Obsess Over The Fiscal, Not The Monetary

The market and the economy are “all about the money”; they are both fundamentally tied to the flow of funds — even though there are lag times of variable length. That is why we pay more attention to fiscal policy than we do to monetary policy. Monetary policy does not “print” money like the sovereign currency-creator does.

Monetary policy affects the private banks’ chartered ability to create “temporary” credit money, i.e. loans. All private bank loans create deposits out of thin air-limited only by the availability of credit-worthy borrowers and the SLR requirements — and, at the same time, a liability which must be cancelled (the loan must be paid back).

Fiscal policy, on the other hand, creates deposits in private bank accounts by spending according to Congressional spending laws. These new dollars, unlike bank credit, do not have to be cancelled by taxation. This makes fiscal deficit-spending a more “permanent” form of money than bank credit. Loans must be paid back (cancelled), if not by the borrower, then by the bank’s own capital (loan-loss provisions), while money created by government spending can be left in the economy simply by not taxing it back.

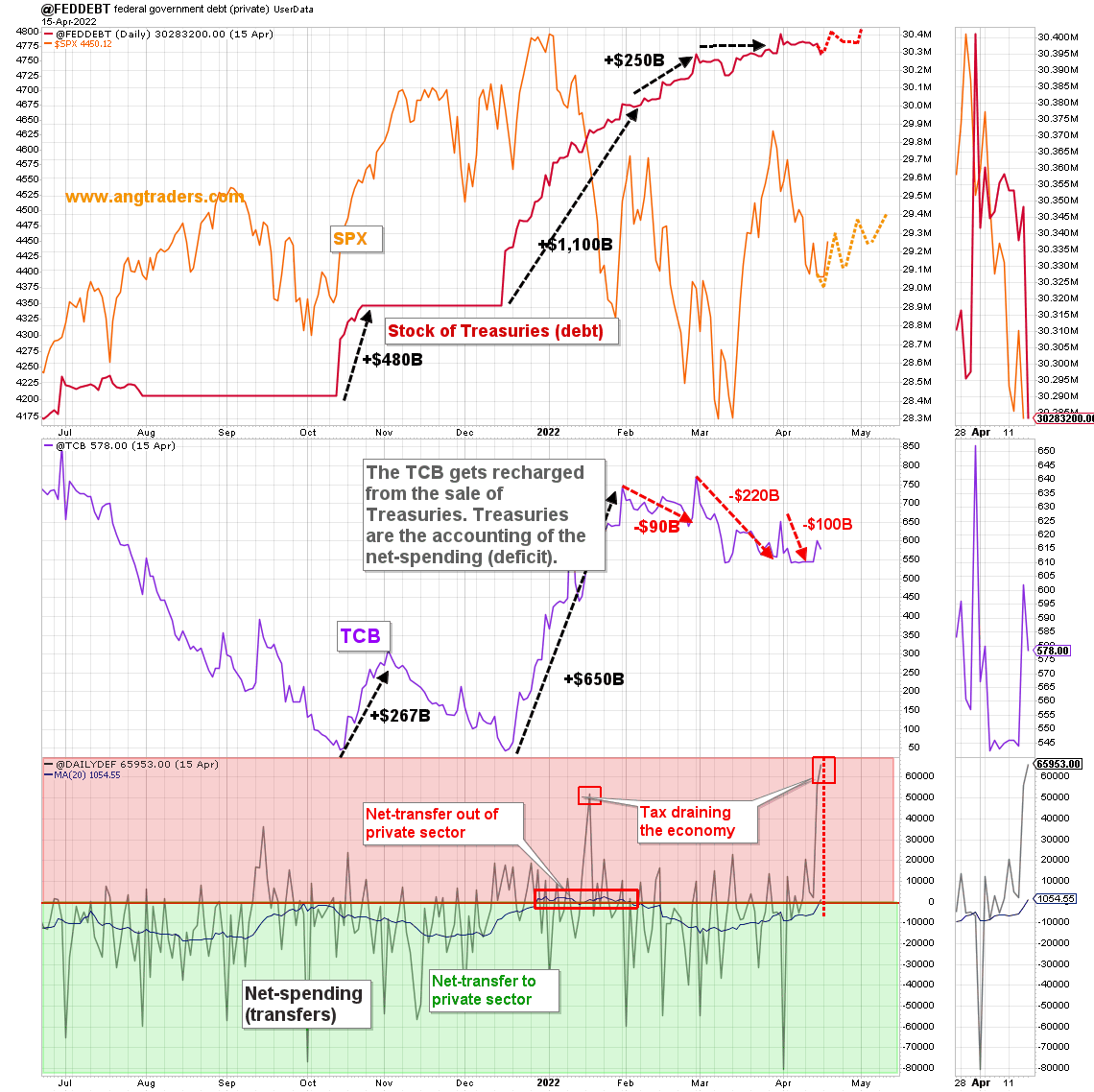

What is erroneously called national “debt”, is not debt — at least not like household debt which must always be paid back. The national “debt” is the accounting of the dollars that were spent into existence but not taxed back and cancelled. It is the net-surplus enjoyed by the non-government sector. Treasuries are a vestigial leftover from the gold-standard when the government tried to avoid currency-devaluation during periods of deficit-spending. Creating dollars without increasing the amount of gold in the vaults, would make each dollar be worth less relative to gold; by matching deficit spending to the creation of Treasury-bonds makes it look like no new money have been created. Since 1971, the monetary system has been decoupled from gold, but the matching of deficits to T-bond creation remains in place, making them a form of interest-bearing dollars that serve as UBI (risk-free interest payments) for those (mostly banks) who have lots of dollars, and serve as a vehicle for the Fed to control interest rates and to encourage the demand for holding dollars.

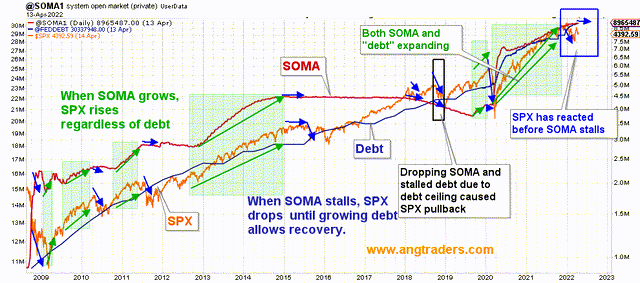

The Federal Reserve is simply a bank. It makes loans to the private banks, and can adjust the type of assets the banks hold. QE is an asset swap that increases the SOMA (system open market account) balance sheet; liquid dollars in exchange for loan assets of various types (Treasuries, MBS, and commercial loans). It is not money creation like fiscal policy is. QT is the reverse; loan assets are swapped back to the private banks (primary dealers) in exchange for liquid dollars which are cancelled by the Fed, just like all loan liabilities are when a loan is paid back .

The Fed has been broadcasting its intention to reduce its balance sheet (stock of T-bonds and MBS) for months now, but it has not yet started to actually reduce it. The market, however, has already reacted as if the balance sheet was shrinking and rates had been raised 6–7 times. So far, the Fed has been reducing the rate at which it is increasing its balance sheet (SOMA), but is not scheduled to stop growing it until May.

Historically, the market reacts negatively once SOMA stops growing and until the National “debt” (deficit spending) increases. Since the market has already reacted, even before SOMA has stopped growing, it is possible that the market rallies once SOMA actually stops growing. The FOMC meeting is scheduled for May 3–4.

When the SOMA is growing, the SPX rises. When the SOMA stalls, the SPX drops until growing “debt” allows recovery. In the last few months, the SPX has dropped in anticipation of the SOMA stalling. It is possible that, since the market has already priced in disaster, it will be relieved by the 50 bps rate hike and SOMA reduction that Fed will announce at the May 3–4 meeting and start a relief-rally. However, since the fractal trading-range is still not one-year old (the average length of these things) the market is unlikely to break out to new highs until Q4…perhaps after the election (chart below).

Deficit spending (net-transfer to the private sector) has been decreasing since the start of March. The 20-day average of the daily net transfer is now negative, which means money is being transferred out of the economy. This has to change before the stock market can break out of its trading-range and start making new highs.

As a stock market participant, you should be obsessing about fiscal policy more than monetary policy.