SurgePays Will Surge Ahead As Subscribers Flock To The Company

Image Source: Sugrepays.com

Summary

- The company offers broadband internet and fintech services to underserved Americans, greatly benefiting from Federal ACP subsidies made permanent last year.

- The company has already gained 150K subscribers way ahead of schedule with the help of their partner network of local shops, the acquisition of Torch Wireless and the use of innovative marketing tools.

- 48M Households qualify for ACH subsidies, this is a greenfield opportunity, rampant subscriber growth is unlikely to slow down for 2.5-3 years

- These revenues are recurring and produce much higher margins, opening the prospects for greatly improved financials, profits and cash generation.

- The share price hasn't discounted this opportunity anywhere near enough, in our view as the company could easily have 500K subscribers by the end of FY23.

- We took our questions directly to SurgePays CEO, Brian Cox, to get the inside scoop on what to expect.

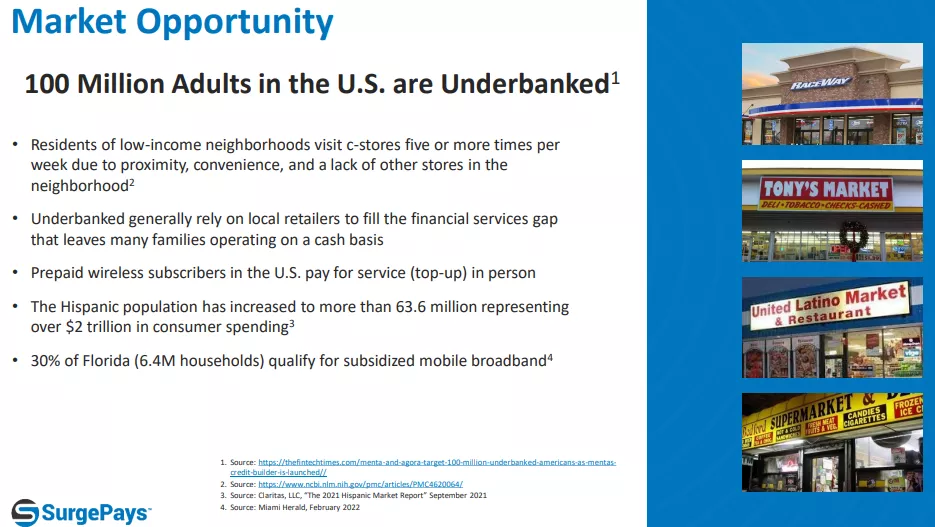

SurgePays (SURG) is a company focused on the underbanked and underserved communities, offering telecom, mobile broadband and fintech services, from an April 2022 IR presentation:

SurgePay IR presentation

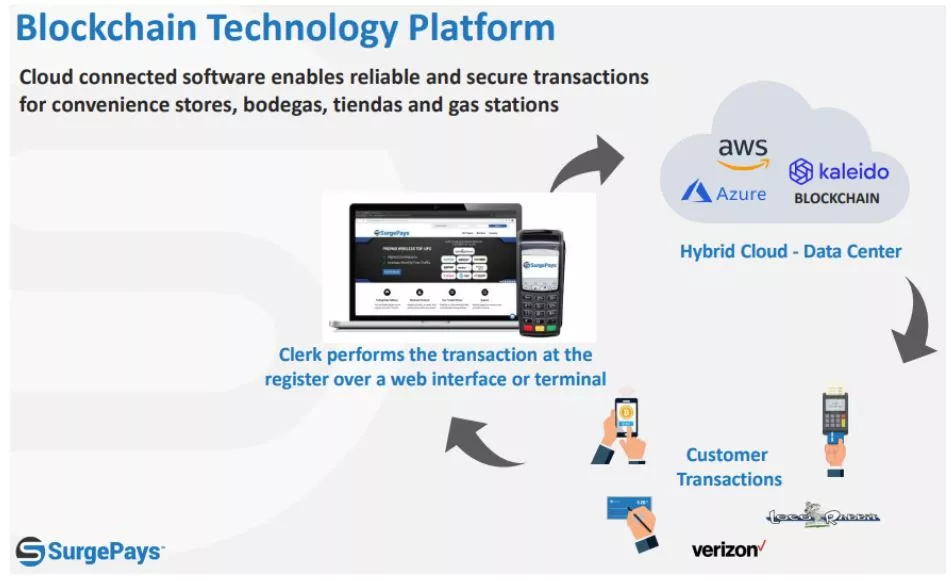

One of the central planks in their business strategy is to leverage a network of local shops for offering their services:

SurgePay IR presentation

There are two categories of services that are offered through these local stores:

- Fintech products through a series of community shops connected by their proprietary CRM software platform (which can be licensed as well).

- Telecom products

Here are some of the Fintech products on offer:

SurgePay IR presentation

The company is at the forefront of offering digital currency services to the underbanked:

SurgePay IR presentation

One might wonder why these local shops want to cooperate with SurgePays, well here is one good reason (from March 2022 IR presentation):

SurgePay IR presentation

And of course the shops also benefit from the payment and top-up services, but these are all products and services from third parties and therefore generating low gross margins (4-6%).

The idea is to increase the network of participating shops (they have 8K stores now but the goal is 50K in 3-4 years) and then use their position as a kind of Trojan Horse, start selling their own product and services as well, generating much higher margins.

One idea that management has ventilated was telehealth services, which would also produce societal benefits as it could unburden emergency services which many underserved Americans use as a first line of healthcare services.

This seems a nice concept, and having a network of local shops hooked up to their own software seems a pretty leverageable asset to us, but the action at the moment is elsewhere, in their mobile broadband services.

Mobile Broadband Services

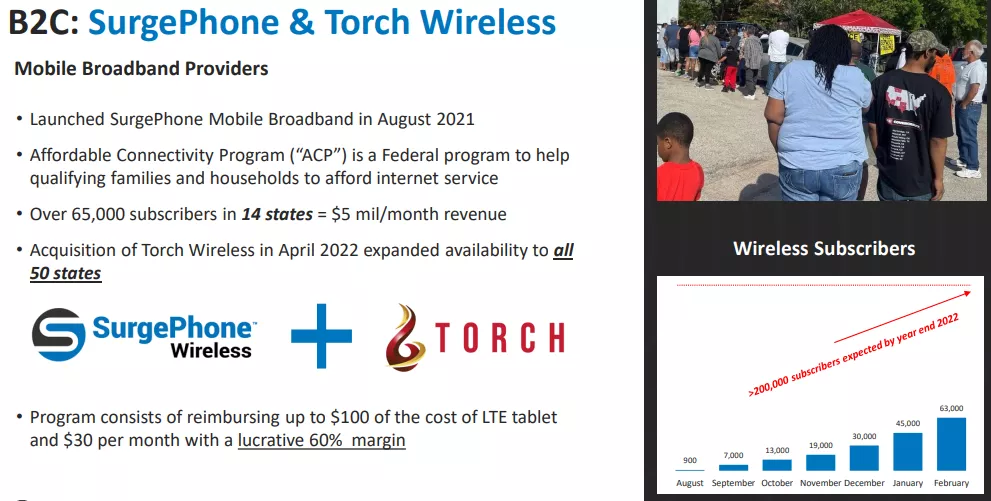

Last year, the company started to leverage the network of partner stores to offer telecom services:

SurgePay IR presentation

This works via the ACP, the Affordable Connectivity Plan, started off as a pandemic emergency plan (to enable poor communities to attend classes and doctor appointments over Zoom) but has now been made permanent (as part of the recent large infrastructure bill), aimed at solving the digital divide.

The ACP program provides a huge opportunity for SurgePays. The program consists of reimbursing up to $100 of the cost of a 4G tablet and $30 per month for data usage. In addition, the FCC is spending $100M over 5 years for outreach of this program. From CEO Brian Cox on the Q1CC:

Initially SurgePhone wireless was licensed to offer this program in 14 states. As we grew our enrollment from zero customers in August of last year to over 100,000 in those 14 states, each subscriber provides $30 of monthly reoccurring revenue. This includes the cost of equipment and commissions paid to sales. Our gross margin is approximately 40% per subscriber.

But with the acquisition of Torch Wireless in April, this is now scaled up to all 50 states. The increased scale enables a significant decline in acquisition cost. On July 14, 2022 the company announced it had exceeded 150K subscribers in its mobile broadband business. From the SurgePays CEO Brian Cox:

It’s been my experience that scaling to the next 150,000 subscriber milestone should be much quicker based on economies of scale, software efficiencies and factoring most of the last year we only had 14 states. Now, we have all 50 states, are hitting on all cylinders and reinvesting the gross positive cash to accelerate sales growth.

Online acquisition costs are much lower (Q1CC):

The numbers that were coming in that we're seeing online, is a cost of about $20 to $25, compared to a $45 commission in the field. So we're hoping that continues. And we're able to look at more of a blended cost per acquisition, somewhere in the $30 to $35 range, which is would significantly, and estimates a 25% drop in our cost per acquisition by being able to go directly online.

However, we will stick with the $45 field acquisition cost as that’s where most of the new subscriptions are coming from (on average 1000-1500 a day versus 300 online).

The field operations are almost like Obamacare open enrollment season, with tents close to the community shops and banners reading “free internet.”

The market is very large, there are at least 48M households qualifying for the ACP subsidies and this could be up to 100M if you include immigrants. Households that qualify for other government programs like SNAP automatically qualify for ACP.

The program provides an unbeatable proposition to those people: free internet and a tablet for $11. Demand is not an issue, the company has hardly scratched the surface.

They leverage their network of community shops as a trusted partner for much of the customer acquisition efforts, setting up tents with banners “free internet” in their parking lot.

The company functions as an MVNO (mobile virtual network operator), using T-Mobile’s wireless backbone which costs them $15 (can be a bit lower, depending on data usage of the customer). So gross margins are 50%+.

Hypergrowth and cash flow problems

The only limiting factor is financing, as the CEO (who is the largest shareholder with over a third of the outstanding shares), doesn’t want to dilute. They can easily sustain the present growth and that will likely last another 2.5-3 years.

As we noted above, we have to add 1000-1500 on average a day of new subscribers signing up in the field to the 300 online, and that’s some 50K a month. The CEO revealed his target of 500K subscribers by the end of next year.

Given the cost of the tablets ($80-$85) and customer acquisition cost ($45), new subscribers are cash flow negative for the first two months of their subscription.

So the faster the company grows, the bigger the (temporary) cash flow problem becomes. The company has two ways to deal with this, without having to dilute shareholders:

- The increasing size of the installed base of subscribers provide an a steadily increasing amount of cash flow, which is plowed back into customer acquisition.

- The receivables $5M+ from the ACP program a month are highly bankable and can be easily leveraged through cheap financing.

- They also get some vendor financing from the maker of the Tablet, given that they are a significant client ordering in the tens of thousands.

So, we once again stress, demand is no problem, they can sell as many tablets as they want (there are no supply chain issues either), they are limited by cash as they don’t want to dilute the shares.

But, given that the rapidly increasing base of existing subscribers is providing ever-increasing amounts of cash flow, this financial constraint is decreasing all the time.

The increasing pace of subscriber growth (starting the year with 30K, achieving 100K in April, 150K in mid-July) testifies to this. They will increase their yearend target of 200K fairly soon.

We believe it could well be in the order of 300K subscribers or more by yearend as there are still 5 months to go in the year and they’re signing 40K-50K subscribers a month now.

Competition

The market for underserved Americans isn't attractive for large competitors (otherwise these Americans wouldn't be underserved) as these large companies are often not equipped to deal with prepaid cards as a form of payment.

There are other issues like the wiring in old housing, who has to pay for the modem, and stuff like that.

There are smaller competitors with a similar business model but the company benefits from its existing network of shops where it already offers financial services and its relation with AT&T which has the best rural network coverage and where there are few other resellers.

Given the speed with which the company is amassing subscribers these advantages seem far from theoretical.

Finances

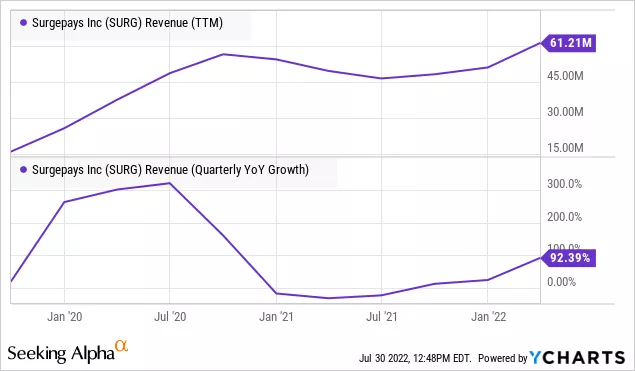

Given the subscriber growth, it’s no surprise revenue growth is accelerating:

A disaggregated view from the 10-Q:

SurgePays 10-Q

Clear to see how the broadband business as ramped from basically nothing to over half of revenues already. Some additional data points:

- Q1 revenue $21.1M up from $9.9M Q1/21

- Gross profit up 133% to $2.6M

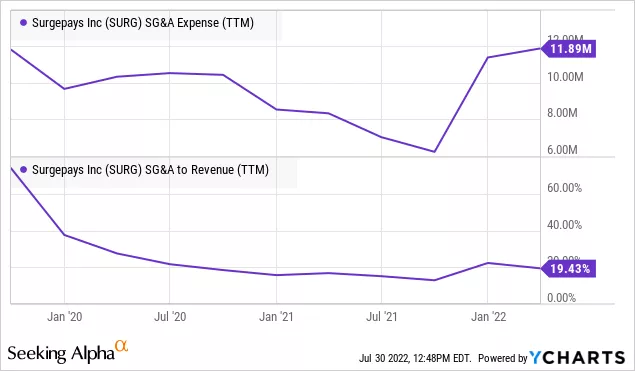

- SG&A up 14%

- Loss from operations was $1.1M in Q1 (versus $2.1M in Q1/21)

- Net loss at $1.2M (EPS -$0.10) versus a loss of $4.8M (-$1.85 EPS) in Q1/21

- EBITDA at -$873K versus -$4M in Q1/21

- Becoming EBITDA positive by Q2/22 and generate $15M+ in FY22

- Cash at $3.4M at the end of Q1 down from $6.3M end Q4/21

- Accounts receivables +74% (from US govt subsidies, payments 30-60 days)

- $1M in debt

With the acquisition of Touch Wireless operational cost jumped a bit, but there doesn’t seem to be an upward trend so we can expect significant operational leverage on the strong revenue growth:

What should also not be overlooked is the likelihood that their fast-ramping broadband segment generates considerably higher gross margins compared to their fintech segment (which are mainly prepaid cards).

The company didn’t experience much of a boost in gross margin in Q1 as we know that the first two months of new subscribers are cash flow negative, but management argues the following:

SurgePay IR presentation

LogicsIQ

And that’s not all, there is LogicsIQ, an enterprise software development company providing marketing business intelligence, plaintiff generation, and caseload management solutions for law firms representing plaintiffs in Mass Tort legal cases.

This is a business (owned by SurgePays) that produces over $20M in revenue and positive EBITDA ($3M-$4M) and there is going to be a dividend tax-free spin-off to existing shareholders somewhere in H2.

They are also working with the management of LogicsIQ to smooth out the revenue stream more evenly throughout the year, as at present it is very much driven by sudden bursts in Tort Law cases, and achieve cash flow breakeven.

Discussions with the SEC are ongoing for the spinoff but there doesn’t seem to be any major issue holding it up, that is, (Q1CC):

We're really looking forward as well, to the market understanding that if you're a shareholder of SurgePays, you're going to get a dividend of stock from this Spinoff IPO.

A pretty nice bonus, we’re inclined to say.

Valuation

Fully diluted (including the 5.7M warrants), there are 17.8M shares outstanding for a market cap of $107M (at $6 share price). Management guides $130M revenue run rate by the end of Q4.

This isn't the same as FY22 revenue, which is likely to be lower, but not by all that much the way their subscriptions are growing. So we take $100M as a benchmark for FY22 revenue.

That would mean that the shares sell well below 1x sales for a company that is rapidly expanding (recurring) sales, margins and cash flow. That seems very cheap to us.

Management also argued they expected $15M+ in EBITDA, which would produce an EV/EBITDA multiple of 7.1x, which is modest as well.

We think they could have 300K subscribers by the end of the year and 500K by the end of next year, which the CEO mentioned as his personal target in a recent interview with JTC (which we highly recommend).

Here is some back of the envelope calculation of run rates (based on a conservative 50% gross margin and $15M in OpEx):

|

Subscribers |

300K |

500K |

|

Revenue run rate |

$108M |

$180M |

|

Gross profit |

$55M |

$90M+ |

|

Net profit |

$40M |

$75M |

|

EPS |

$2+ |

$3.75 |

Keep in mind, these are end-of-year run rates (albeit for their mobile broadband business only), actual FY22 and FY23 revenues from the mobile broadband business will be lower as subscribers rise during the year only reaching these figures by year end and there are one-off subscriber acquisition costs.

The one-time customer acquisition cost (minus the one-time tablet subsidy) of $35 per subscriber would amount to $7M in FY2023 on 200K new subscribers (which is a conservative target of they come close to 300K by yearend 2022 as it implies a considerable growth slowdown).

The CEO sees present growth to continue for 2.5-3 years as this is still largely a greenfield opportunity and they’ve just signed up a fraction of available households (48M+). There is no reason they couldn’t reach 1M+ in subscribers in a couple of years.

There is also some attrition, management mentioned 8%-10% but these are typical industry data as they have insufficient data yet. In rural areas it's likely to be less and given their relationships with customers (through the local shops and their CRM platform), they might be able to reduce that further.

Then there is the ACP itself, which depends on politics, but it had broad bipartisan support as part of the infrastructure bill. Not really a vote winner trying to curtail that.

Recession and inflation aren’t likely to dent the growth much either, if at all. While attrition might go up a bit in case of a recession, there would be more families qualifying for the ACP subsidies.

Conclusion

The company has a lot going for it:

- 100M underserved Americans with at least 48M households qualifying for the ACP program, a large market opportunity, it has hardly scratched the surface.

- The ability to leverage their network of local corner stores, bodegas and local convenience stores to sell broadband subscriptions.

- The acquisition of Torch Wireless, enabling access to ACP in all 50 states (from 14 states previously). Together with the use of their CRM software and automated marketing is greatly scaling up the broadband landgrab of getting new subscribers and significantly reducing acquisition cost.

- They reached the first 150K subscribers in less than a year, the next 150K will likely arrive a lot sooner and could well arrive at yearend 2022.

- The mobile broadband business could reach 500K subscribers or even more by the end of next year, producing a run rate of $180M in revenue and $90M in gross profit at 50% gross margin.

- The present growth can continue for 2.5-3 years and there is nothing stopping the company from reaching 1M+ subscribers in a couple of years.

- There will be a significant amount of operational leverage on the ramp in broadband subscribers as their overhead is pretty fixed and can accommodate scaling up of operations.

- Shareholders get two for the price of one: LogicsIQ's upcoming tax-free dividend spin-off.

- Management has considerable skin in the game and they are not selling. This explains why dilution is the lid on subscriber growth.

- The shares are still cheap, even after the recent rise.

Related Articles:

SurgePays Is An Undiscovered Diamond With An Upward Trend

SurgePays Passes 150,000 Mobile Broadband Subscribers

What The Market Is Missing About Surge Holdings

More By This Author:

Bion Environmental Technologies Turns Waste Into Marketable Products

Protalix PRX-102: Likely Approval Could Be A Game Changer

Ituran Is Set To Recover

Orgenesis' Leveraged Approach To Lower The Cost Of Cell And Gene Therapies

Disclosure: This article is part of a new “UnderCovered” series of exclusive articles featuring companies with limited coverage. Authors are compensated by TalkMarkets for their ...

more

Why do you suppose so many like to short this stock? I think it looks promising.

Sounds like a promising opportunity to me.

Nice find. What other stocks do you recommend?

This stock looks to have a lot going for it. I will be adding a small amount to my portfolio to see how it goes.

Good additional information for readers. It should hit these numbers and I suspect they can exeed them. Their barrier to growth seems mainly to be a limit to their cash flow which should be helped with their move to profitability.

Yes, $SURG is looking good to me and is already up.

Good stock find.

Thanks people. The recent investor talks like the one with JTC are also pretty interesting

Wow, how have I not heard of this stock before. Definitely going to pick some $SURG up.

Impressive. $SURG is looking better and better to me.