The Poison Chalice Of Low Interest Rates

When HSBC, the seventh-largest bank in Canada, advertised that a variable mortgage rate of 0.99%, it caused quite a stir within the industry. The Canadian mortgage industry has seen a steady drumbeat of lower mortgage rates, starting in 2012 when the 5-year fixed-rate fell to 2.99%, only to fall yet again in 2015 to 1.49% and now the dam has broken yet again with HSBC offering of 0.99%. HSBC’s variable rate represents a 1.46% discount to the commercial banks’ prime rate, currently set at 2.45%. With the Bank of Canada clearly indicating that its policy rate of 0.25% will remain unchanged at least until 2023, it is a safe bet that the mortgage borrower will be assured of this low rate for three years. The decision to drop rates, ironically, comes at a time when home sales, especially in the large metropolitan areas have risen dramatically along with home prices. The record level of sales and average prices have occurred in Toronto, Vancouver, and Montreal.

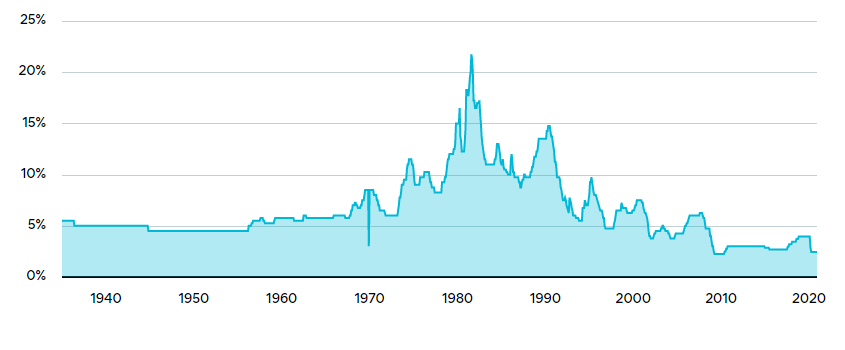

Figure 1 Mortgage Rates in Canada

Mortgage rates in Canada have been on a steady downward trend since the early 1980s when rates exceeded 20%. What lies behind this dramatic decline in interest rates and what does it indicate about the health of the economy? One clear explanation is the fall in inflation expectations. When bond investors expect inflation to surge, they demand higher rates of interest to protect against erosion in future purchasing power. Clearly, fixed income investors are not worried about inflation over the next 5 years if mortgage rates are just 1%.

The more difficult issue concerns ‘real’ rates of interest, that is the current rate, adjusted for inflation. Real rates of interest have also declined significantly along with nominal rates. Milton Friedman raised the alarm bells about the fall in real rates in the 1990s in Japan, stating it represented weakness in the overall economy. Today, Canadian 5-year rates are hovering at the 0.5% mark, implying a real rate of return of minus 1%. While the Canadian housing market is very robust today, the same cannot be said of many other sectors, directly impacted by the lockdowns due to COVID-19. Negative real rates signify that economic growth is very anemic. Hence, many economists refer to these low-interest rates as drinking from a ‘poisoned chalice’.Low rates are highly beneficial to governments in reducing borrowing costs arising from their income support programs. The low rates are supportive of the housing sector. But they are truly symptomatic of an economy struggling mightily to return to historical growth rates.

Certainly the very low interest rate paid on savings smells like the setup for some really nasty happenings in the future, when folks have been convinced to not save anything. At some point those missing savings wil be very sorely needed and the only alternative will be to sell whatever the buyer wants to buy, at whatever price is offered. Thus freedom will be sold to purchase enslavement. Not really a nice picture.

The reason why interest rates are so low is because there is excessive savings. Germanyand Japan for example have excessive savings even though they havenegative interest rates.. They chose as a nation to produce more more than they consume and export the surplus. The US chose the opposite

This has been going on for decades.