Buy The Bad Profit News

Corporate tax collection is a proxy for corporate profits, and in the first 15-days of October 2021, there was $15.4B collected, while in the first 15-days of October this year, only $12.7B, which is 18% lower.

Because the fiscal impulse has been greatly reduced--$3T down to $1T--, it is obvious we will see lower corporate profits.

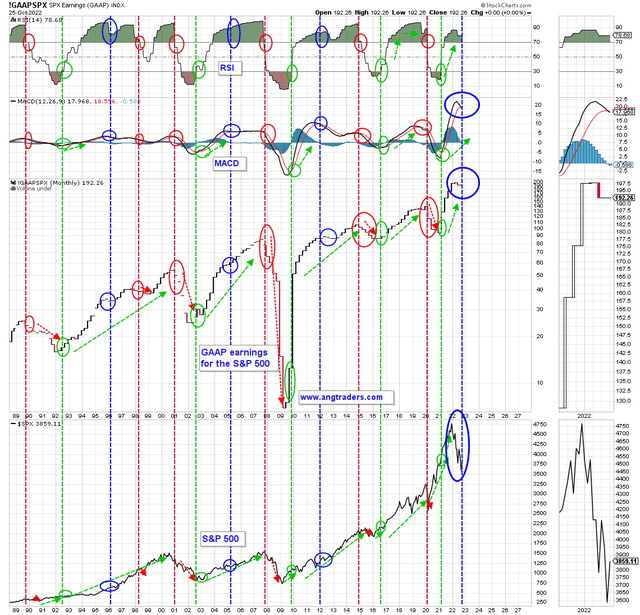

The MACD of the GAAP study has crossed over, but the RSI is still hanging above 70. Until the RSI drops below the 70 mark, the model says this is not a pivot into a true bear market like 2000 and 2008 (red verticals).

It is interesting that the SPX has gone down ahead of the GAAP weakening. An argument can be made that we are in a "buy the bad news" opportunity.

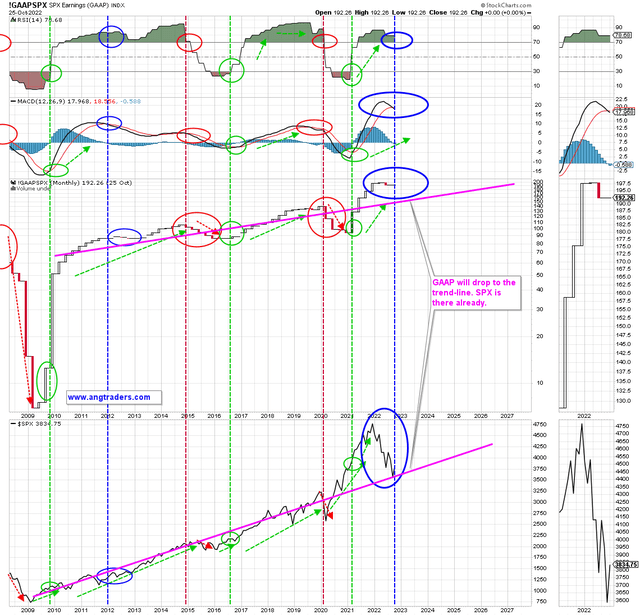

The SPX price has already returned to the pre-pandemic level, so now the GAAP will do the same. If the +$1T net-transfer rate is maintained, I say a true bear market cannot develop. [However, if the SPX remains below the Raff mid-line and 40-month MA, then we will raise cash accordingly.]

Here is a closer look that shows the trend lines; GAAP should drop to meet it, while SPX price is there already.

We suggest buying the bad news during this earnings season.

More By This Author:

A Checkup On The Screws Holding The Economy Together

Corporate Taxes Predict Corporate Earnings

Obsess Over The Fiscal, Not The Monetary