3rd To Last Powell Fed Day

Image source: Wikipedia

Today will be the 65th Fed Day (FOMC day) of Chair Powell's tenure, dating back to early 2018 when he first took the helm. The US stock market has more than doubled since Powell became Fed Chair, so his tenure has been a big success in that regards even though stock market gains are not part of the Fed's mandate.

When it comes to stock market performance on Fed Days specifically, however, Powell's tenure has been the weakest of the "modern" Fed era.

The "modern" Fed began in February 1994 when they first began announcing policy decisions on the day of FOMC meetings. Before 1994, the Fed didn't announce interest rate decisions until weeks after their meetings, which forced investors to monitor the Fed's open market trading desk activity in the meantime for any policy adjustments.

There have only been four Fed Chairs in the modern era, beginning with Alan Greenspan, who was Chair when the Fed first began announcing policy decisions on FOMC days. After Greenspan came Ben Bernanke in 2006, Janet Yellen in 2014, and Jerome Powell in 2018.

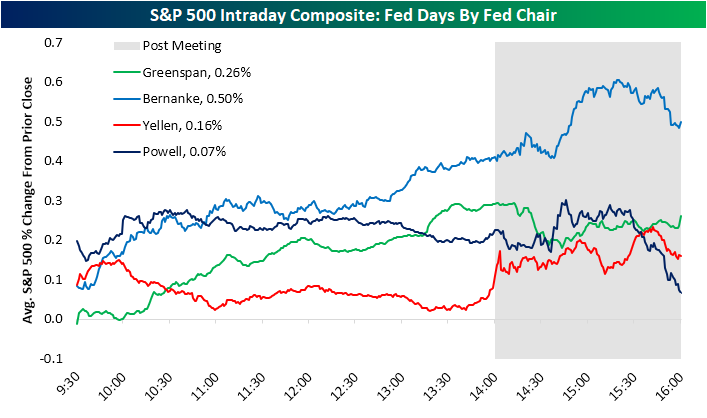

Below we've created a chart that shows the S&P 500's average intraday path on regularly scheduled Fed Days since 1994.

As shown, Bernanke saw the best stock market performance on Fed Days with an average one-day gain of 0.50%, followed by Greenspan at 0.26% and Yellen at 0.16%. Powell currently ranks last of the four with an average one-day gain of just 0.07% on Fed Days during his tenure.

Notably, Powell has actually been the best Chair for the stock market in the first half-hour of trading on Fed Days. From there, though, the market has tended to trickle lower under Powell and then sell off sharply in the final hour of trading.

There have been many-a-Powell Fed Days that saw sharp market selloffs after Powell press conferences. Not every Powell Fed Day has seen a late-day selloff, of course, but the "average" tells the overall story.

Again, the stock market is up huge since Powell became Fed Chair, so buy-and-hold investors have nothing to complain about when it comes to late-day weakness on Powell Fed Days.

For short-term traders, though, the "post-Powell-presser-plunge" will soon become a distant memory once a new Chair takes the helm this spring.

More By This Author:

Home Prices Vs. Stocks Long Term

Country ETFs Hot Hot Hot

Capital One's Impressive Streak

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more