A Shot Of Liquidity

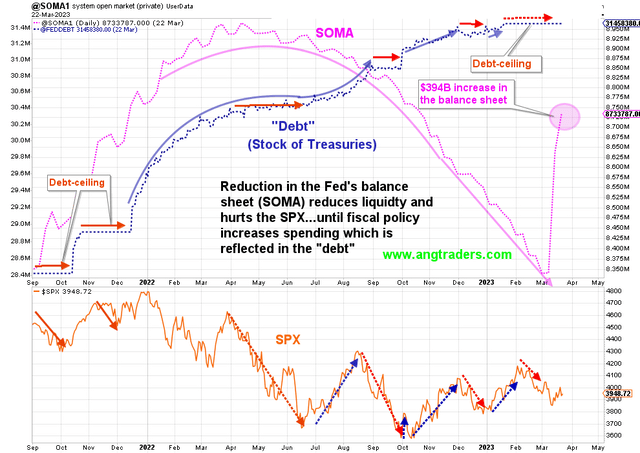

No matter what the semantic arguments are (QE, not QE, reverse QT...), the hard reality is that $400B of encumbered assets were added to the Fed's books at par, and an equal amount of unencumbered money (liquidity) was released into the economy. This was not money-printing. This was not a gift. This was a swap of assets (like QE): paper assets for liquid assets. No argument that I have heard can deny that reality. Call it what you like, but it is a huge asset swap that releases these funds into the economy.

(Click on image to enlarge)

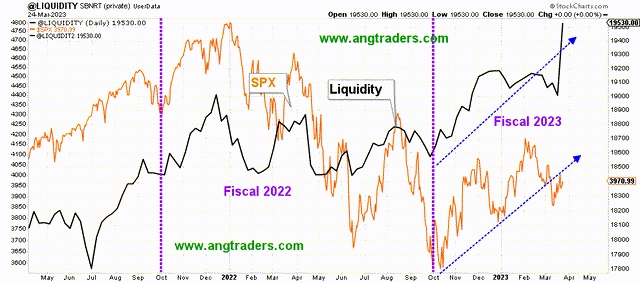

Our liquidity model captured the Fed's 'at-par' collateral-lending.

(Click on image to enlarge)

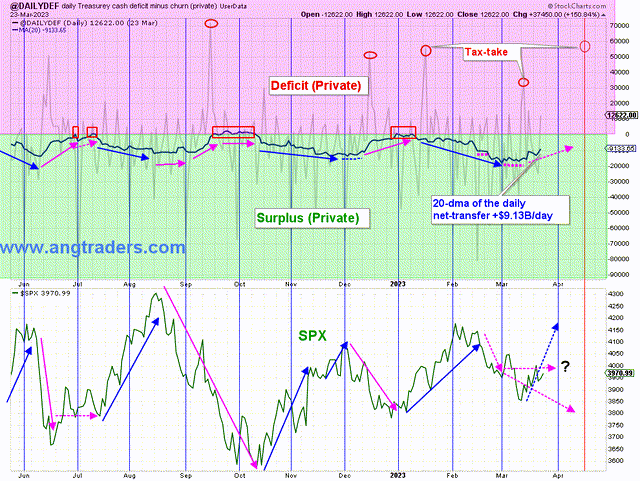

In addition to the Fed's liquidity-releasing swap, the Treasury's spending net-transferred +$75B to the private sector last week. The 20-day average transfer rate is +$9B/day.

(Click on image to enlarge)

Even with all the doom and gloom, the market is staying afloat…becasue it is all-about-the fund-flows!

More By This Author:

Liquidity Breakout And The Resart Of QE

Private Debt And Recession In 2023

Buy The Bad Profit News