Capital One's Impressive Streak

“The profit margin for credit card companies now exceeds 50%. One of the biggest. And they charge Americans interest rates of 28%, 30%, 31%, 32%. What happened to usury?” – Donald Trump

The weekend before last, President Trump made some critical comments about the credit card companies, and he pushed for a 10% cap on the interest rates they’re allowed to charge. After sleeping on those headlines for the rest of that weekend, investors headed into the week looking to unload. As one example, Capital One (COF) opened sharply lower on that Monday and remains near those levels now. This morning, the President reiterated his critical comments towards the card companies in Davos and called on Congress to do something about it (since he can't actually unilaterally cap rates himself).

For COF specifically, the company will report earnings on Thursday after the close, and investors will be looking for any comments from company management regarding how they plan to react to the President’s animosity towards them and any legislative push that arises from it. We’re not sure exactly what (besides the mid-terms) made the President so focused on the credit card companies lately, but maybe it’s the performance of COF in reaction to its earnings reports over the last three years.

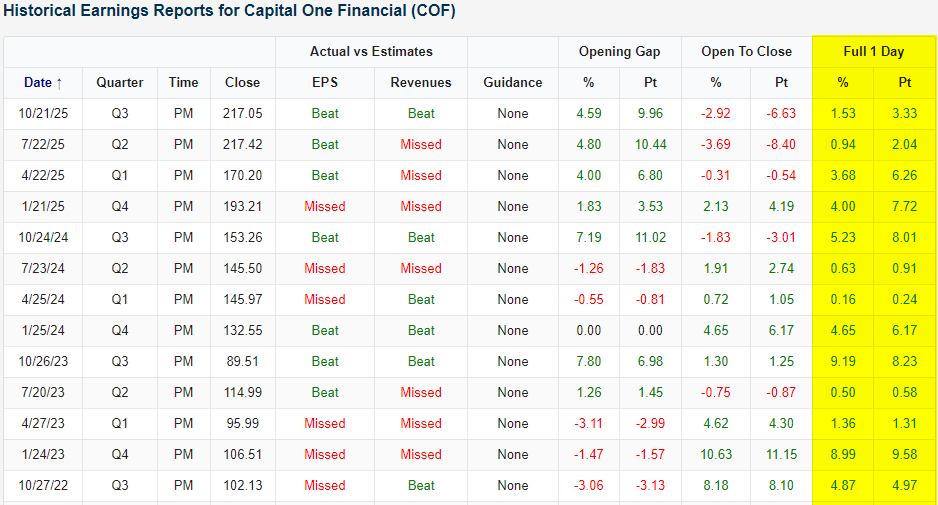

The snapshot below comes from our Earnings Explorer and shows COF’s earnings results and subsequent stock performance in reaction to each of those reports. Since the bull market began in October 2022, COF has exceeded EPS forecasts only 7 out of 13 times and beat sales forecasts just 6 times. Combined, the company has exceeded EPS and sales forecasts in the same earnings report only three times. Based on its results relative to expectations, it doesn’t appear as though COF has been minting money.

While COF’s earnings results haven’t been particularly strong, the stock’s reaction to those earnings reports has been stellar. As shown in the right side of the table, since Q4 2022, the stock’s earnings reaction day performance has been positive all 13 times for an average one-day gain of 3.5. Shares have seen one-day gains in response to earnings on each of its last 13 reports!

(Click on image to enlarge)

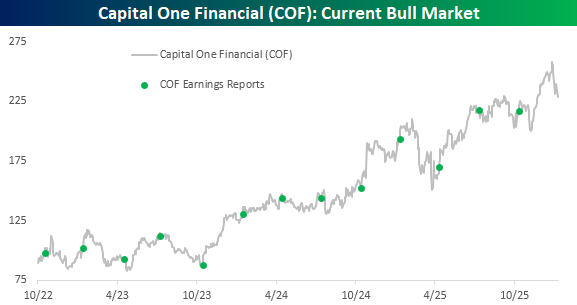

Besides the positive earnings reaction day performance, COF has been a very strong performer between earnings reports. Since the bull market began in October 2022, the stock has rallied 156%, which is 66 percentage points more than the S&P 500. It may not be the best performer in the S&P 500 during this bull market, but COF has been one of the better performers. That's great if you're a shareholder, but it also makes for an easy scapegoat when an issue like affordability is poised to be a central theme of this year's mid-term elections. What other issue can you think of out there where Donald Trump and Elizabeth Warren would be on the same page?

More By This Author:

First Year Of Trump's Second Term In The BooksWeird Breadth From Small Businesses

Biggest Risks To The Market?

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more