7 Reasons Why SurgePays Is Going To Surge

Image Source: SugrePays.com

We give you seven reasons why SurgePays stock (SURG) is an excellent bet for 2023:

- The company’s mobile broadband business grew from 30K subscribers to 220K in October and growth is set to accelerate.

- Non-dilutive financing against government receivables is removing the bottleneck for growth, the number of tablets the company can pre-finance.

- The company can now sell mobile broadband subscriptions in their network of 8K community shops, serving the underbanked by connecting the Shockwave software to the POS software that runs in these shops. This enables the company to continue to bring in new subscribers during the winter months.

- Together, the financing and ability to sell through their partner shops are likely to greatly boost the number of new mobile broadband subscribers in 2023 to 70K+ a month and higher, there are no constraints anymore.

- The company is leveraging its mobile broadband business and Master Service Agreement with GPO Plus to expand its network of community shops, giving the company a unique and difficult-to-replicate position to service the underbanked and underserved, some 48M US households. This is setting in motion a virtuous cycle where they use mobile broadband business to entice more shops to join and more shops will expand the number of mobile broadband subscribers.

- The company is improving the unit economics of its mobile broadband business, increasing margins, scale, network cost, and tablets, as well as reducing CAC through shops.

- Based on the above, we think their mobile broadband subscribers can hit 500K by mid-2023 and the company will start generating significant amounts of cash in H2/23 and could end the year with an EPS of $2, which isn’t at all reflected in the share price.

Let us get some meat on these items, first, a quick introduction:

SurgePays (SURG) is a fintech company that serves the underbanked via a network of 8K+ community shops and bodegas, offering third-party products like prepaid and top-ups.

While the company has a pretty unique position with its software in that network of shops, the third-party products and services it sells are only generating gross margins in the range of 4-6%.

But late last year, as we described in our earlier article on TalkMarkets, the company took advantage of the ACP (Affordable Connectivity Plan) for its mobile broadband business. The company serves as an MVNO (mobile virtual network operator) using AT&T and T-Mobile's wireless backbones, paying them $15/M per subscriber, on average.

The ACP offers $30/M and a one-time $100 per tablet for offering broadband services to qualified households (of which there are some 48M in the US). Since only some 15.3M (per December 19) of these have applied there is still plenty of the market to go after.

And that’s what the company has done, it went from 30K subscribers at the start of the year to 220K in early October, already over their 200K year-end target.

220K at $30/M that’s a run rate of almost $80M/Y at 50% gross margin and $15M OpEx amounts to $25M in net profit, but:

- The company faces one-time CAC (customer acquisition cost) of $45, minus a one-time $10 profit on the tablets, that’s $35/M upfront cost, although stay tuned, because all of these figures are going to improve (see below).

- Then there is their FinTech business, although that’s much less profitable.

- These are run rates, not FY22 figures.

- There is some attrition, in the order of 8%.

As we will explain below, 220K is just the start, management is thinking in millions, but nevertheless this would still produce well over $1 in EPS once the one-off CAC runs off (although they never do, as they are supplanted by new CAC for new subscribers and there is a 30-60 day turn between sign-up and getting paid).

Financing

The company is going to seriously accelerate its subscriber growth through:

- A $25M non-dilutive financing with ACP receivables as collateral from Affordable Connectivity Financing V LLC ("ACF V") - a wholly-owned subsidiary of Horizon Capital LLC and affiliate of ACP Finance.

- They connected their CRM program Shockwave to the software running in the network of 8K community stores, enabling these stores to sell the mobile broadband subscription in a simple manner.

The $25M receivables financing removes a huge bottleneck for growth as the company has to pre-finance the tablets out of cash flow, which puts a constraint on growth.

The financing produces two immediate benefits:

- The company can now buy double, triple, quadruple the number of tablets, removing the constraint of growing subscribers.

- Given a much larger order size it can also benefit from considerably lower prices for the tablets which could fall to $75.

But these benefits will be compounded by the following:

Selling mobile broadband in their partner stores

The company has a network of some 8K partner community stores that use their software to sell third-party services. They have now connected the CRM program, Shockwave, they use for signing up customers for their mobile broadband business to the POS software they run in these partner stores.

That is, they can now sign up customers in their partner stores. Since these are community stores geared toward underbanked people with some 75% of visitors on SNAP (which automatically qualifies them for ACP) and these stores are highly trusted, the picking is quite rich here.

This move is compounding the advantages of the financing:

- Signing up customers in the stores is cheaper (roughly $20, like signing up customers over the internet, which they’re also doing) compared to the outdoor tent drives, so their average CAC will fall from $45 to an average of $35 per subscriber.

- It’s a no-brainer and attractive sell for store operators (no up-front costs for them and earning a commission in a minute on any new broadband subscriber, as well as the other products that are sold through SurgePays’s FinTech platform). So they will attract more stores to join their (8K strong) network. In fact, they appointed Jeremy Gies as President of SurgePays Fintech to grow their network of stores and increase margins.

- Since no competitor has a similar network of stores SurgePays gains a competitive advantage, especially during the winter when outdoor tent selling drives become much less viable in much of the US.

Say they sign up, on average, 2 new mobile broadband customers a week per store. That doesn’t seem much of a stretch, but it does add up rapidly, that 64K new subscribers per month.

Master Services Agreement with GPO Plus

Apart from hiring a manager whose sole task is to increase the number of community shops and bodegas on their network, they’re also entered into a Master Services Agreement with GPOPlus:

to bring more stores onto the SurgePays Network, utilizing the SurgePays POS System. In addition, GPOX will sell SurgePays products to its retailers, including the Surge Wireless ACP Broadband program. GPOX will also place their proprietary products onto the SurgePays Platform reaching over 8,000 retail partners.

So apart from expanding the stores on SurgePays network (GPO Plus has a 40+ salesforce), this immediately increases the reach to potential ACP subscribers. Now think of 15K of these shops (which happens to be their target), that’s 120K new subscribers per month (at a very modest two new subscribers a week), minus the attrition.

The combined effect of the financing, the coupling of Shockwave to their store network POS system and the Master Services Agreement with GPO Plus will be a sharp acceleration in new subscribers for their ACP mobile broadband business.

We believe that from January onwards, this can move to 70K a month and increasing throughout the year, there are no real constraints anymore.

But that’s not all, their partner network of community shops and bodegas will expand and at the same time become more valuable, according to Brett J. Pojunis, CEO of GPO Plus (GPOX):

The Surge Marketplace is fantastic as it simplifies how retailers make their purchases, provides unique financial products like their cellular top-up and ACP Broadband programs, which not only create additional revenue streams for GPOX, but also alleviate pains for consumers. While we continue to explore additional ways we can monetize each other's network, we increase our buying power that will save our customers money and pass those savings to the consumers who desperately need it today!

More products, cheaper prices, and greater reach will make it more attractive for community shops and bodegas to join the network, this is setting in motion a virtuous cycle and uniquely positions SurgePays to serve the underbanked and underserved, a market position that can be leveraged in many ways and which no competitor can easily reproduce.

They can leverage that position once the cash flow from their mobile broadband business starts coming in (H2/23) in order to offer additional products and services.

For instance, management has suggested partnering with a telehealth company, from the Q3CC:

Again, I do not want to offer Telehealth, but partnering with companies who do, putting those apps on our tablets, their devices or phones. And all of those folks who cannot use Telehealth because you need a credit card, but we could package it with top text data and now facetime your doctor is a plan that could go pay cash at the convenience store. That's something I definitely want to do and roll out.

This sounds pretty interesting and we’re sure they have other ideas as well, like once they got 500K subscribers (these are households) to their mobile broadband business they can start selling other family members pre-paid cards, for instance, leveraging the trust they have acquired with their mobile broadband business (and/or their partner community shop).

Unit Economics

So far, the rough economics of their mobile broadband business are:

- $30/M revenue

- $15/M COGS (the MVNO cost at T-Mobile and AT&T networks)

- One-off CAC of $45 per subscriber

- One-off $10 margin on tablets

But apart from the $30/M revenues (which come from the ACP), all three of these metrics are going to change in favor of the company, improving the economics, which will be more like:

- $30/M revenue (unchanged)

- $14/M COGS (from the second month onwards through throttling high data users)

- CAC of $35 per subscriber

- One-off $25 margin on tablets.

The gross margin will rise a few points but more importantly, the one-off CAC minus the one-off margin on tablets will now be just roughly $10.

In the old model:

- Buy a tablet to be delivered in two weeks or less for about $90, pay $45 for CAC with street teams and about $15 COGS first month, $14 thereafter.

- So old model cost = Tablet $90 + CAC $45+ COGS $15= $150 and bill the ACP $130 in first month ($100 for the tablet and $30 for the service).

- That’s a net $20 CAC per new subscriber.

In the new model:

- Cost of tablets $75 + Blended CAC $35 (mix of street teams, online and instore) + $15 COGS = $125. Bill $130.

Rather than losing $20 on signing up subscribers in the first month, the company now even make money ($5) on new subscribers in the first month!

And there is more. This is not only important in its own right but this will also greatly reduce the cost of attrition as well (to roughly $10 per lost subscriber, see below), which we think is a major element in the significant short position in the stock (see below).

In addition to that attrition will also come down as the company is educating subscribers that they can use the chip in their mobile phone, rather than just the tablets.

So not only will we see a significant acceleration in subscriber growth, the unit economics will also improve considerably and the company is greatly solidifying its already unique position serving the underbanked and underserved by adding new stores and new products/services to its network.

Finances

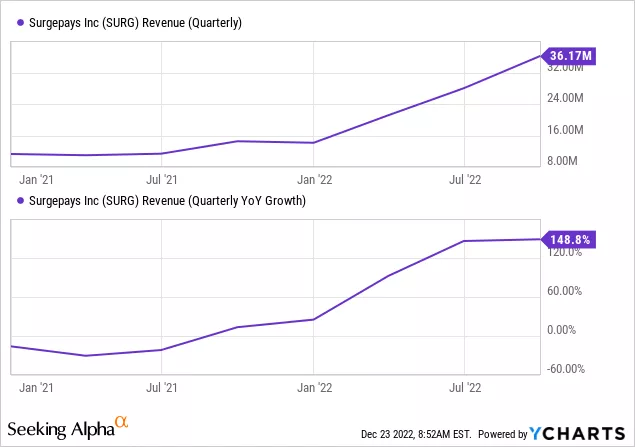

Meanwhile, before the coming acceleration of subscriber numbers and improvement in unit economics revenues are already on a steep upward trajectory:

This isn’t yet leading to profits (the company produced a net loss of $1.5M in Q3/22) for the simple reason that the up-front cost of signing up ever more subscribers is still outweighing the cash flow from existing subscribers.

But this will change as:

- Subscriber growth will accelerate in the new year and the cash flow from existing subscribers will outweigh the up-front (one-off) cost of adding new subscribers.

- These up-front, one-off costs for new subscribers will also decline from roughly $35 to more like $10 ($35 for CAC and $25 profit on the tablet), adding the $15 profit on the broadband subscription makes new subscribers profitable even in the first month.

- Attrition is also going to decline.

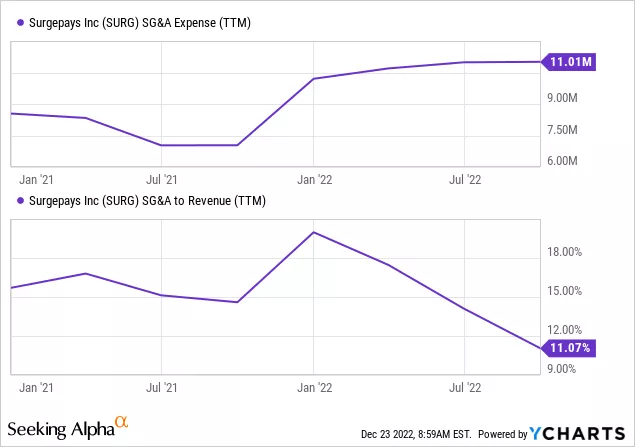

Apart from the one-off subscriber acquisition cost declining, investors will also appreciate the huge leverage that exists in the business model:

Whilst revenues have exploded, the dollar value of SG&A have not and are still just $11M/Y at present, declining sharply as a percentage of revenue. We don’t expect SG&A to increase much either, so this leverage is also going to accelerate next year with the acceleration in revenue growth.

Valuation

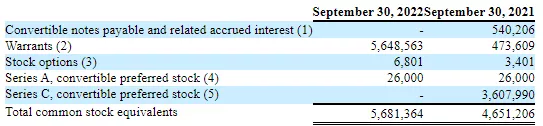

With 12.5M shares outstanding and 5.6M warrants for a total of 18.2M shares, from the 10-Q:

At $6 a share produces a market cap of $109.2M, which is less than 1x FY22 sales of at least $130M and much less on an FY23 sales basis.

Their official mobile broadband subscriber target for the end of 2023 is 500K (we believe it will be substantially larger than that and the CEO’s target is by Q2/23, see minute 39 of this interview, but let’s go with the 500K by year-end).

This would be a $180M run rate (and add to that roughly $50M for their FinTech business). But $180M at 50%+ gross margin (likely to be higher) delivers $90M+ gross profit with OpEx $11M (although let's assume that raises to $15M).

That’s $75M in net income or over $4 in EPS (again, this is a run rate, not FY23 EPS) for a stock that trades at $6. We think the company could achieve 1M mobile broadband subscribers by year-end 2023, which doubles these figures.

Then there is the drive to add new shops to their 8K partner community shop network, which is also given a big boost through the ability to sell mobile broadband subscriptions in the shop (easy money for them) and the new manager targeted with expanding the network and the Master Services Agreement with GPO Plus.

They can add additional services selling to this network, like telehealth and prepaid phone to other household members of their mobile broadband subscribers.

The company will also start generating significant amounts of cash flow in H2 next year, which could be used to buy back shares and/or expand its FinTech business.

Shorts

There is a substantial short position in the stock (1.6M, nearly 13% of outstanding shares), but we also have to point out that there are large insider holdings (the CEO alone holds 27.6% of outstanding shares) and substantial insider buys.

We have to guess about the reasons for the dim view of the shorts, some candidates:

- ACP political, 2024 funding runs out

- Fraud with ACP

- Attrition

- No profit yet

- Insiders have been buying

The ACP was part of the infrastructure bill which was passed with bipartisan support and this was a popular element in the bill as it became clear during the pandemic that internet access is crucial for disadvantaged families in a host of areas like employment, education and health. From CNET:

The ACP is a long-term program. The government has committed $14 billion to this endeavor, and there is currently no end date.

The funding runs out somewhere in 2024. Even if it doesn’t receive new funding (which would surprise us given the bipartisan support and vulnerable people dependent on the service), by that time SurgePays will have leveraged the cash flow from the program to greatly build out its network of community shops and bodegas and introduce new services, limiting the risk.

Like most programs, there is some fraud involved, some reports appeared (here and here for instance). Overall, this isn’t a significant problem:

In its alert, issued Thursday, the inspector general acknowledged the total amount of improper payments "remains low" - but stressed that the data show "use of this flagrant technique is steadily increasing, particularly for certain providers."

And SurgePays is better protected than most here by virtue of their CRM software Shockwave, which (Q3CC):

we're integrated into the National Verifier and the National Accountability Database of the FCC. And it also integrates us into the AT&T and T-Mobile backbones, which is what we use to provide the wireless service and mobile broadband. So we're one of the – to my knowledge, the only company that offers ACP that owns their own CRM, now stack onto that

The company bought Shockwave earlier in the year when they realized buying it outright would be cheaper than paying for its use, and they gained some revenues from competitors using the service.

Attrition

Attrition could provide a significant headwind as with an ever-increasing subscriber base, the company has to ever increase the number of new subscribers just to make up for the attrition, each time incurring the one-off net-CAC cost (CAC minus the gain on the tablet sale). However:

- So far attrition isn’t a serious problem, given that the company has managed a rather spectacular increase in subscriber numbers (from 30K at the start of the year to approaching 250K at year-end).

- Attrition is down to roughly 8% as customers are told they can put the chip in their mobile phones.

- With the lower CAC ($35) and increased profits on the tablet ($25) the cost of replacing lost subscribers with new ones falls to $10.

- Even when new subscribers just make up for the attrition, the economics is still very favorable.

Suppose an attrition rate of 8%/M then at 1M subscribers they have to sign up 80K new subscribers a month just to keep the subscriber numbers constant, and the company incurs a monthly cost of at least $800K (at a net-CAC of at least $10).

However, 1M subscribers deliver $360M in recurring revenues and close to $200M in gross profit or some $180M in net income and cash flow. The $800K is a rounding error compared to that, even if the net CAC would be double at $20.

Conclusion

- With some 200K new subscribers this year the company is already experiencing blistering subscriber growth for their mobile broadband business, but this is set to greatly accelerate in 2023 now that they have no longer any constraints with the number of tablets they can pre-finance and have enabled their network of 8K community shops to sign up new subscribers.

- That network of shops is an advantage that is difficult to match for those competitors who rely on these open-air tent subscriber drives.

- The unit economics of their broadband subscription business is going to improve with gross margins increasing a couple of points and net-CAC (CAC minus profit on tablets) towards $10 (from $35), also greatly reducing the cost of attrition.

- Selling the broadband subscription through these community shops is easy money for shops not on the network so this also serves to expand the 8K network of community stores.

- The hiring of a FinTech President tasked with expanding the shop network and the MSA with GPO Plus will further expand their network of community shops.

- This network uniquely positions the company serving the underbanked and underserved (those with no bank account or credit score) and they will leverage that to offer host of additional products and services

- The business is basically recession proof as more people would qualify for ACP during a recession.

- The business model contains tremendous operational leverage with OpEx fixed in dollars and revenue growth in the triple-digit area.

- While there is a considerable short position there is a much larger insider position and insiders have also been buying a significant number of shares this year. We don’t find any possible short argument very compelling and think there is a considerable chance for a short squeeze once it becomes clear how inherently profitable the business is.

Related Articles:

SurgePays Will Surge Ahead As Subscribers Flock To The Company

SurgePays Is An Undiscovered Diamond With An Upward Trend

SurgePays Passes 150,000 Mobile Broadband Subscribers

More By This Author:

Protalix BioTherapeutics Well Placed to Advance in 2023

SOBRSafe: A Very Favorable Risk/Reward Play

A Paradigm Shift In Healthcare Produces A Big Market Opportunity

Disclosure: This article is part of a new “UnderCovered” series of exclusive articles featuring companies with limited coverage. Authors are compensated by TalkMarkets for their ...

more

I'm sold. Count me in.

I've never heard of this company before but $SURG sounds like a compelling opportunity.

2023 is the year for $SURG

Very thourough. Sounds like a promising stock.

$SURG should be getting far more love from investors than it is.

Great news for #SurgePays!

Rough month. But I'm still bullish on $SURG.

This opportunity sounds very promising. I'm a bit baffled by the shorts on this stock. What do you think is behind that? $SURG

Thanks people, it seems a pretty good opportunity here, IMHO.

Loading comments, please wait...