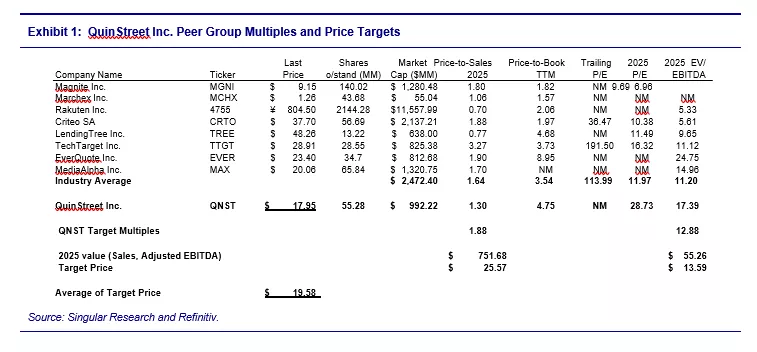

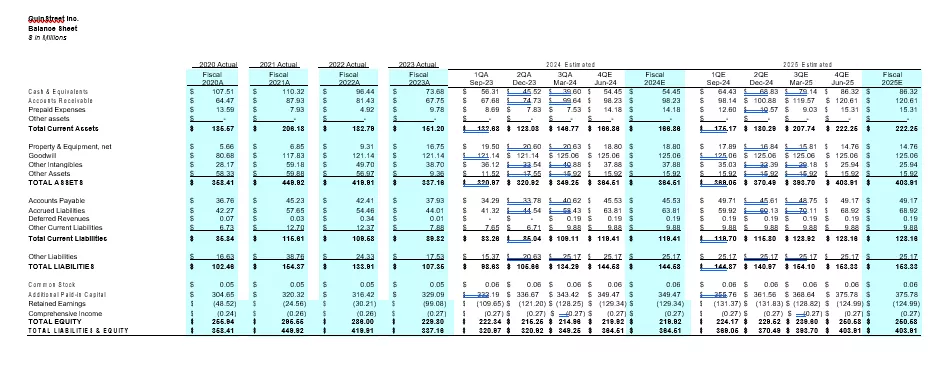

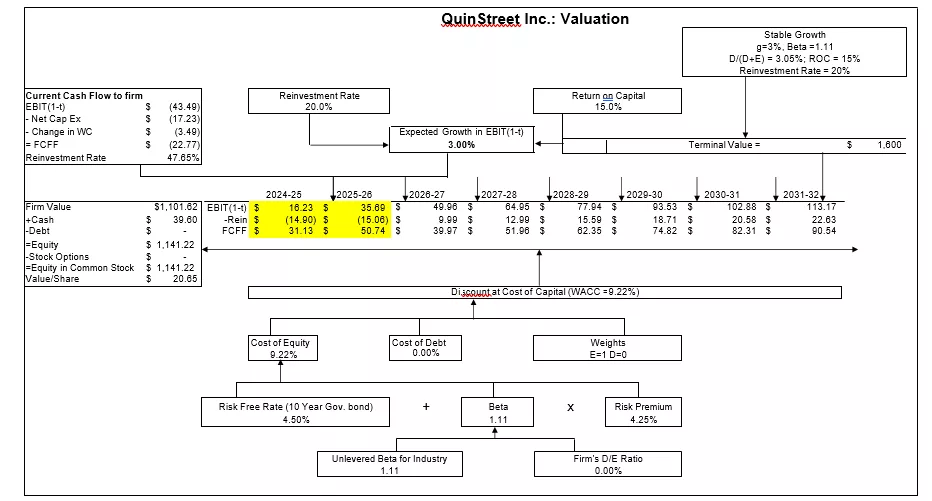

We value QNST using a combination of multiples based on industry peer companies (P/S and EV/EBITDA multiples), blended with our Discounted Cash Flow (DCF) valuation to derive a fair value target price for the Company.

We are valuing QNST using P/S and EV/EBITDA multiples. We value QNST at a 15% premium to the peer group average given the expectation of strong growth and profitability over the medium term. We apply these multiples to our 2025 forecast and then average the two price targets. The average of these two multiple based targets is $19.58. We apply 50% weight to this multiple based target.

We weight the other 50% of our target using our Discounted Cash Flow target. Our DCF model uses our forecasted free cash flow to the firm over the next two years and then grows EBIT at a 40% rate over year three, 30% over year four, 20% over years five and six, 10% over years seven and eight, and at a 3% rate thereafter. We apply a weighted average cost of capital of 9.22%. Thus, our DCF produces a value of $20.65.

The combination of $19.58 at 50% and $20.65 at 50% results in a weighted average price target of $20.11, which we round down to $20.00. The exhibit below summarizes our peer group multiples while the DCF is included at the end of this report.

Technical Analysis

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

Rating Definitions

BUY, 30% or greater increase in the next 12 months.

BUY-Long-Term, near-term EPS horizon is challenging, attractive long-term appreciation potential.

BUY-Venture, initial stages with little to no revenue and the potential for outsized returns with higher amounts of risk.

HOLD, perform in line with the market.

SELL, 30% or more declines in the next 12 months.

More By This Author:

Three Undervalued Micro-Caps With An Emerging Catalyst

Why GOOG Is A $1900 Stock

Twitter Has More Downside Ahead

Disclosure: This report has been prepared by Singular Research, a wholly owned subsidiary of Millennium which is an investment advisor registered in the State of California. Singular Research ...

more

Nice stock pick on $QNST. what other stocks do you recommend?