A Gasoline Salesman In A Hurricane

Market Update: Thursday's early price action has taken us much higher.

Bitcoin ripped to $63,000, and that's probably not the end of that rally. Copper eclipsed $4.30, a sign of some central banking and monetary inflation effort. And the S&P 500 has ripped to 5,700. Now, BMO has raised its price target to 6,100.

Once again, the BIGGEST moves (the early) moves happened after our signal went positive last week. Read “It Already Happened” to understand how it works.

Dear Fellow Expat,

They'll tell you your food is more expensive because of "shrinkflation."

They'll say grocery stores are price gouging. They'll say housing is unaffordable because of zoning laws and higher wages. But you know there's something wrong with these statements. They've been saying the same thing for 30 years.

The truth?

Things aren't getting more expensive.

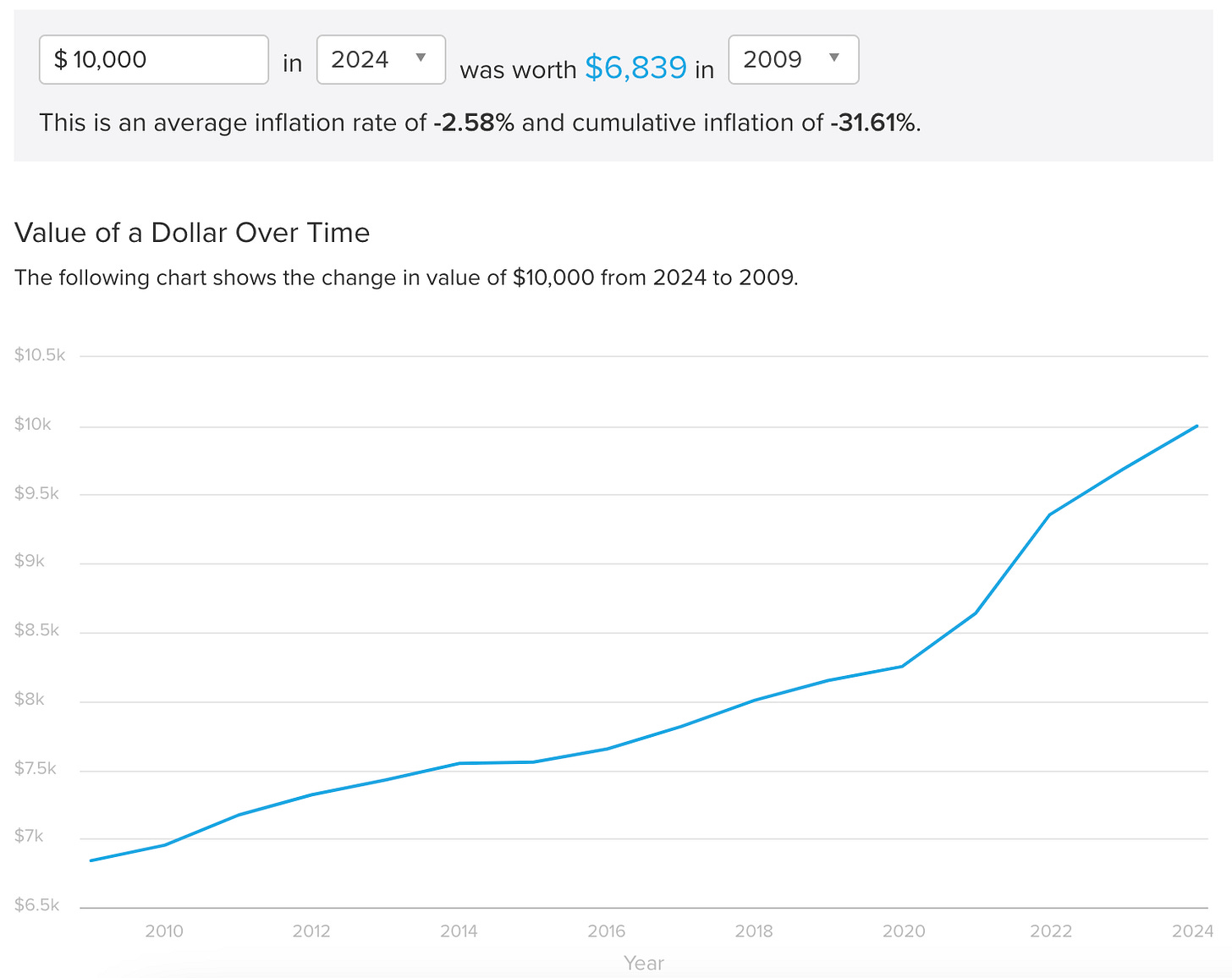

Your fiat dollar - that greenback in your pocket - has seen its purchasing power evaporate since the first round of Quantitative Easing in 2009. In 16 years, the dollar is down 31% in purchasing power.

But here’s the S&P 500 ETF (SPY) since early March 2009, when the Fed started pumping capital into the financial system.

That’s about a 676% “gain” in the market.

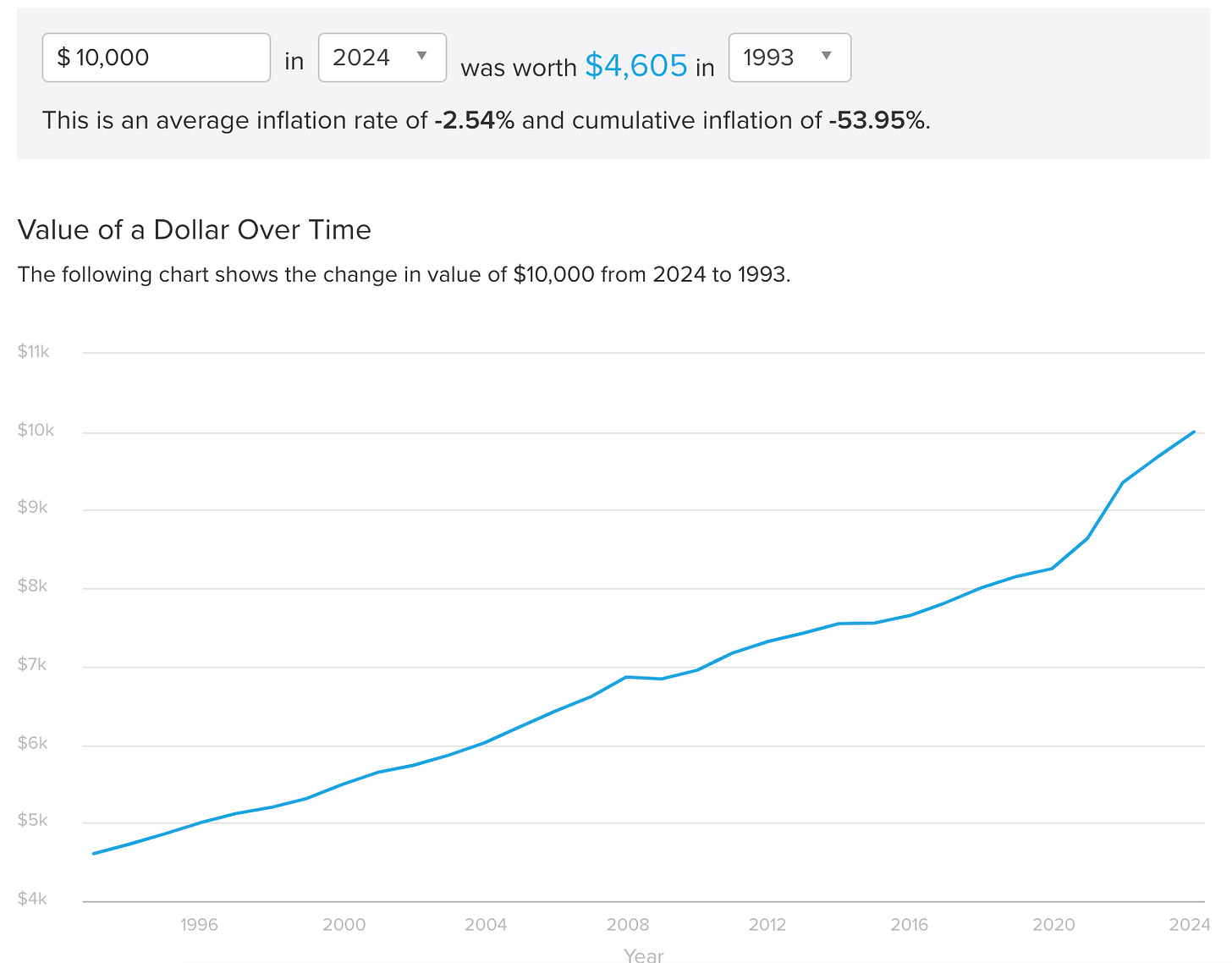

It's even worse if you look back to 1993 when the central bank began its inflation targeting. The dollar's purchasing power has been down 54% since 1993, while the S&P 500 has been up more than 1,166% in those 31 years.

Do you see it?

What’s happening? The truth about why you need to own equities?

The equity market isn’t about investing…

It’s about surviving our central bank and our reckless politicians.

The same people who perpetually bail out the financial system repeatedly while you panic sell because of the ugly cycles they’ve created with fiat currency.

Nothing but boom and bust… and you’re left chasing both sides.

And in some cases, you get so frustrated that you throw in the towel.

Imagine playing Monopoly.

Instead of buying properties, most Americans go around the board collecting $200, giving up their money to the wealthy in fines and rent payments.

Now imagine that Monopoly money's value went DOWN at every turn.

That's closer to the truth.

How to Play This Trend

In March, we wrote "The Hedge of Tomorrow," a free report outlining the case for gold, recommending Bitcoin, and highlighting stocks central to addressing monetary inflation.

Three days ago, I explained our worldview: expanding Global Liquidity, momentum, and Insider Buying. I gave everything away… complete transparency.

The hedges of tomorrow have been off to the races since the bottom of September 6.

And AIG (AIG) has steadily climbed, benefiting from central bank coordination and bailouts. We expect more of the same in the future—even with hiccups.

So, it’s no surprise that BMO Capital has raised its price target to 6,100, higher than our initial target when we started the Hedge of Tomorrow story. I might have to raise my target like the gas salesman changing prices in the hurricane.

We’ve realized the game’s flaws and flipped the board over on the table.

It’s your turn to do the same.

I don't care who you use to measure capital flows, insider activity, or uncover trends.

I'm just putting it all in one place… and I want you to know how flawed this system is.

More By This Author:

Risk: A 50-Basis Point Cut And a Change of ShortsPostcards: Yes, The Market Game Is Rigged - The S&P 500 Goes Red For An Hour

Is This The Next Speed Bump For U.S. Markets In October?

Disclosure: None.

Rusell green is like social security living -- most useless one to trade -- Lot of gloating with no performanc e--only cheer leading and destruction of lot of companies like what the so called truu-huump is doing to our nation.