A Checkup On The Screws Holding The Economy Together

Fear of impending recession, coming out of the Fed's announced tightening cycle, has driven the herd out of the stock market. We take a look at the state of the US economy by checking on the tightness of the "screws" that hold the economy together in order to assess the risk of recession.

The Screws Holding the Economy Together

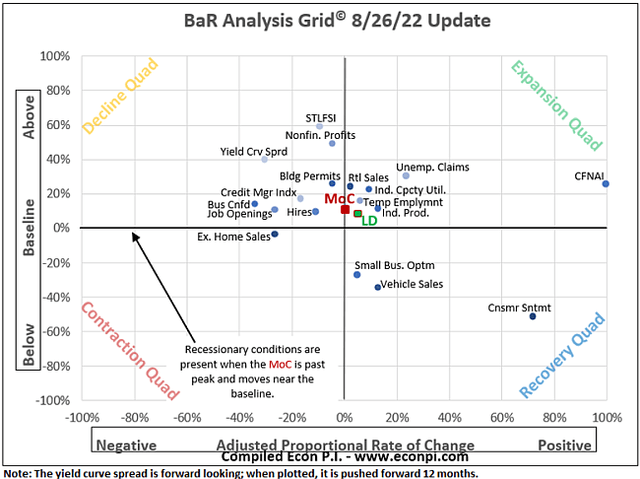

The first chart below is the BaR grid (from econpi.com) for July 30, 2022, and the second chart is the most recent chart dated August 27, 2022.

BaR (econpi)

econpi

Notice that both the LD (leading indicators) and MoC (mean of coordinates) have moved back into the expansion quadrant during the latest week. This means that the average economic measures are, once again, starting to show economic growth. This screw is no longer loose, and progressively getting tighter.

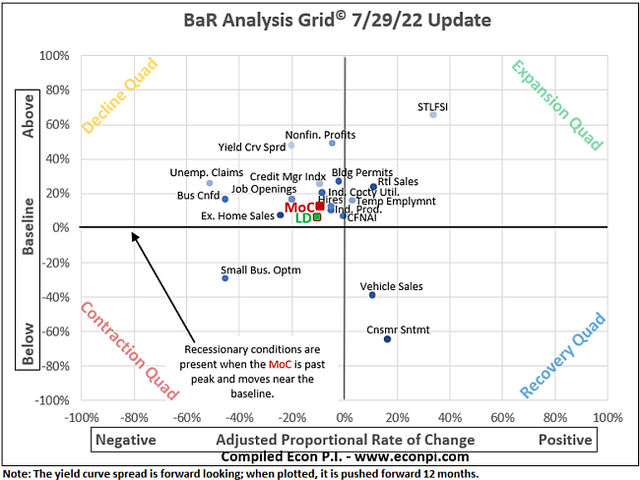

The GDPNow estimate of Q3 is oscillating around the 2% mark. This screw is 'tight enough' (chart below).

GDPNow (FRED)

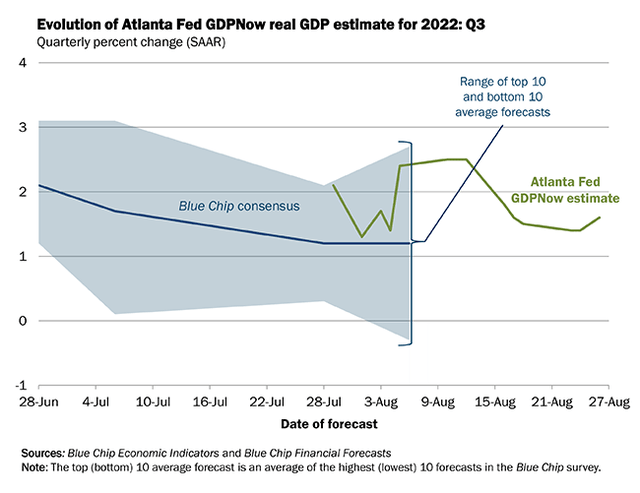

Core PCE (personal consumption expense), which is the Fed's preferred gauge of inflation, continues to move lower; it is at 4.6% YoY which is the lowest reading since October 2021. Inflation is a supply issue, and a slowing PCE indicates that supply is starting to come back. This screw is in the tightening process (chart below).

Core PCE (tradingeconomics.com)

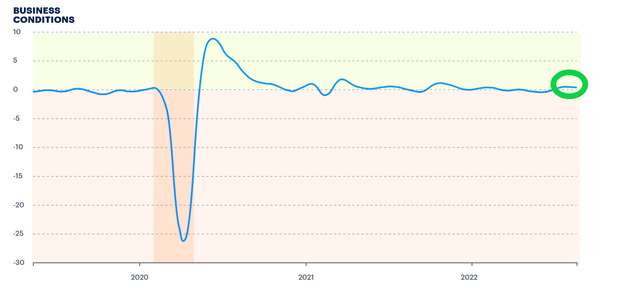

The Aruoba-Diebold-Scotti business conditions index is designed to track real business conditions at high frequency. The average value of the ADS index is zero. Bigger positive values indicate progressively better-than-average conditions, and bigger negative values indicate progressively worse than average conditions. The index shows that business conditions are above average, which makes it a tight economic screw (chart below).

Business Conditions (philadelphiafed.org)

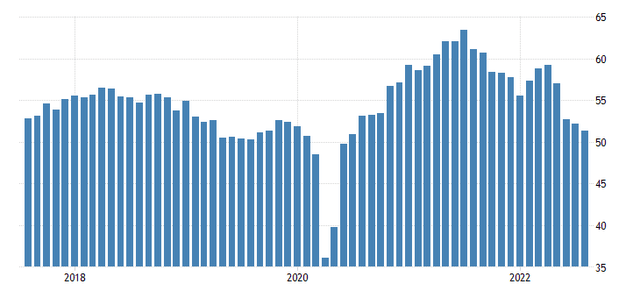

US Manufacturing PMI has fallen four months in a row amid muted demand conditions and production cutbacks. However,..." manufacturers registered the slowest rise in cost burdens since January 2021, and signs of improvements in supply chain disruption emerged. Meanwhile, manufacturers recorded a greater degree of optimism regarding the outlook for output over the next year on hopes of stable supply chains and increased customer demand". This screw is loose (chart below).

Manufacturing PMI (tradingeconomics.com)

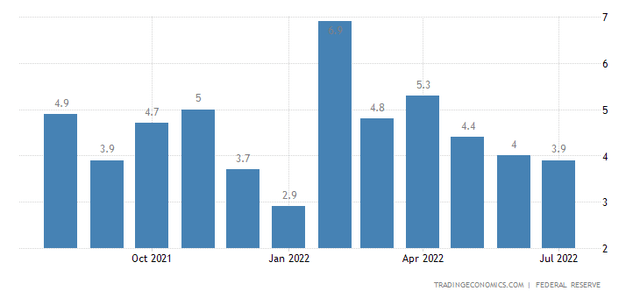

Industrial production in the United States increased 3.9% y-o-y in July of 2022, the smallest annual gain since January. Although the rate of increase is lower, industrial production continues to increase. This screw remains tight enough (chart below).

Industrial Production (tradingeconomics.com)

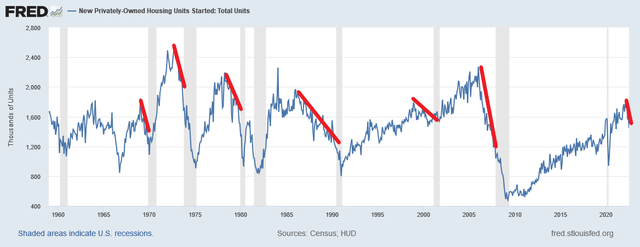

Recessions are always preceded by at least one year of falling housing starts. Housing starts have fallen in recent months, but a full year of declines is required to regard this screw as loose (chart below).

(Click on image to enlarge)

Housing Starts (FRED)

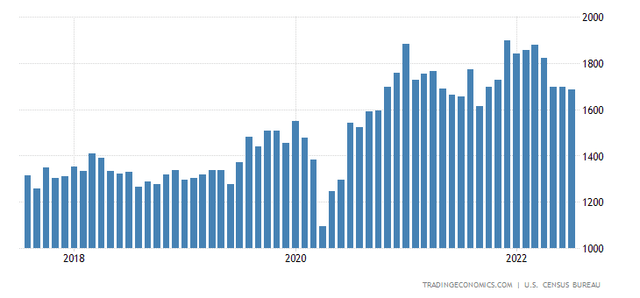

Building permits have stabilized after declining from historically high levels, but remain well above pre-pandemic levels. This screw continues to be tighter than average (chart below).

Building Permits (tradingeconomics.com)

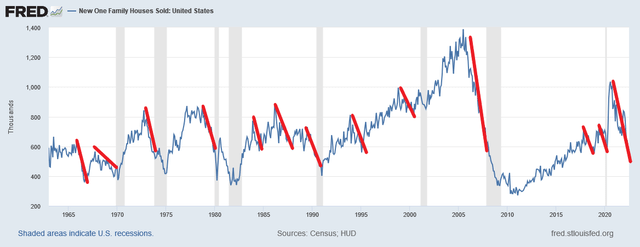

New home sales have had a steep decline in the last year. This screw is completely loose and home sales tend to drop ahead of recessions. However, lower home sales alone are not sufficient to cause a recession--home sales have dropped many times in the past without recessions developing. This screw is loosening (chart below).

(Click on image to enlarge)

Houses for Sale (FRED)

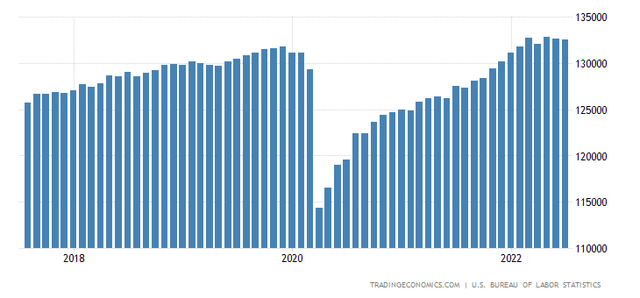

Private non-farm employment remains above pre-COVID levels, but off slightly from historic highs. The employment screw is still tight (chart below).

Employment (tradingeconomics.com)

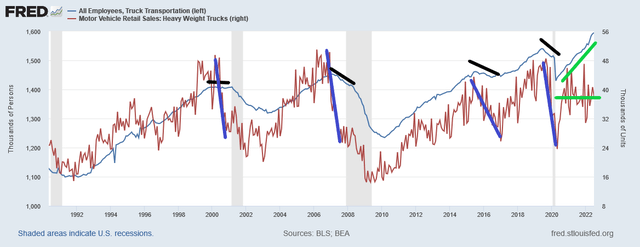

Truck transport employment stops growing or declines and heavy truck sales collapse for more than a year ahead of recessions. Truck employment is growing and truck sales are stable. This is a tight economic screw (chart below).

(Click on image to enlarge)

Truck Sales and Employment (FRED)

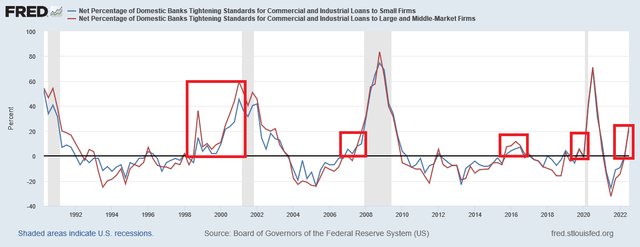

Credit conditions have been tightened by banks over the last 6-months. However, tightening occurs for a minimum of one year ahead of recessions. This screw has started to loosen, but is still tight enough (chart below).

(Click on image to enlarge)

Bank Standards Tightening (FRED)

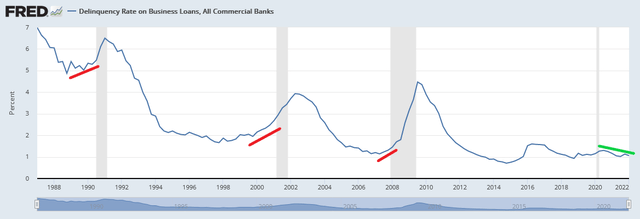

Business loan delinquencies rise for at least one year ahead of recessions. Delinquencies are near historic lows and are decreasing. This screw is tight (chart below).

(Click on image to enlarge)

Loan Delinquencies (FRED)

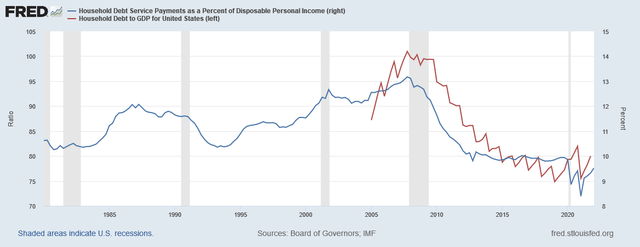

Household debt, both as a percent of GDP and a percent of disposable income, is at historically low levels. This is not what happens ahead of recessions. This economic screw has never been tighter (chart below)

(Click on image to enlarge)

Household Debt (FRED)

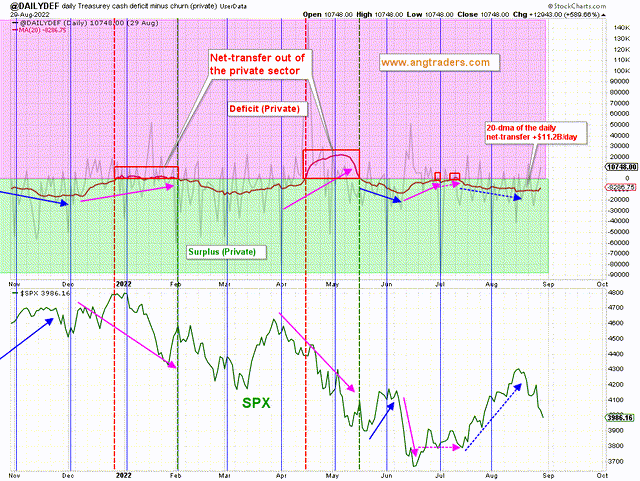

The fiscal response to COVID produced a post-WWII record deficit (private-sector surplus) which prevented a depression. The net transfer to the private sector returned to pre-COVID levels in Q4 2021 and Q1 2022, but in April and June the tax collection drained ~$400B and ~$125B, respectively, from the private sector which caused the stock market to extend its "tightening tantrum". In July and August, however, the Treasury has net-transferred ~$600B into private-sector bank accounts--this has supported the economy and the stock market, and as long as the Treasury maintains the positive net transfers (budget surpluses), a recession and a bear market can be prevented (chart below).

(Click on image to enlarge)

Net-Transfer and Deficit (ANG Traders, stickcharts.com)

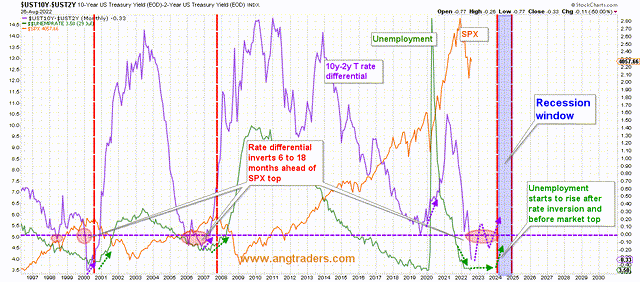

The 10y-2y inversion and the unemployment data still do not suggest a nearby recession. The 10y-2y inverted at least twice and the unemployment rate started to increase 6-18 months ahead of both the 2000 and 2008 bear markets; we are not there yet. This screw is still tight and should remain tight for at least another 6-months (chart below).

(Click on image to enlarge)

Rate inversion and Unemployment (ANG Traders, stockcharts.com)

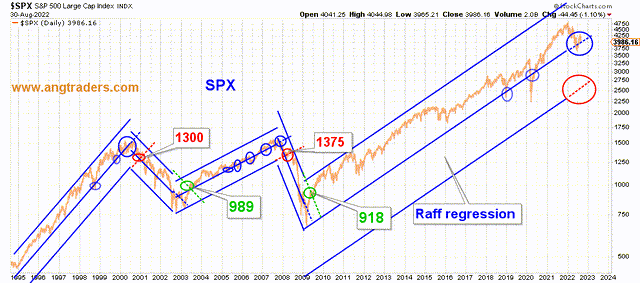

Although the market has had a hard correction, the key levels (blue and red ovals below), which indicate a change to the primary bull trend, have not been breached (chart below).

(Click on image to enlarge)

Primary Trend (ANG Traders, stockcharts.com)

Despite the slowing growth rate of the economy, the majority of the important "economic screws" remain tight enough to prevent a recession and to keep the stock market from falling into a bear market over the next six months.

More By This Author:

Corporate Taxes Predict Corporate Earnings

Obsess Over The Fiscal, Not The Monetary

Crimea In 2014 Can Inform Us About Ukraine In 2022

Some really great information here.