Protalix BioTherapeutics Well Placed To Advance In 2023

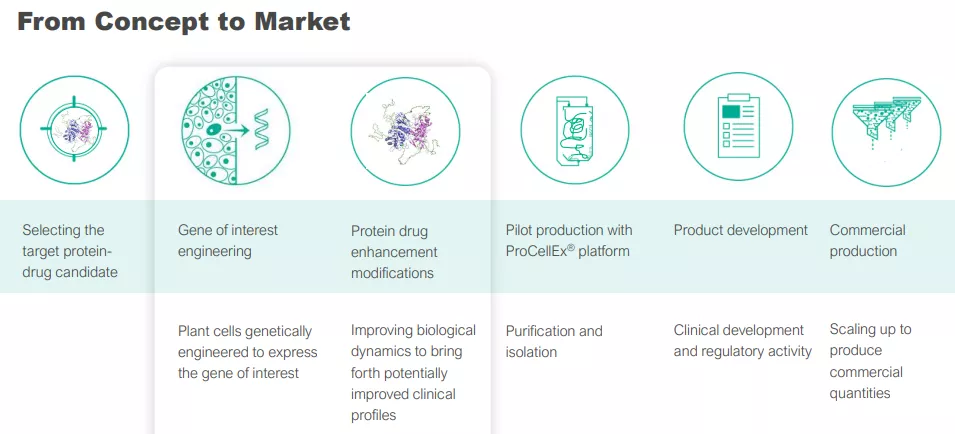

Protalix (PLX) is a clinical-stage biotech company that has developed a proprietary ProCellEx plant cell-based protein expression system with which it develops and commercializes recombinant therapeutic proteins.

The company’s platform already counts one commercial drug under its success, but there is a pipeline of others coming, some of which are in the clinical stage already.

The ProCellEx Plant Cell-Based Protein Expression System

We won’t go into the technical details here too deeply, what matters is that the process is novel and proprietary and can be scaled to produce commercial levels of proteins.

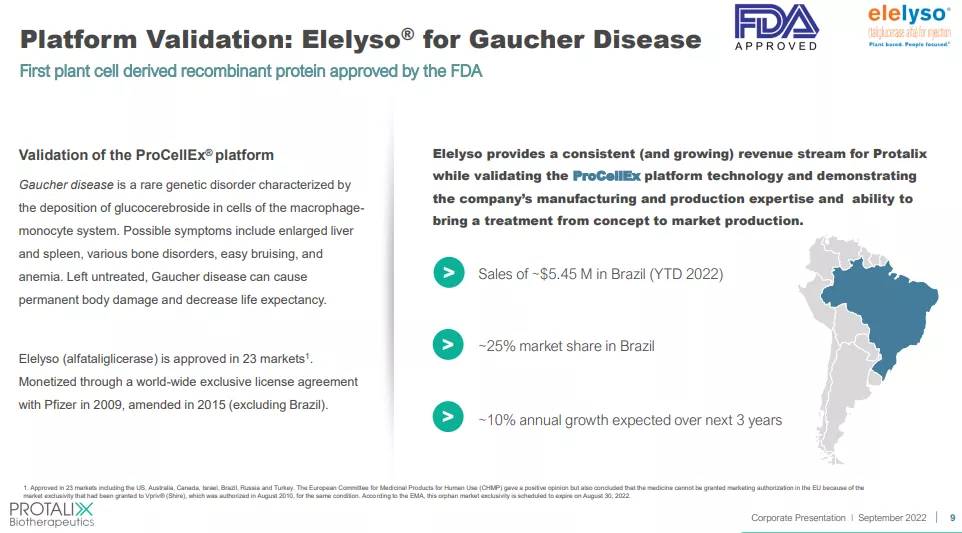

It has already produced at least one successful (that is, FDA-approved) drug in the form of Elelyso. From the company’s September 2022 IR presentation:

The company's proprietary protein expression system, an alternative for mammalian-based cell production, offers a host of advantages. Management believes that the platform enables the company to develop proprietary recombinant proteins that are therapeutically equivalent or superior to existing recombinant proteins currently marketed for the same indications.

Because the company is targeting biologically equivalent or better versions of highly active, well-tolerated, and commercially successful therapeutic proteins, they believe their development process is associated with lower risk compared to other biopharmaceutical development processes for completely novel therapeutic proteins.

Elelyso

Elelyso (taliglucerase alfa) was successfully developed with the ProCellEx platform and the FDA approved the drug in 2012 for long-term enzyme replacement therapy for type 1 Gaucher disease. The company derives revenue from Elelyso in two ways:

- A worldwide marketing deal with Pfizer (PFE), closed in 2015 which gives Pfizer the rights to and all revenues from Elelyso worldwide except in Brazil. Pfizer pays Protalix for the production costs.

- Company sales in Brazil through a distribution through a supply and technology transfer agreement with Fiocruz, an arm of the Brazilian MoH (ministry of health).

So basically Pfizer and Protalix have divided the world market with Protalix responsible for Brazil and Pfizer for the rest of the world. What have these sales looked like? Well:

It won’t be a surprise that company sales to Brazil experienced some headwinds during the pandemic as that country was hit pretty hard with Covid. This year, there is a recovery although not yet to pre-pandemic levels of sales.

In the first nine months of 2022, sales in Brazil increased to $7.16M from $4.19M in the same period in 2021, although the Q3 results ($1.7M) were weak.

Sales in Brazil were $9.14M in 2019, $8M in 2020 and $6.4M in 2021 and $7.15M in the first nine months of 2022, the pandemic and devaluation of the real have dampened growth.

Elelyso has a 25% market share and management expects a growth of 10% a year.

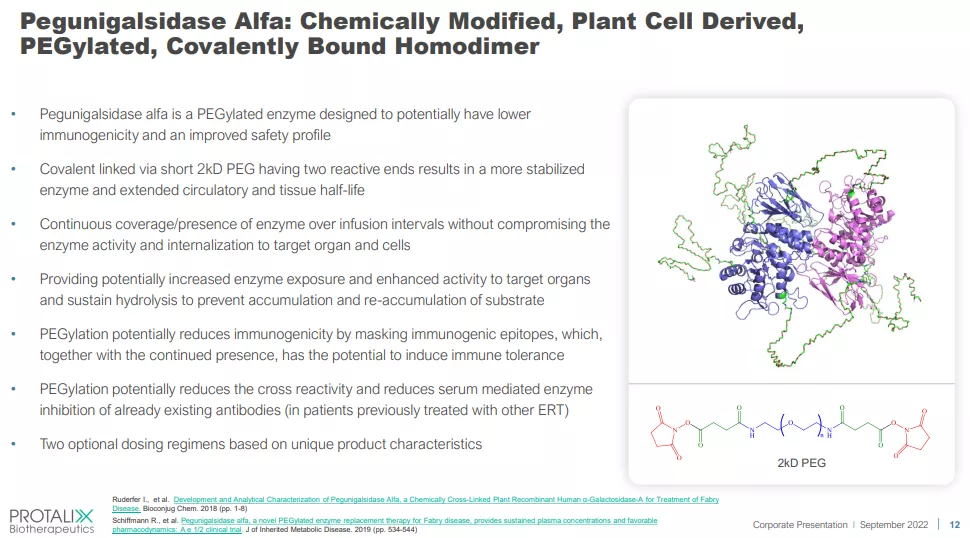

PRX-102

The next drug to come from their platform is PRX-102 or pegunigalsidase alfa, which is a drug in development for the treatment of Fabry disease

Fabry disease is an inherited disorder that results from the buildup of a type of fat, called globotriaosylceramide, in the body's cells. Beginning in childhood, this buildup causes signs and symptoms that affect many parts of the body. Characteristic features of Fabry disease include episodes of pain, particularly in the hands and feet (acroparesthesias); clusters of small, dark red spots on the skin called angiokeratomas; a decreased ability to sweat (hypohidrosis); cloudiness or streaks in the front part of the eye (corneal opacity or corneal verticillata); problems with the gastrointestinal system; ringing in the ears (tinnitus); and hearing loss. Additional signs and symptoms are possible, which can vary among affected individuals. Fabry disease also involves potentially life-threatening complications such as progressive kidney failure, heart failure, and stroke.

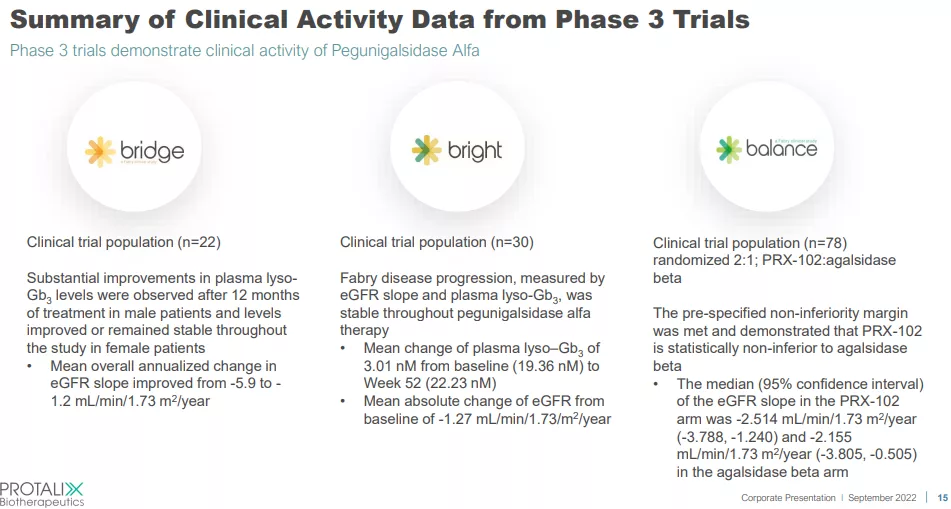

PRX-102 has successfully advanced through clinical trials with three phase 3 trials completed and the company is awaiting regulatory approval in the US and EU, which are expected in the first half of next year.

Phase 3 Trials of PRX-102

We described the three clinical trials in some detail in our previous article but all three of these trials have now completed, meeting their endpoints.

The Balance study is probably the most significant one as this was a comparison trial with the main commercial alternative for treating Fabry disease, Fabrazyme (or agalsidase beta) produced by Sanofi. Comparing the results of the two drugs based on the PR and a handy overview (the better results for PRX-102 are in bold):

|

PRX-102 |

Fabrazyme |

|

|

Medium eGFR slope |

-2.514 |

-2.155 |

|

% patients with at least one adverse event |

90.4% |

96% |

|

% of patients on treatment for adverse event |

40.4% |

44% |

|

Number of infusion related reactions per 100 infusions |

0.5 |

3.9 |

|

Number of patients (% of total group) who are ADA (anti-drug-antibody) positive at the baseline |

18 (34.6%) |

8 (32%) |

|

Number of patients (% of ADA+ patients*) who has neutralizing antibody activity [against the drug] at the baseline |

17 (94.4%) |

7 (87.5%) |

|

Number of patients (% of total group) who are ADA (anti-drug-antibody) positive at 24 month |

11 (23.4%) |

6 (26.1%) |

|

Number of patients (% of ADA+ patients*) who have neutralizing antibody activity [against the drug] at 24 month |

7 (63.6%) |

6 (100%) |

|

Number of patients (% of total group) discontinued in the trial |

5 (9.4%) |

1 (4%) |

|

Number of deaths |

0 |

0 |

What can be concluded from the results? While PRX-102 has a better safety record, patients on Fabrazyme had, on average, a slightly lower decline in kidney function (medium eGFR slope) that wasn’t statistically significant and the prespecified non-inferiority margin was met..

This is important, because the requirement has been changed from superiority to non-inferiority, from the 10-Q:

Given the changed regulatory landscape in the United States with the full approval of agalsidase beta in March 2021 based on clinical endpoints, the primary analysis of the BALANCE study was changed from superiority to non-inferiority, as demonstrating superiority is no longer required under FDA guidelines.

PRX-102 also produced better immunogenicity (that is, the existence and development of anti-PRX-102 antibodies or anti-agalsidase beta antibodies producing a lower immune response), from the 10-Q:

in the study indicated that for the PRX-102 arm, 18 (34.6%) patients were ADA-positive at baseline, of which 17 (94.4%) had neutralizing antibody activity. For the agalsidase beta arm, eight (32.0%) patients were ADA-positive at baseline, of which seven (87.5%) had neutralizing antibody activity.

ADA stands for anti-drug-antibody. Again not a huge difference, but positive nevertheless, although over the two year period the proportion of patients with neutralizing ADA decreased in the PRX-102 arm while it remained stable in the agalsidase beta arm.

The FDA argued in preliminary talks that the results had the potential to support an approval and management itself argued that the results met their primary end-point with PRX-102 not being inferior to Fabrazyme.

As a result, the companies resubmitted the BLA (Biologics License Application):

Protalix will be eligible to receive a milestone payment from Chiesi upon BLA approval. Protalix and Chiesi anticipate that the FDA will complete its review of the resubmission within six months of receipt… The European Medicines Agency (EMA) is currently reviewing the marketing authorization application for PRX–102, and interactions with the EMA are ongoing.

We are not in a position to pre-empt regulatory decisions but it does look good. Renal decline was a little better with respect to Replagal (per the Bright study) and a little worse compared to Fabrazyme (Balance study). PRX-102’s advantages are the slightly better safety profile and possibility of once a month doses, rather than bi-monthly for alternatives.

Market Opportunity of PRX-102

The Fabry disease market, according to a recent report:

The Global Fabry Disease Treatment Market size was estimated at USD 2,134.00 million in 2021 and expected to reach USD 2,308.83 million in 2022, and is projected to grow at a CAGR 8.36% to reach USD 3,456.52 million by 2027.

A $2.1B market growing at 8%+ a year is significant, but it remains to be seen how much of the market PRX-102 can conquer. A promising sign is that most patients in the Bright study who were previously on Replagal and were switched to PRX-102 chose to continue with the latter, but keep in mind Replagal is only approved in the EU.

A key to that is likely to be the possibility of less frequent dosing which will be included in the marketing. The contrast with Replagal is considerable. In the Bright study patients switched from 2 doses per week for Replagal to one dose per month for PRX-102.

The main advantage of PRX-102 over Fabrazyme is the better immunogenicity (producing a lower immune response) and safety, although the margins are small.

We discussed the competitive landscape in greater detail in our previous article.

Apart from the competitive landscape, the company can receive well over $1B in regulatory and milestone payments as well as (additional) royalties from partner Chiesi.

The company has two exclusive license deals with Chiesi, one for the US and the other for the rest of the world. There are $25M payments upon approvals in the EU and US each.

The biggest potential are the regulatory and commercial milestone payments (up to $290M for the rest of the world and up to $760M for the US market) and US royalty tiers (10%-40% for the US and 15% to 35% for the rest of the world). That can add up.

Pipeline

Neither PRX-115 (for refractory gout) nor PRX-119 (for NETs related diseases) have advanced to clinical trials yet although the plan is for a Phase 1 study for PRX-115 in the first half of next year. Not even in the slide above is PRX-110, which has been licensed for inhaled indications to SarcoMed USA, but it has additional possible indications.

These will take years to develop but it’s good to know they have not only a platform that can produce new drugs, but already a pipeline of developed ones.

Finances

From the Q3/22 10-Q:

And here is our own compiled roster:

|

Q1/21 |

Q2 |

Q3 |

Q4 |

Q1/22 |

Q2 |

Q3 |

|

|

Pfizer |

4.51 |

2.23 |

1.13 |

2.29 |

3.56 |

3.38 |

4.54 |

|

Brazil |

0 |

0.99 |

3.20 |

2.21 |

5.45 |

0 |

1.7 |

|

Chiesi |

0 |

0.02 |

0.17 |

0 |

0.22 |

0 |

2.56 |

- Revenue +96% to $8.8M

- COGS +91% to $7.1M

- R&D $7.4M (+$0.1M)

- SG&A $2.8M (-$0.2M)

- Outstanding notes $28.1M

- Cash $20.8M

The gross margin on the Pfizer revenues are zero and those on milestone payments are 100%, so the below graph isn’t terribly informative:

What matters much more is the company’s cash burn:

They have only one clinical trial (for PRX-115, starting in Q1/23) planned (although they’re still monitoring patients on extended usage of PRX-102) so expenses aren’t likely to increase.

What’s more, the company will receive $25M each for approval in the US and EU, which will give them additional leeway as they don’t have to shoulder all the S&M costs either.

Valuation

There is quite a bit more (10-Q):

The calculation of diluted LPS does not include 33,922,624 and 33,295,154 shares of Common Stock underlying outstanding options and shares of Common Stock issuable upon conversion of the outstanding 2024 Notes and the exercise of outstanding warrants for the three and nine months ended September 30, 2022, respectively.

That adds up to 84M shares, fully dilutes so the company has a market cap of $96M and an EV of $76M, Whether that’s expensive really depends on whether PRX-102 will be approved in the US and/or EU and how much it will sell after approval.

It’s difficult to say much about that as we don’t know the exact milestones and royalty tiers, nor is it clear what part of the market the company can conquer.

Nevertheless, it should be clear the potential is huge with over $1B in potential milestone payments and then 15%-40% royalties in the US and 15%-35% royalties in the rest of the world.

Conclusion

We can roughly repeat what we argued in our first article, which is that we see a number of reasons to be positive about the shares:

- We think approval in the EU and US is likely, opening up a substantial market opportunity and initial payments of 2x $25M upon approval.

- The company has an important partner in Chiesi which will market PRX-102 and provide a possible $1B in milestone and regulatory payments as well as considerable royalty payments.

- The company already earns growing revenue from an approved drug and has a pipeline with other compounds for rare diseases.

- The company has a proprietary platform that is much cheaper than alternatives and has other advantages in producing these compounds.

- The company is funded for years, longer if they get approval for PRX-102.

However, there are also some risks. While approval is likely, it isn't guaranteed and reimbursement and market sales could disappoint as the drug isn’t obviously superior to alternatives.

There is also some chance better drugs become available in the future given the development of certain gene therapies, but as we argued in a previous article, even if these develop successfully, they aren't going to be on the market anytime soon so investors have few reasons to worry about these for quite some time to come, if ever.

Related Articles:

Protalix PRX-102: Likely Approval Could Be A Game Changer

Why Protalix Is Back On The Radar

Protalix BioTherapeutics: Management Sounds Confident Despite CRL

PLX Upcoming Volatility Creates Opportunity

More By This Author:

SOBRSafe: A Very Favorable Risk/Reward Play

A Paradigm Shift In Healthcare Produces A Big Market Opportunity

A Ground Floor Opportunity in Splash Beverage

Disclosure: This article is part of a new “UnderCovered” series of exclusive articles featuring companies with limited coverage. Authors are compensated by TalkMarkets for their ...

more

Bullish on $PLX.

Good read, added this stock to my watchlist.

Very thorough and impressive as always, thanks.

Thanks Derek, appreciated.

I read your last article on $PLX as well which was equally impressive. Sounds like the company has a promising 2023 to look forward too!

Thanks, appreciated!

Your OS count after note conversion/options/warrants is around 33 million too high. It isn’t 33m and another 33m… they are reflective 3 month and 9 month periods.

Possibly amend your article? If you wish to be accurate with the potential OS and market cap. Otherwise, great article!

It looks like the article has been corrected already.

Right… shares outstanding should be around 74-78m after notes, warrants, options, existing shares. Which is relatively low (all things considered). Not having to worry about commercialization costs is a huge (often overlooked) benefit too!

Yes. I’d add that the Bridge Trial was a total blowout and 102 was a grand slam on all points. This data was the original submission with Balance 1/2 under the AA BLA. Also, all three trials were switchover trials that didn’t include the negative adverse events for Fabrazyme/Replagal because those who can handle those ERTs are the only ones in 102s switchovers. >20% drop out of Fabrazyme/Replagal trials from severe adverse events and these are not reflected into the data. If it were a fresh ERT patient trial against 102 vs Replagal/Fabrazyme/Galafold/Placebo…. 102 would’ve blown them out of the water!! They all missed endpoints Vs Placebo.

The Balance Trial had older ERT patients whose kidneys were already close to being shot. Majority was on Fabrazyme for many years.

Maybe as a p4 trial they could perform a small scale fresh ERT head 2 head? I think that would be super compelling for prescribers!

I also still have wondered about the once a month dosing protocol. Like every article says "may be able to do that" but what does the data say for the once monthly dosing? Was the drug effective enough? Is there NDA/EMA submissions gunning for a once a month dose protocol in labeling discussions? My guess is not as they wanna stay conservative for initial approval then work towards getting additional labelings down the road for once a month... guess time will tell but if the once a month dosing comes to fruition thats a huge advantage too.

I'm bullish on $PLX.

You're right, bit of a confusing sentence (the one quoted from the 10Q) but I read that the wrong way. First time I've seen that split out into 3 and 9 month periods, but they are almost entirely overlapping, not separate quantities I now realize.

So they have a $96M market cap, rather than the $130M I assumed in the article and an EV of $76M, that's quite a bit less..