Crimea In 2014 Can Inform Us About Ukraine In 2022

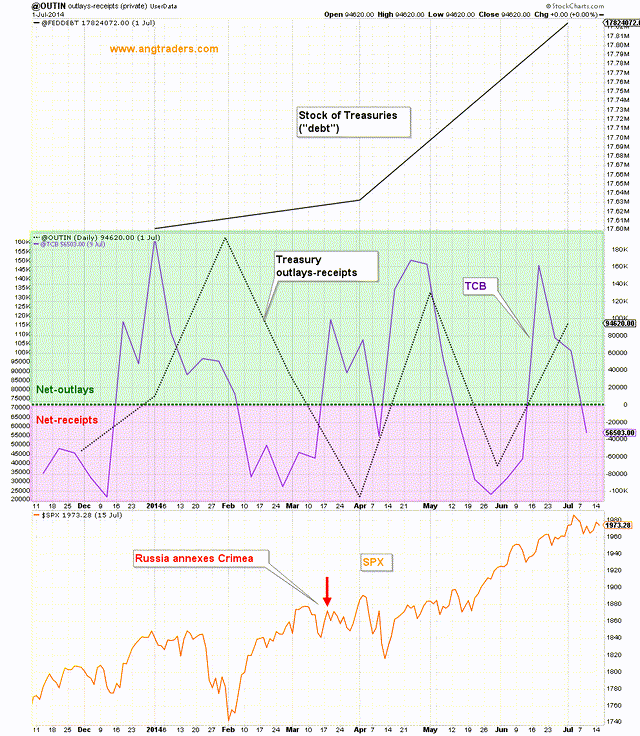

The following two charts show the Treasury net of outlays - receipts, the Treasury account balance (TCB), and the SPX. The first chart is from 2014 when Russia annexed Crimea. The SPX went sideways for a couple of months, but did not collapse. In fact, the SPX went on to rally.

2014

(Click on image to enlarge)

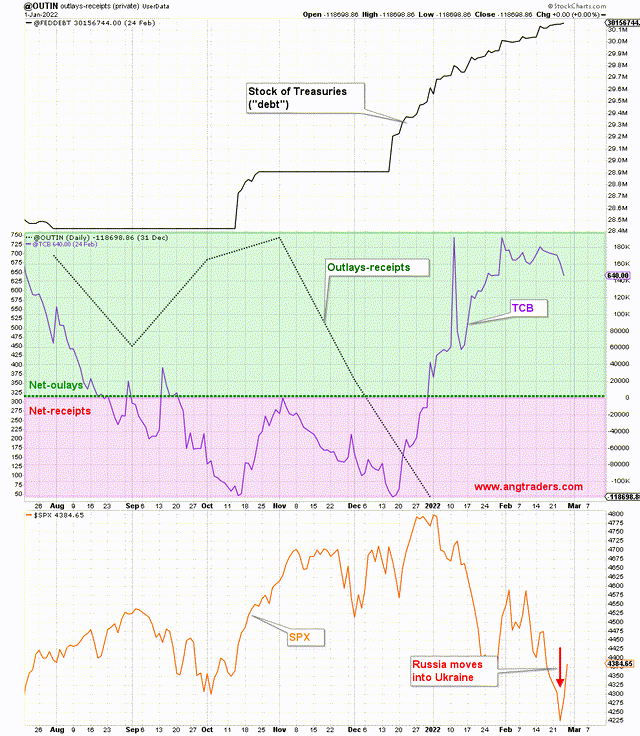

Like in 2014, the current picture shows the net-flows have been negative (net-receipts into the Treasury) and the "debt" is growing as Russia invades. The fact that net-transfers have been positive since the start of February (chart below only shows quarterly net-transfers, but we track the daily numbers), makes us confident that the market won't collapse and instead rally after a period of sideways pricing...like in 2014.

2022

Perversely, war is good for stocks. Especially when it is someone else's war and it is someone else's destruction.