Beginner's Luck Or The Best Trade Ever?

Image Source: Unsplash

My daughter likes to open baseball card packs. It’s not a cheap hobby in any regard, but it’s a good way to make memories. And she’s a shark.

Two weeks ago, I purchased a hobby box of 2022 Topps baseball cards for $39. She got half the packs. I got the other half. I didn’t pull a single good card. She pulled an Aaron Judge print -- the star player of the New York Yankees. There are only 25 of these specific cards in circulation. It’s worth a pretty penny.

This comes after she did the same with a rare Grayson Rodriguez (Baltimore Orioles) card a month prior. I have no wins like that. While I wait for the judge's card to be graded (to assess the quality), she asks, “How is my $500 card doing?” She says that she wants to sell the card.

I’d be okay with that, but only if she does one of two things. And this is my advice for you today, too.

Buy Berkshire (And Don’t Stop)

Each year, I buy Amelia one share of Berkshire Hathaway B (BRK-B) stock and spend the remaining $38 on whatever. Berkshire Hathaway is a multinational conglomerate holding company headquartered in Omaha, Nebraska. Investment legend Warren Buffett leads it. The company was originally a textile manufacturing firm, but it transformed into one of the largest and most diversified companies globally under Buffett's leadership.

Berkshire Hathaway owns significant stakes in public and private companies across various industries, including financial services, utilities, energy, railroads, consumer products, etc. It also operates with a brilliant business model.

It owns prominent insurance companies, such as GEICO, General Re, and Berkshire Hathaway Reinsurance Group. These businesses generate substantial cash flow because people have to pay their insurance premiums.

Because they have the best insurance underwriters in the business, they limit their risk (meaning they make money on their insurance sales) and have a huge float of cash. Then, they take that cash, and Buffett buys well-known companies like Apple, Coca-Cola, American Express, and Bank of America, among others.

Now, Amelia owns seven shares of the B shares -- one for each year. If she wants to sell the Judge card, she should exchange it for one share of Berkshire B stock. She can, but there’s a better option.

Owning SRH Total Return Fund, Inc. (STEW)

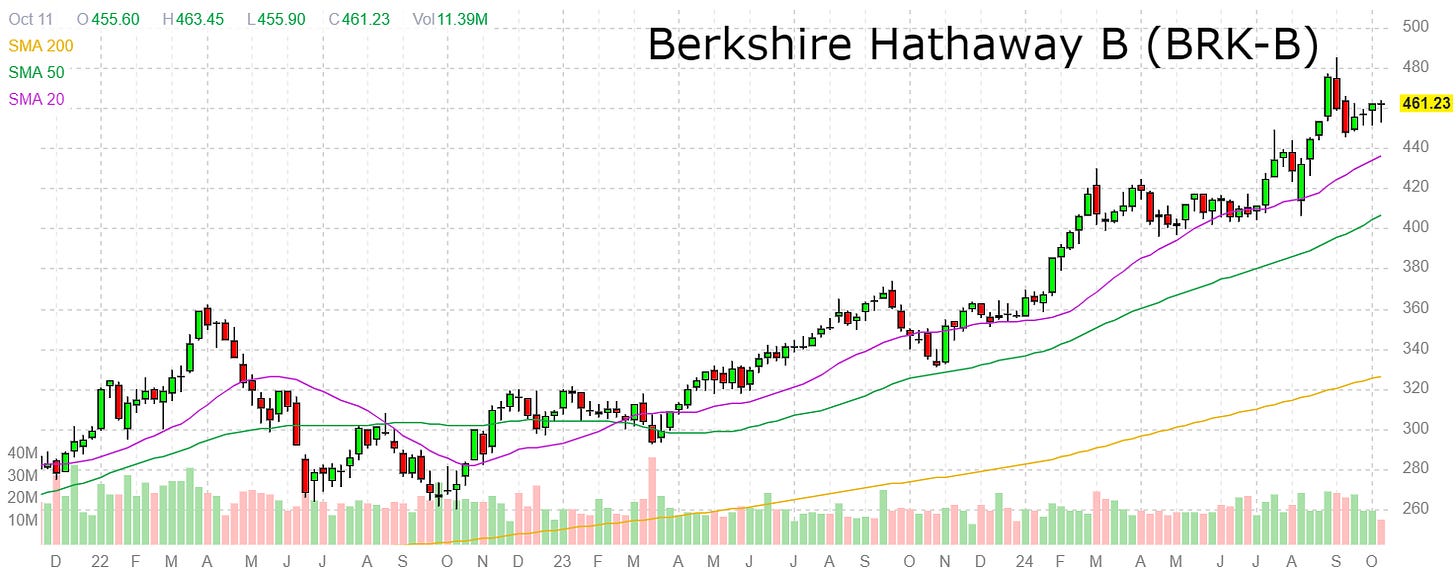

The cost of one Class A share in Berkshire Hathaway (BRK-A) is an eye-watering $691,000 per share. And B shares now run at around $460.21 per share.

(Click on image to enlarge)

If that’s too much, let me show you a backdoor to owning Buffett and Berkshire.

Tap into the SRH Total Return Fund

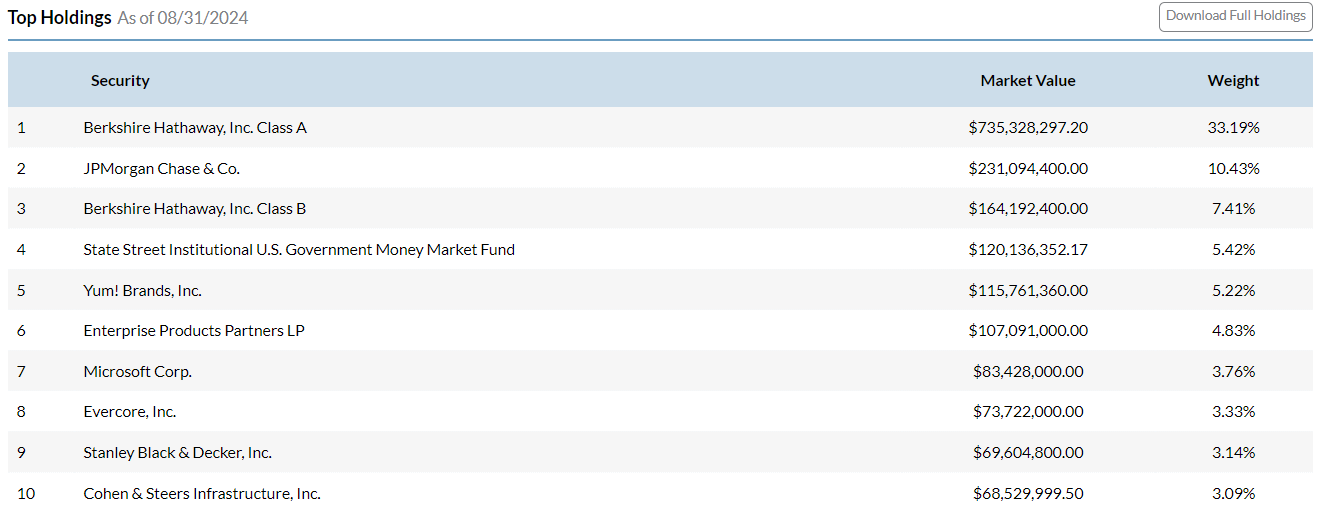

This closed-end fund owns $735 million in BRK Class A stock and another $164 million in BRK Class B stock. It also owns many stocks that Buffett loves, such as JPMorgan Chase (JPM), Yum! Brands (YUM), and Enterprise Product Partners (EPD).

(Click on image to enlarge)

The SRH Total Return Fund trades at a 24% discount to its net asset value (NAV). It has been trading at a massive discount to what the underlying shares are worth.

Shares trade at $15.86 compared to the NAV of $20.32. Plus, it pays a distribution (dividend) of 3.2%. Not bad.

If you’re looking for cash flow, or looking for a way to have your money make money, consider selling some stuff on eBay, selling some baseball cards, looking under the couch, or just tossing some money at the SRH Total Return Fund.

(Click on image to enlarge)

If this fund gets an activist insider or sees more buybacks in the future, it will close that gap on its NAV. These assets sell for 76 cents on the dollar in one of the world’s greatest companies and its best investors.

More By This Author:

Things I Think Before Happy HourYou Party, I Party, Chart Party

A Gasoline Salesman in a Hurricane

This is a reminder that we’re publishing on FinPub.com. I really need you to help out in this transition and be one of our first readers on that platform. I think you’ll love that ...

more