Private Debt And Recession In 2023

Image Source: Pixabay

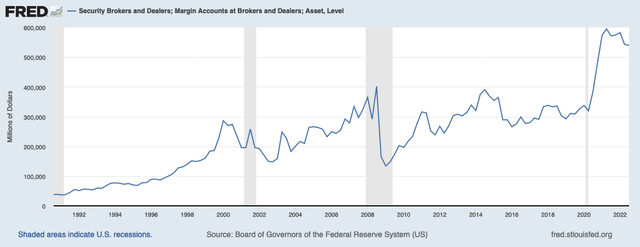

The "herd" continues to bleat about how high debt levels will cause a recession in 2023. We disagree. Margin debt and consumer debt are regularly referenced in this bleating. When we look at the "stock" of margin debt in isolation, we see a scary mountain of debt.

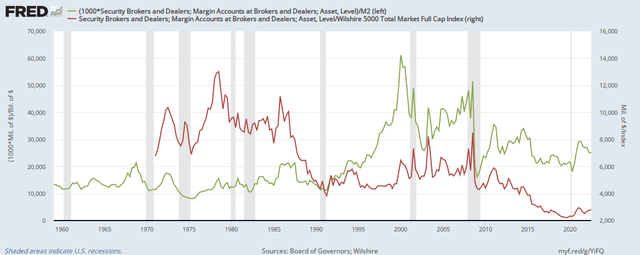

However, it is meaningless to assess debt separate from assets--no banker would look at the size of your mortgage without taking the value of your property into account. When we look at the ratio of margin:M2 (green line below) and margin:Wilshire5000 stock index (red line below), we get a more realistic perspective; margin debt is close to historic lows.

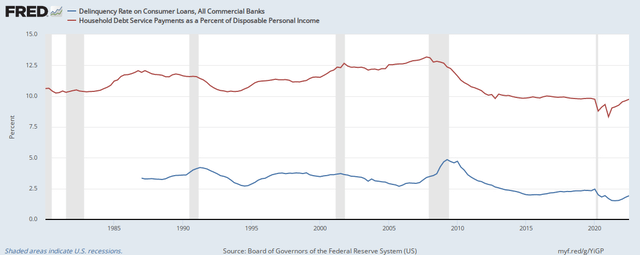

And when we look at the broader consumer debt, we get a similar situation: delinquencies for consumer debt (red line below) and household debt burden as a percent of disposable income (blue line below) are at near-historic lows.

At this point, private debt is not threatening to cause a recession in 2023.

More By This Author:

Buy The Bad Profit News

A Checkup On The Screws Holding The Economy Together

Corporate Taxes Predict Corporate Earnings