Is The Lagged One Year Inflation Rate A Good Predictor Of Five Year Ahead Inflation?

Answer: No.

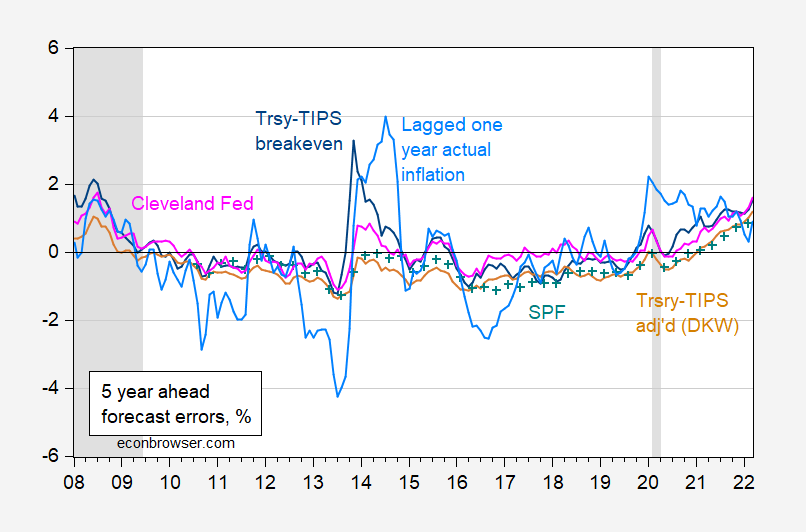

Here’s a picture of CPI inflation expectations errors at the five year horizon.

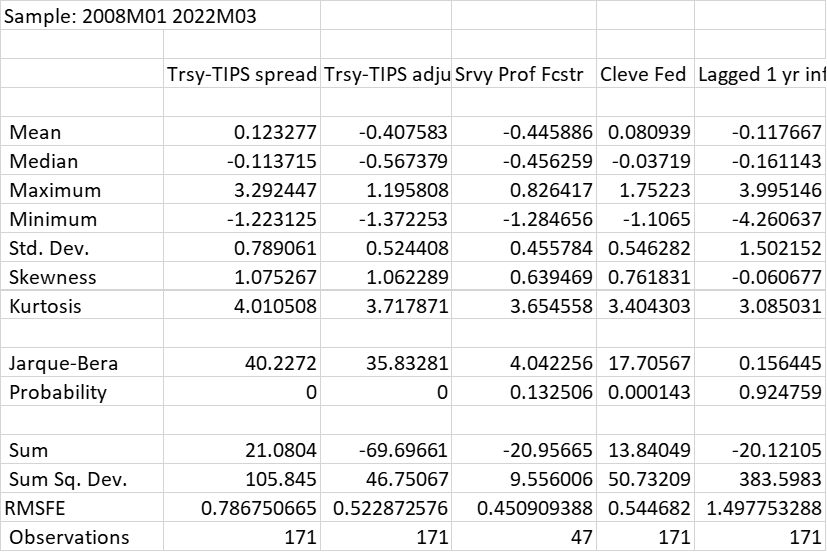

Figure 1: Actual 5 year ex post inflation minus expected from 5 year Treasury-TIPS breakeven (dark blue line), from Treasury-TIPS breakeven adjusted for premia by KWW following DKW (tan), from Survey of Professional Forecasters median (blue +), from Cleveland Fed (pink), from lagged ex post one year inflation (sky blue). NBER defined peak-to-trough recession dates shaded gray. Source: For CPI, BLS via FRED (CPIAUCSL); inflation rates calculated by author using exact formula (not log approximations). Treasury and TIPS from FRED (GS5, FII5), for adjusted breakeven KWW (accessed 4/8), for SPF Philadelphia Fed, Cleveland Fed, and NBER.

I have provided hyperlinks to the specific data sources since reader JohnH has written: “It’s hard to argue with data that does not link to any specific source data!”

Over the 2008M01-2023M02 period, the smallest mean error (in absolute value) is for the Cleveland Fed. The smallest median error (in absolute value) is for the Cleveland Fed. The largest maximum forecast error is for one year lagged inflation. The smallest minimum forecast error is for one year lagged inflation. The largest mean squared forecast error (by far!) is for one year lagged inflation.

I think it reasonable to conclude (if you didn’t already know it) that adaptive expectations using one year lagged inflation is a bad predictor for five year ahead (or 10 year ahead) inflation.

More By This Author:

Nonfarm Employment RisesWeekly Macro Indicators Through End-March

Private NFP Growth Predicted Using ADP Data